U.S. stocks drifted lower on Monday as investors braced for a pivotal week filled with uncertainty in Washington, D.C., and around the world. The S&P 500 slipped 0.3%, while the Dow Jones Industrial Average fell 0.6% and the Nasdaq composite slipped 0.3%. Companies like Intel and Dow saw declines in their stock prices after being notified that they will no longer be included in the Dow Jones Industrial Average. Warren Buffett’s Berkshire Hathaway also dropped 2.2% after reporting a drop in operating profit for the latest quarter. However, most stocks within the S&P 500 rose, with Fox experiencing a 2.8% gain after reporting stronger-than-expected profits.

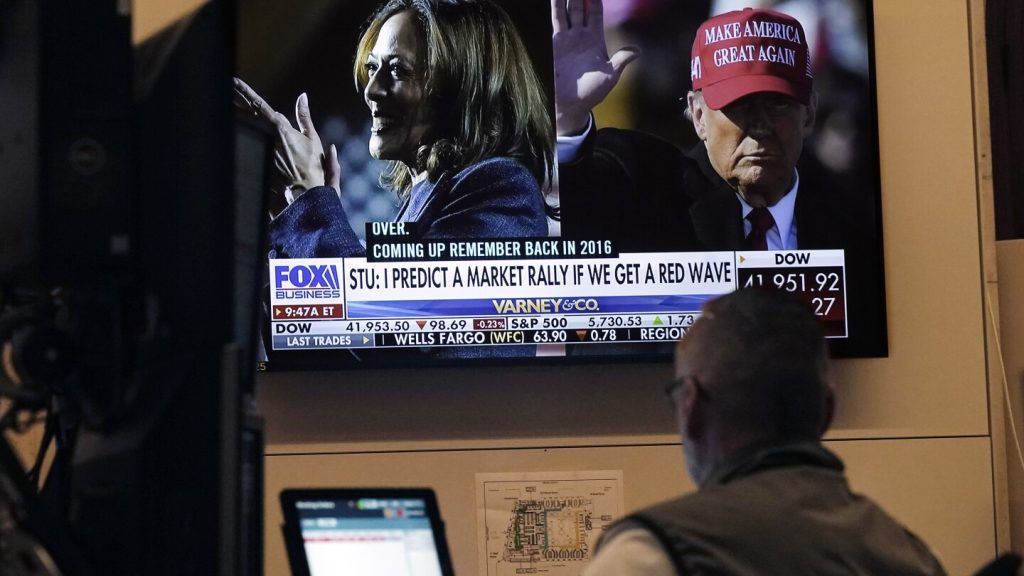

Election Day loomed on Tuesday, bringing fears of sharp market swings around the world as officials counted votes and uncertainty loomed. However, historical data suggests that the stock market tends to rise regardless of which party wins the White House. In 2020, U.S. stocks rallied after Election Day, despite former President Donald Trump’s refusal to concede, largely due to optimism surrounding the potential for a COVID-19 vaccine. Market strategist Michael Zezas from Morgan Stanley emphasized that while the election is important, the process is likely to be noisy, and prices may have already factored in expected outcomes.

A victory for Trump in the election may result in U.S. tariffs on Mexican imports, impacting the value of the Mexican peso. However, the peso has already fallen against the U.S. dollar in recent months, potentially limiting further moves if a Trump win were to occur. Treasury yields have climbed in anticipation of a Trump victory, along with positive economic data. On Monday, Treasury yields retraced some gains, with the 10-year Treasury yield falling to 4.29%. Trump Media & Technology Group saw a significant swing in its stock price, rising 12.4% after veering between losses and gains earlier in the day.

In the oil market, the price for U.S. crude rose 2.8% to $71.03 per barrel after Saudi Arabia and other oil producers announced a delay in plans to increase crude production. Brent crude, the international standard, also rose 2.7% to $75.08 per barrel. Concerns about demand from China, amidst economic challenges, have kept the price of Brent down for the year. This week, the Federal Reserve is expected to cut its main interest rate for a second time, following the latest meeting. The hope is that the U.S. economy can remain resilient and avoid a recession, in part due to anticipated rate cuts.

On Wall Street, Nvidia and Sherwin-Williams were announced as replacements for Intel and the parent company of Dow chemical in the Dow Jones Industrial Average. Stocks in the nuclear power industry fell after U.S. regulators denied a request that would have increased electricity supply to an Amazon data center. Talen Energy, which operates the Pennsylvania nuclear plant in question, experienced a 2.2% drop. Overall, the S&P 500 fell 16.11 points, the Dow dropped 257.59 points, and the Nasdaq composite lost 59.93 points. In global markets, European indexes were mostly lower after gains in Asia.