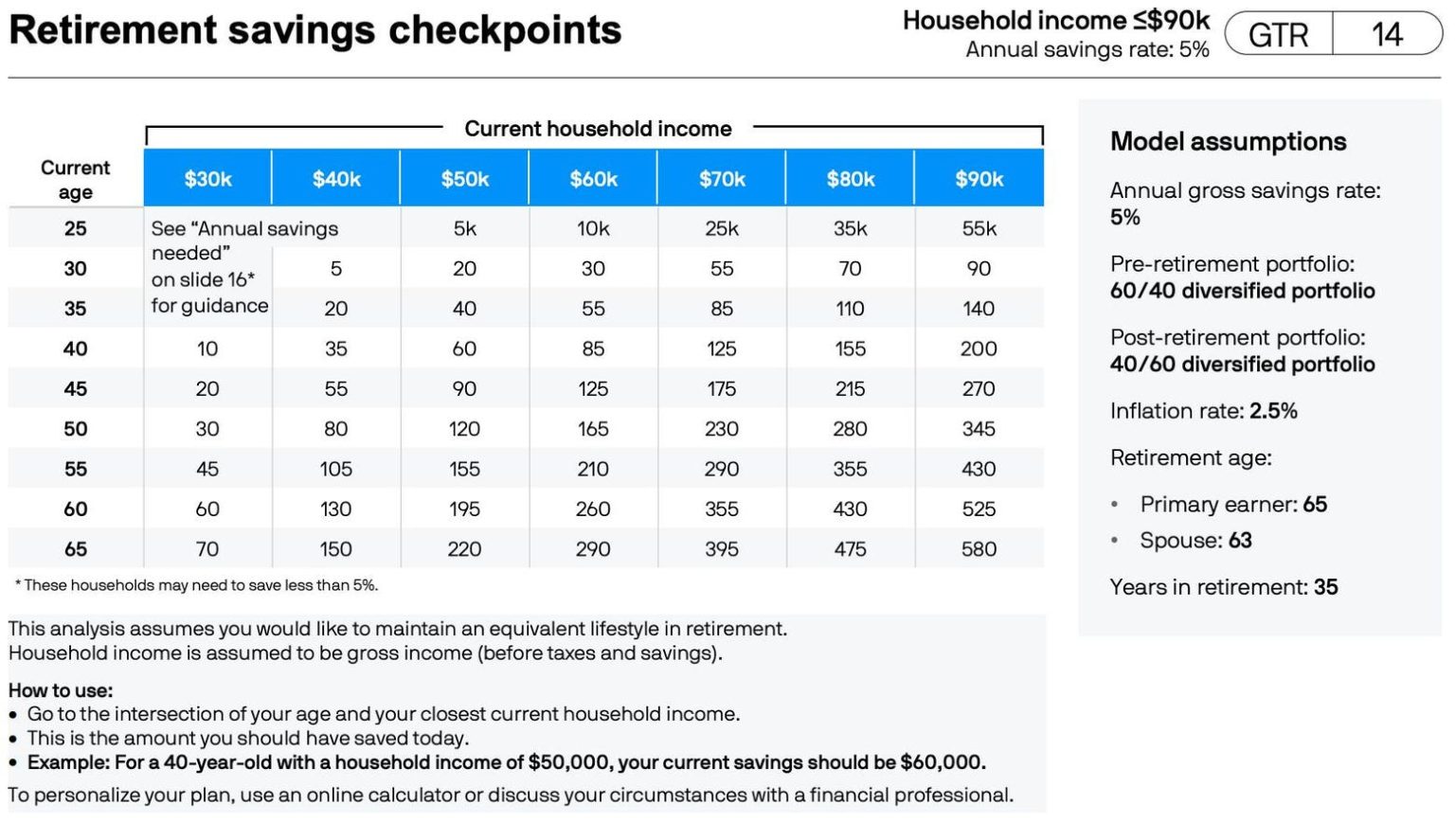

JP Morgan Asset Management recently released its 2024 Guide to Retirement, which aims to help individuals save for their golden years by answering key questions related to retirement savings. One aspect of the guide looks at how much one should have already saved for retirement based on their age and income. For instance, a 30-year-old making $50,000 a year should have saved $20,000, while a 50-year-old making $300,000 should have saved $1,955,000.

In addition to calculating how much one should have saved by a certain age and income level, JP Morgan also examined what percentage of income one should save if they are just starting out with retirement savings. The guide shows that the percentage of income required for savings goes up as an individual gets older and as their income increases. For example, a 25-year-old making $50,000 should start saving 5% of their income, while a 50-year-old making $50,000 needs to save 24% of their income to get on track.

The results in the JP Morgan report are based on several key assumptions, including retirement age, portfolio allocation, inflation rate, life expectancy, and income levels. The report also makes assumptions about how much of retirement savings can be spent each year in retirement and the amount of pre-retirement income needed to maintain a similar lifestyle in retirement. The report uses a conservative 60/40 portfolio during an individual’s working years, further reducing stocks to 40% in retirement.

While the JP Morgan report provides a high-level checkpoint for retirement savings, individuals may benefit from using more comprehensive financial planning tools like New Retirement or NetWorthify for a more thorough analysis. New Retirement offers a detailed financial planning tool that can help individuals track their progress towards retirement goals, while NetWorthify provides a quick and easy way to determine if one is on track for retirement. Ultimately, starting early and saving consistently are key factors in building a solid financial foundation for retirement.