The Consumer Financial Protection Bureau (CFPB) scored a major win when a Texas federal judge accused major banking industry groups and the U.S. Chamber of Commerce of venue shopping in their lawsuit against the bureau. The judge ruled that the lawsuit should be transferred to Washington, where the banking lobby has more resources and expertise in handling such cases. The lawsuit in question pertains to the CFPB’s new regulations on credit card late fees, which would cap the average late fee at $8, significantly lower than the current average of $32. The banking groups had filed their lawsuit in Texas, known for its historically conservative judges, in an attempt to stop the new rule and protect potential losses of billions in revenue for the banks.

The CFPB estimated that banks earn around $14 billion annually in credit card late fees, making the new regulation a significant financial concern for the industry. Judge Mark Pittman found little justification for the banking industry groups’ choice of venue for filing their lawsuit, as the only connection to the Texas district was a recent acquisition by the Fort Worth Chamber of Commerce of a major bank as a member. Pittman agreed with the CFPB’s argument that Washington, being closer to regulators and with expertise in industry regulation law, would be a more appropriate venue for the case.

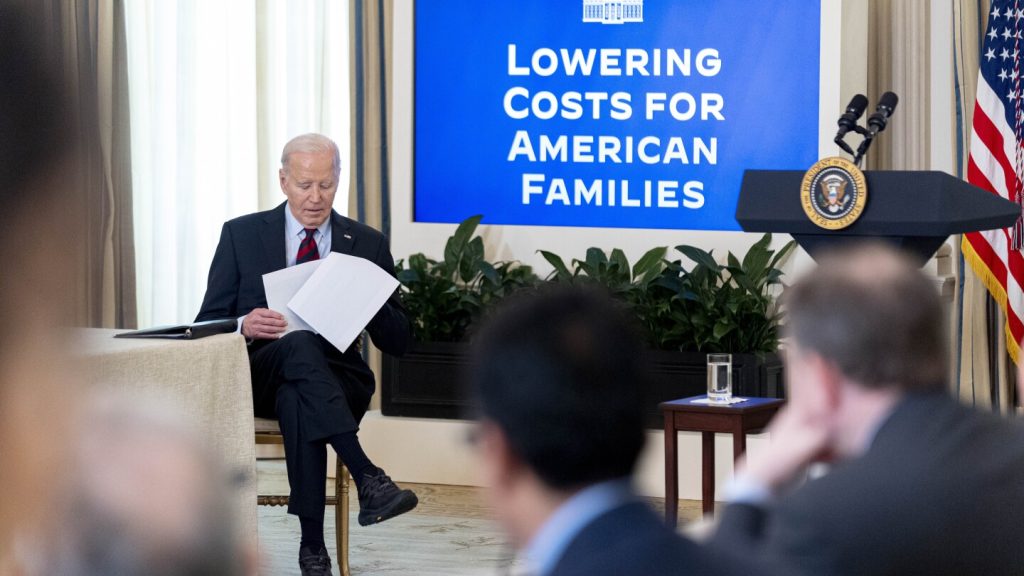

The Biden administration’s stance on the matter was supported by Pittman’s ruling, which highlighted the lack of direct relevance of the Texas district to the banking industry regulation lawsuit. The American Bankers Association and the Consumer Bankers Association, two major industry groups involved in the lawsuit, did not immediately respond to requests for comment on the ruling. The decision to transfer the case to Washington is seen as a victory for the CFPB and a blow to the banking industry’s efforts to challenge the new regulations on credit card late feesas they now have to fight the case in a less favorable venue for them.

Venue shopping in legal cases is a common tactic employed by parties seeking a favorable outcome, but in this instance, Judge Pittman called out the banking industry groups for attempting to manipulate the system. By transferring the lawsuit to Washington, where the CFPB holds more sway and expertise in industry regulations, the judge has leveled the playing field and given the federal regulator a better chance at defending its new rules. The outcome of this case could have significant implications for the banking industry and consumers, as the battle over credit card late fees continues to unfold in the legal arena.