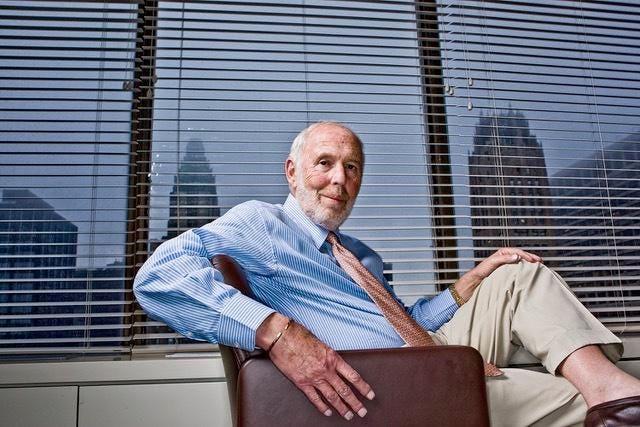

Jim Simons, a renowned mathematician turned hedge fund founder and philanthropist, passed away at the age of 86 at his home in Manhattan. Simons founded Renaissance Technologies in 1982, a hedge fund known for its Medallion Fund, which has consistently outperformed the market and achieved impressive returns. The firm, located in East Setauket, New York, boasts a team of highly educated employees, with 90 out of its 300 staff holding PhDs in fields such as math, physics, and computer science.

Renaissance now oversees approximately $50 billion in assets, with the Medallion Fund only available to Simons and the company’s employees. Despite charging management fees as high as 4% and performance fees ranging from 36% to 44%, the fund has delivered an annualized net return exceeding 30% since its inception. Simons’ success in the finance world made him one of the wealthiest individuals globally, with an estimated fortune of $31.4 billion at the time of his passing.

Simons and his wife, Marilyn, were recognized for their significant philanthropic endeavors, receiving the Forbes 400 Lifetime Achievement Award for Philanthropy in 2023. The couple founded the Simons Foundation in 1994, which has donated over $6 billion to causes supporting education, math, and science research. Simons, a former chair of the math department at Stony Brook University, contributed $500 million to the institution, making it one of the largest donations ever to a public college.

The Simons Foundation has also supported efforts such as Math for America, which provides stipends for STEM teachers in New York City, and research on cancer and autism. One of their recent initiatives involved a $90 million contribution to the Simons Observatory in Chile, which will study radiation dating back to the Big Bang. Simons’ passion for education and scientific research was evident in his extensive charitable work and dedication to advancing these fields.

Throughout his career, Simons remained discreet about the specific strategies behind his investment success, with his investing techniques largely shrouded in mystery. Despite this, his impact on the financial industry and philanthropic efforts have left a lasting legacy. Simons’ commitment to supporting math education, scientific research, and various charitable causes has left a profound impact on society and will continue to inspire future generations.