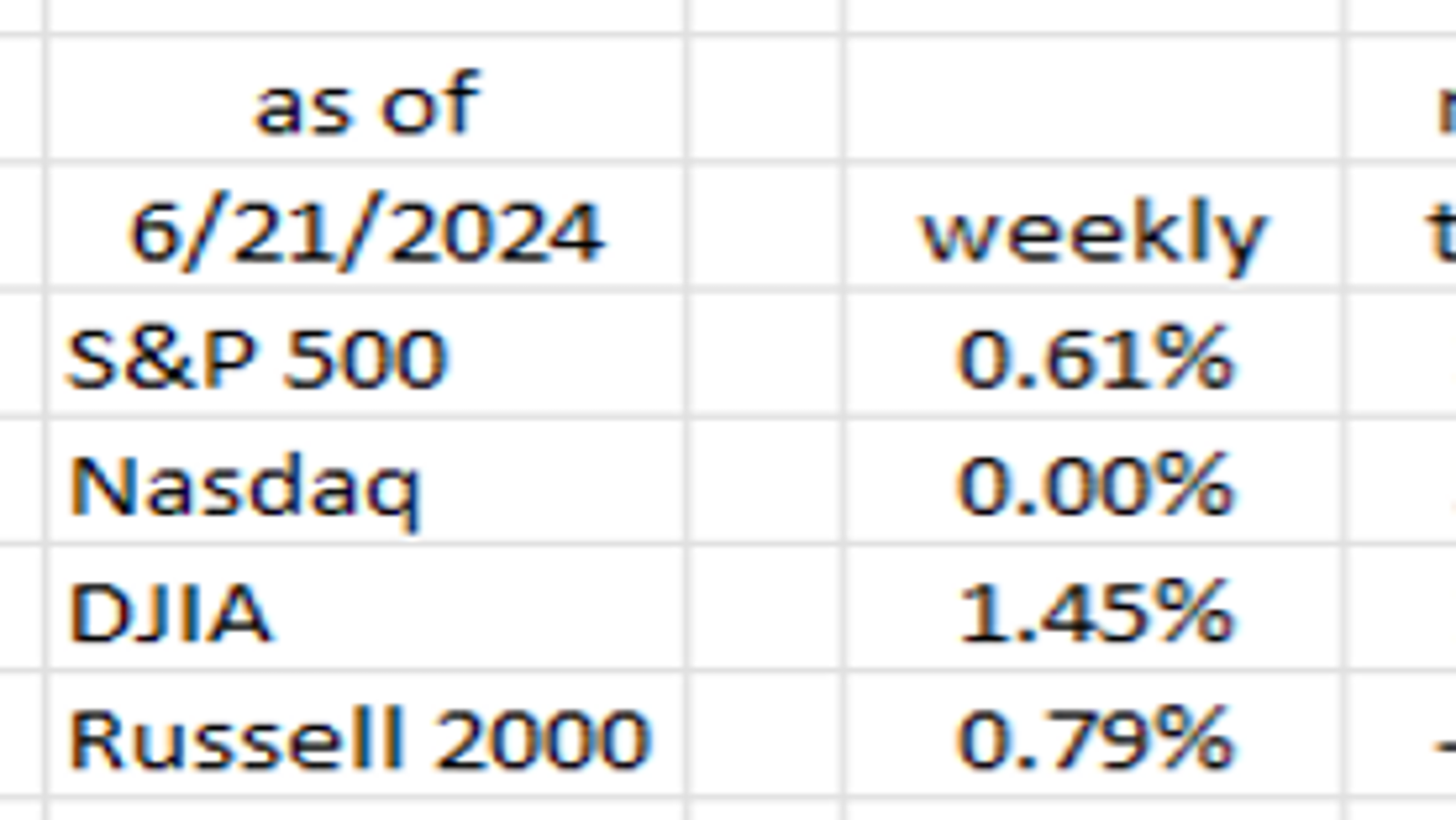

Equity markets experienced a subdued week, with the S&P 500 and Nasdaq being held back by a decline in the price of Nvidia. Despite this, Nvidia’s price is still up 155% year to date. The DJIA and Russell 2000, which are not tech-heavy, lag behind the S&P 500 and Nasdaq. The industrial companies in the DJIA are being affected by the lagged effects of rate hikes, which are starting to show in Retail Sales, housing, and commercial real estate. Small caps are also struggling to compete with the hype surrounding tech companies, particularly those focused on AI.

Retail sales have seen a decline, with same store sales down -0.2% from a year earlier and real retail sales only growing by +0.1% in May, following a -0.5% decrease in April. The National Association of Homebuilders Index dropped to 43 in June, signaling a downturn in the housing market. Total housing starts have decreased by nearly -20% from a year earlier, impacting GDP growth. The rising mortgage rates have limited the supply of existing homes, leading to a slowdown in new housing activity, which will further impact GDP in the upcoming quarters.

The labor market is showing signs of weakness, with voluntary quits falling and over a million full-time jobs lost in the past year. The U3 Unemployment Rate has increased from 3.4% to 4.0%, potentially indicating a recession. Delinquencies are rising across various loan types, including credit cards and auto loans, as well as mortgages. The FDIC’s list of problem banks is growing, with unrealized losses totaling $517 billion, prompting concerns about potential bank failures.

A Japanese bank has announced plans to sell $63 billion of U.S. and European government bonds, which could elevate interest rates. The commercial real estate market is also facing challenges, with distress evident in the Seattle/Tacoma market. As the Fed continues to delay rate cuts despite worsening economic data, there is speculation about their motives and possible future actions. The overall outlook suggests a weakening consumer, a struggling housing market, and potential financial instability in the banking sector if corrective measures are not taken soon.