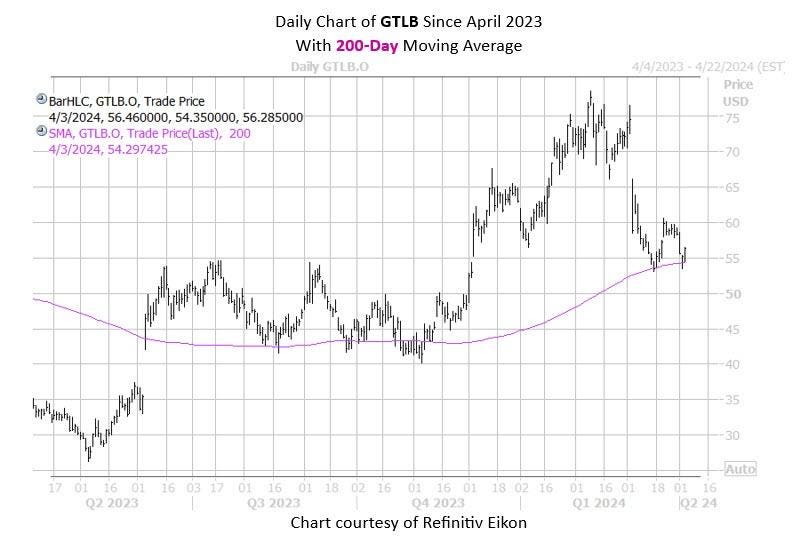

The recent struggles of software giant GitLab have been evident in its weaker-than-expected quarterly earnings and revenue outlook for 2025, leading to a more than 10% decline in its shares so far in 2024. However, there may be hope on the horizon as the stock approaches its 200-day moving average, a historically bullish trendline that has previously resulted in a 13% return with a win rate of 100% over the last three years.

Short sellers have also taken notice of the potential for a run higher, with short interest in GitLab falling nearly 26% in the past two reporting periods. This decrease in short interest, which now accounts for 2.6% of the stock’s total available float, could signal a reversal in sentiment and potentially lead to a short squeeze if the stock starts to rise.

If GitLab does experience a lift from its current level of $56.26 to $63.57, it would reach levels not seen since early March. This potential upside, combined with the bullish trendline and decreasing short interest, could be a positive sign for investors who have seen the stock struggle in recent months.

Investors will be keeping a close eye on GitLab’s performance in the coming weeks to see if it can break out of its current slump and capitalize on the potentially bullish indicators. With the stock hovering near key support levels, any positive news or developments could be the catalyst needed to spark a significant rally in GitLab shares.

While challenges still remain for the software giant, including ongoing competition and market volatility, there is optimism that GitLab may be able to turn its fortunes around and regain some of the momentum it has lost in recent months. As investors await further developments, all eyes will be on whether GitLab can capitalize on the bullish signals and make a successful return to higher levels of performance and profitability.