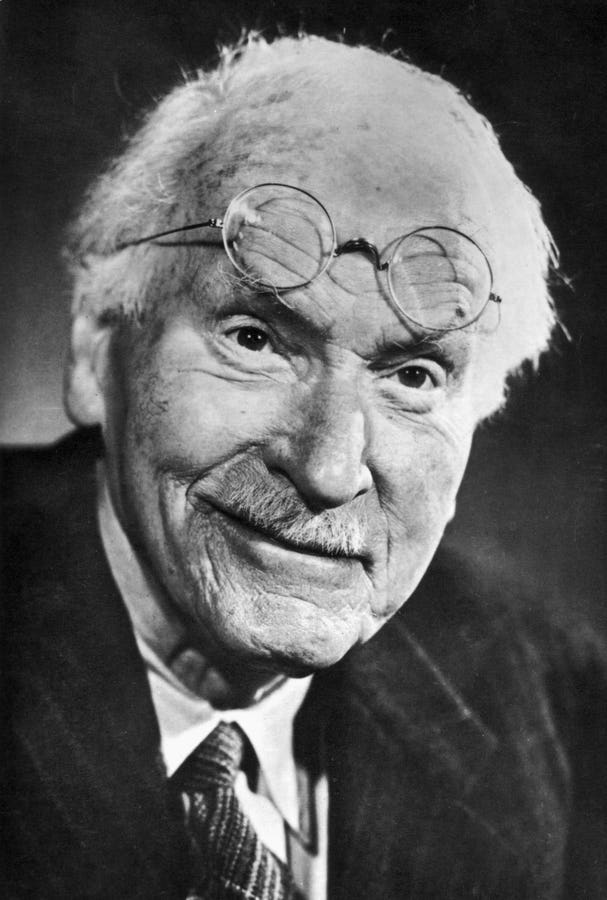

The pain of loss has a greater impact on us than the joy of gain, according to Daniel Kahneman. This insight is particularly relevant in the realm of finances, where losses and gains are quantified. Financial planning often involves managing mistakes, but the key is to recover from these errors. One simple step to get back on track is to do the next right thing. This concept, popularized by the recovery movement, traces back to a response from psychiatrist Carl Jung to a struggling individual in 1933. Jung emphasized that there is no one prescribed way to do financial planning, highlighting the importance of individualized guidance and self-discovery in pursuing one’s financial goals.

Financial planning is not about adhering to a specific formula or following a guru’s advice, but rather about identifying what is important to you in life and leveraging your resources to achieve those objectives. While complexities may arise in wealth management, many financial mistakes have straightforward solutions that can be identified by simply doing what we know is right. Taking the next necessary step, even if it is uncertain, is key to moving forward in any successful pursuit. By acknowledging our convictions and taking meaningful actions, we can navigate financial challenges with confidence and purpose.

Jung’s advice to do the next right thing resonates with our instinctual understanding that the first step in any new endeavor often feels right. Whether embarking on a new diet, exercise routine, job, relationship, or financial resolution, the initial actions are typically aligned with our goals. While financial planning involves multiple steps and strategies, the fundamental principle of doing what is right in the present moment remains constant. By focusing on the immediate task at hand and acting decisively, we can make progress towards our financial objectives and feel a sense of fulfillment in our actions.

The process of doing the next right thing in financial planning is not about seeking perfection or waiting for a profound revelation. Instead, it involves making conscious choices, stepping forward with conviction, and engaging in meaningful actions that align with our values and goals. While the financial landscape may present challenges and uncertainties, taking proactive steps based on what we know to be right can lead to positive outcomes and a sense of purpose. By embracing the simplicity and clarity of Jung’s advice, individuals can navigate financial decisions with confidence and resilience, knowing that each step taken in the right direction contributes to a meaningful journey towards financial well-being.