China reported slower growth on the consumer side, with retail sales rising by 2.3% in April, lower than expectations. Industrial activity remained robust, with industrial production up by 6.7% in April, beating expectations. Fixed asset investment rose by 4.2% for the first four months of the year, lower than expected. Real estate investment saw a steep decline. Infrastructure and manufacturing investment slowed slightly compared to March.

The urban unemployment rate in April was 5%, with the bureau expected to release a breakdown by age. Retail sales grew by 6.8% year-on-year during a recent holiday period, boosted by sales of home appliances and automobiles. The statistics bureau attributed the slower retail sales growth to the May 1 Labor Day holiday and last year’s high base. The real estate sector is still in a period of adjustment, while China kicked off a six-month program for issuing ultra-long bonds to fund strategic projects.

Other data released for April showed a mixed picture for growth in China. Exports and imports grew, consumer prices ticked up, but factory-level prices continued to decline. New loan data slumped to record lows, reflecting sluggish demand from businesses and households. The real estate sector is still in a prolonged slump, with more cities easing housing purchase restrictions to boost sales. Officials are scheduled to announce policies to support the delivery of homes.

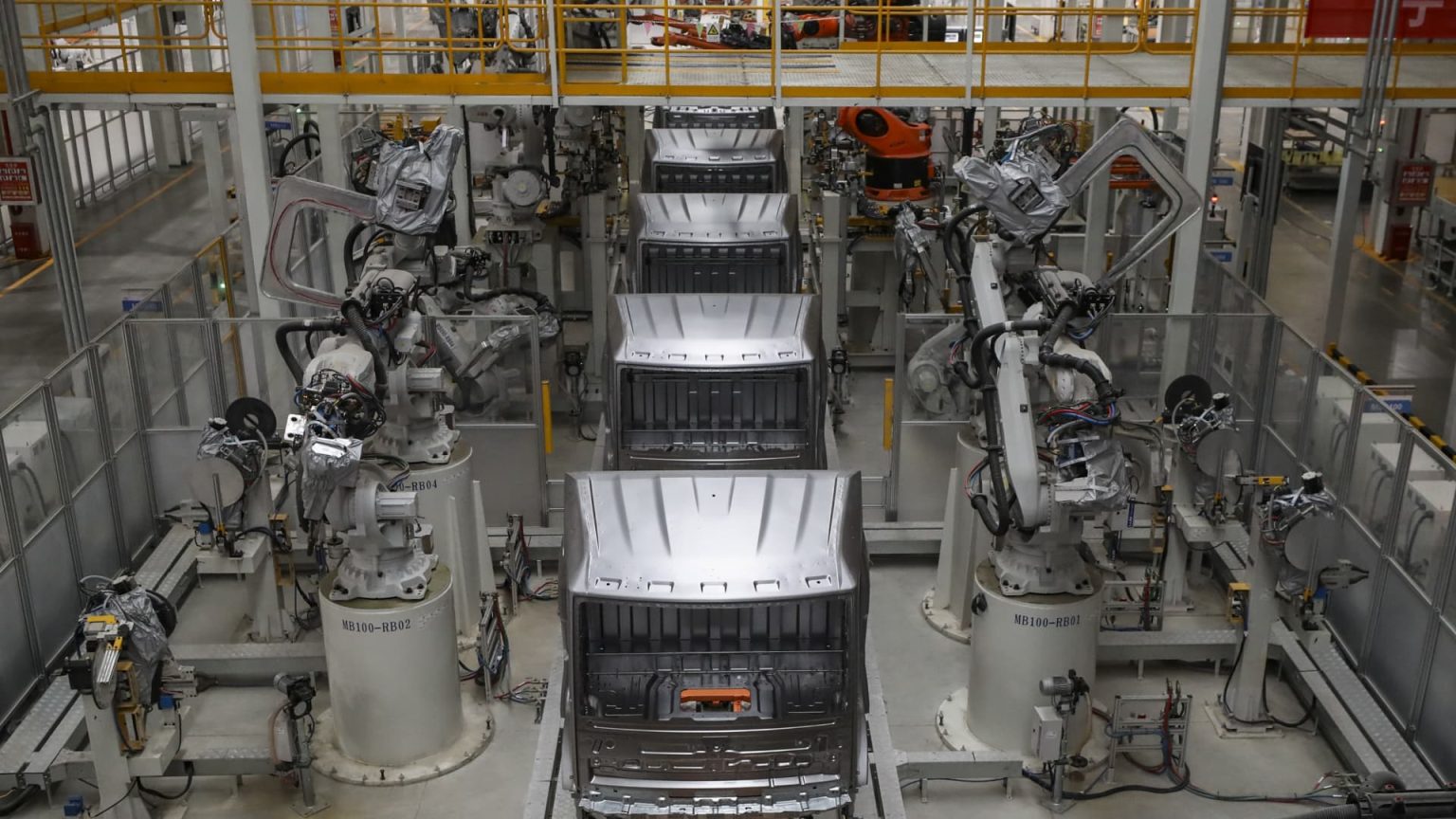

While the real estate slump has impacted middle-class wealth, the overall Chinese economy has shown strength in industrial investment and manufacturing. China’s official GDP grew by 5.3% in the first quarter, exceeding expectations. The EU Chamber of Commerce in China noted that economic pressures appear cyclical, emphasizing the importance of increasing domestic demand for foreign businesses. China’s Ministry of Commerce reported growth in retail sales during a recent holiday period, driven by sales of home appliances and automobiles supported by trade-in incentives.