The state of Washington is facing a contentious issue this November with Initiative 2109 on the ballot, which seeks to eliminate the capital gains tax. This tax has been in effect since 2022 and has generated $1.2 billion in revenue over two years, funding public education, early learning programs, and school construction. Christine Enslein, a former Microsoft employee, has been paying this tax and supports its contributions to public education, citing her own successful career as a direct result of a good education. However, a recent poll shows that 55% of voters are opposed to the initiative.

Supporters of Initiative 2109 argue that the tax harms small businesses, innovation, and the tech economy in Washington. They point to budget surpluses at the state level and accuse lawmakers of misusing tax dollars. Nevertheless, the Washington Technology Industry Association (WTIA) has expressed concerns about the impacts of the tax and reports that some founders are considering moving operations to other states due to the financial implications. The tax applies to profits from the liquidation of stocks and bonds exceeding a certain level, impacting a small fraction of the state’s population.

Washington is one of nine states without a state income tax and lacks a corporate income tax, relying primarily on sales, property, and business and occupation (B&O) taxes for revenue. Critics argue that this tax system disproportionately burdens low-income residents in comparison to high earners. There are a total of 42 states with a capital gains tax, but Washington’s version does not apply to certain transactions such as real estate and home sales, retirement and college savings accounts, farms, and family-owned small businesses.

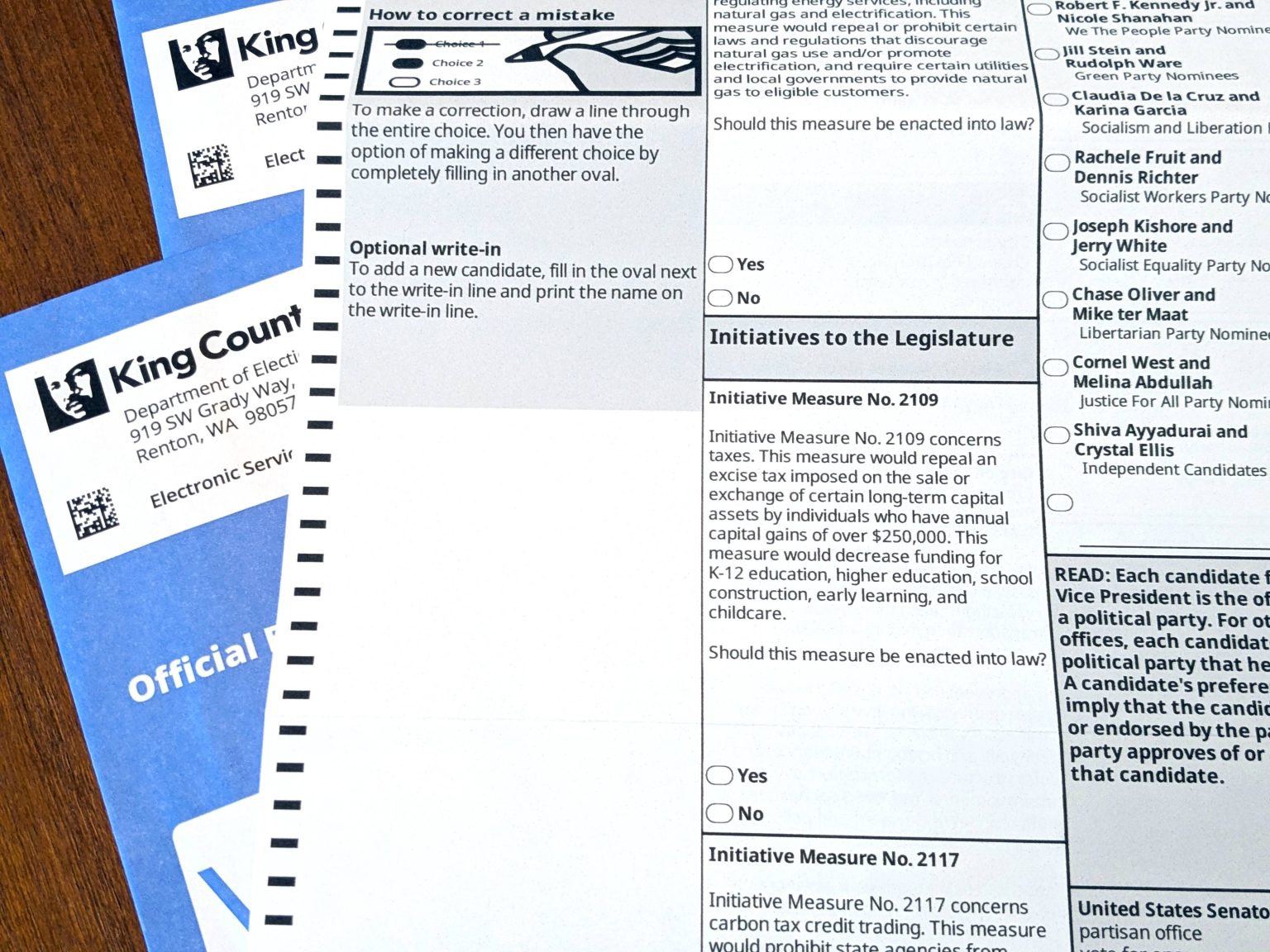

If Initiative 2109 is approved, the state is projected to lose $2.2 billion in revenue over the next five years. The revenue from the capital gains tax is currently directed towards funding public education, with shortfalls already being reported in school budgets across the state. Despite previous legal challenges, the Washington state Supreme Court upheld the tax, and the U.S. Supreme Court declined to hear an appeal. Proponents of the initiative argue that the tax will deter entrepreneurs and investors from relocating to Washington due to the financial burden.

Many tech and corporate workers in Washington, like Sam McVeety, receive stock options as part of their compensation, leading to potential concerns over capital gains tax implications. However, the specifics can vary depending on the type of stock options and the circumstances surrounding their exercise. Companies that are acquired may also have different tax implications for employees with vested stock options. Funding for and against Initiative 2109 has seen large contributions from various individuals and organizations, with supporters aiming to eliminate not only the capital gains tax but also other related measures. Opponents include education and employee unions, along with individual donors who have contributed significantly to the campaign against the initiative.