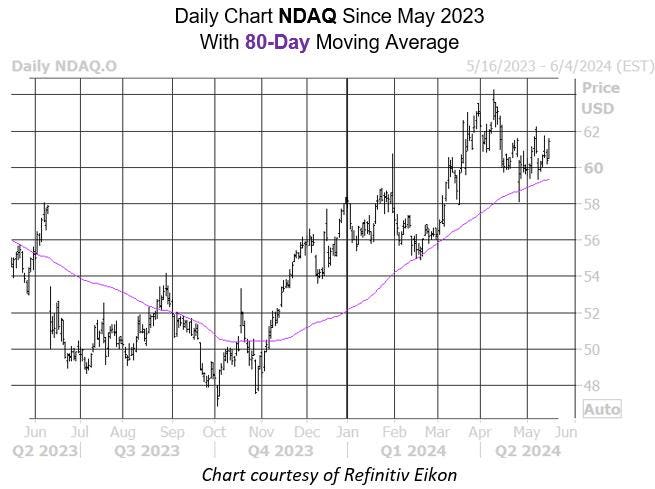

The recent rise in Nasdaq’s stock price comes as the company nears key technical levels, including its 80-day moving average. Data from Schaeffer’s shows that in the past three years, when Nasdaq stock came within one standard deviation of this moving average, it saw an average gain of 4.5% one month later. With Nasdaq currently trading at $61.45, this could potentially push the stock to $64.21, close to its recent high of $64.25 on April 9.

Additionally, options traders may find now to be an attractive time to capitalize on Nasdaq’s next move, as the stock’s Schaeffer’s Volatility Index (SVI) is at just 19%, in the low 16th percentile of its annual range. This means that options premiums are relatively cheap, presenting a potential opportunity for investors looking to leverage Nasdaq’s next price shift.

The recent movement in Nasdaq’s stock price reflects ongoing fluctuations in the global technology sector, as investors navigate concerns around inflation, interest rates, and economic recovery. Nasdaq’s choppy performance in recent months highlights the broader market trends impacting the tech industry, as well as the potential for individual companies to outperform amid uncertain market conditions.

As Nasdaq approaches key technical levels and historical data suggests potential further gains, investors may be keeping a close eye on the stock for any signs of a breakout. With the company’s solid year-to-date gain and recent pullback setting the stage for potential upside, Nasdaq’s stock performance could be a key indicator of broader industry trends in the coming weeks.

Overall, Nasdaq’s recent rise and proximity to key technical levels signal a potential opportunity for investors looking to capitalize on the stock’s next move. With options premiums at attractively priced levels and historical data pointing to potential gains in the near future, Nasdaq’s stock could be one to watch in the coming weeks as investors navigate the complexities of the global technology sector.