European stock markets closed slightly lower on Thursday, with the Stoxx 600 index falling 0.24%. Major bourses closed in the red, with Germany’s DAX down 0.76%, as France’s CAC 40 and the U.K.’s FTSE 100 retreated by 0.63% and 0.08%, respectively. The European Central Bank is likely to cut interest rates in June but should proceed in a “measured” way from there, according to the head of Latvia’s central bank. Markets are nearly certain of a June cut following weeks of heavy signaling from ECB members, but are less clear on the path from there. The euro zone economy exited a shallow recession in the first quarter of the year to record 0.3% growth, while headline inflation in April came in at 2.4%. The ECB’s first few interest rate cuts will keep monetary policy in restrictive territory, but the “economy is not extremely weak,” so the path downwards should not be rushed.

Shares of Danish pharmaceutical company Novo Nordisk dipped on Thursday after a fire broke out at a building under construction at its manufacturing hub in Kalundborg, Denmark. Shares were down 0.45% at 3:40 p.m. London time. Novo Nordisk confirmed the incident had occurred in a Google-translated post on social media platform X. The pharmaceutical giant said it was “optimistic” the fire would not delay its expansion plans. Shares of British telecom company BT soared 10.5%, on course for its biggest daily gain since November 2021, after announcing a cost-cutting program. In its full-year results released Thursday, BT reported revenues of £20.8 billion in the year to March, up slightly from the previous year, but profit after tax fell 55% to £855 million.

German technology giant Siemens reported a drop in profit at its industrial business in the fiscal second quarter and said its automation division had slowed. Industrial profit came in at 2.51 billion euro ($2.73 billion) in the three months ending in March, down 2% from the same quarter last year. The figure was below the company-compiled analyst forecast of 2.68 billion euro. British low-cost airline EasyJet posted a slightly larger than expected pre-tax loss of £350 million for the first half of the year, as it said inflationary pressures on the sector were beginning to ease. The shortfall was above the expected figure, but less than the previous year’s loss, as the airline continued to emerge from a Covid-19-era travel slump.

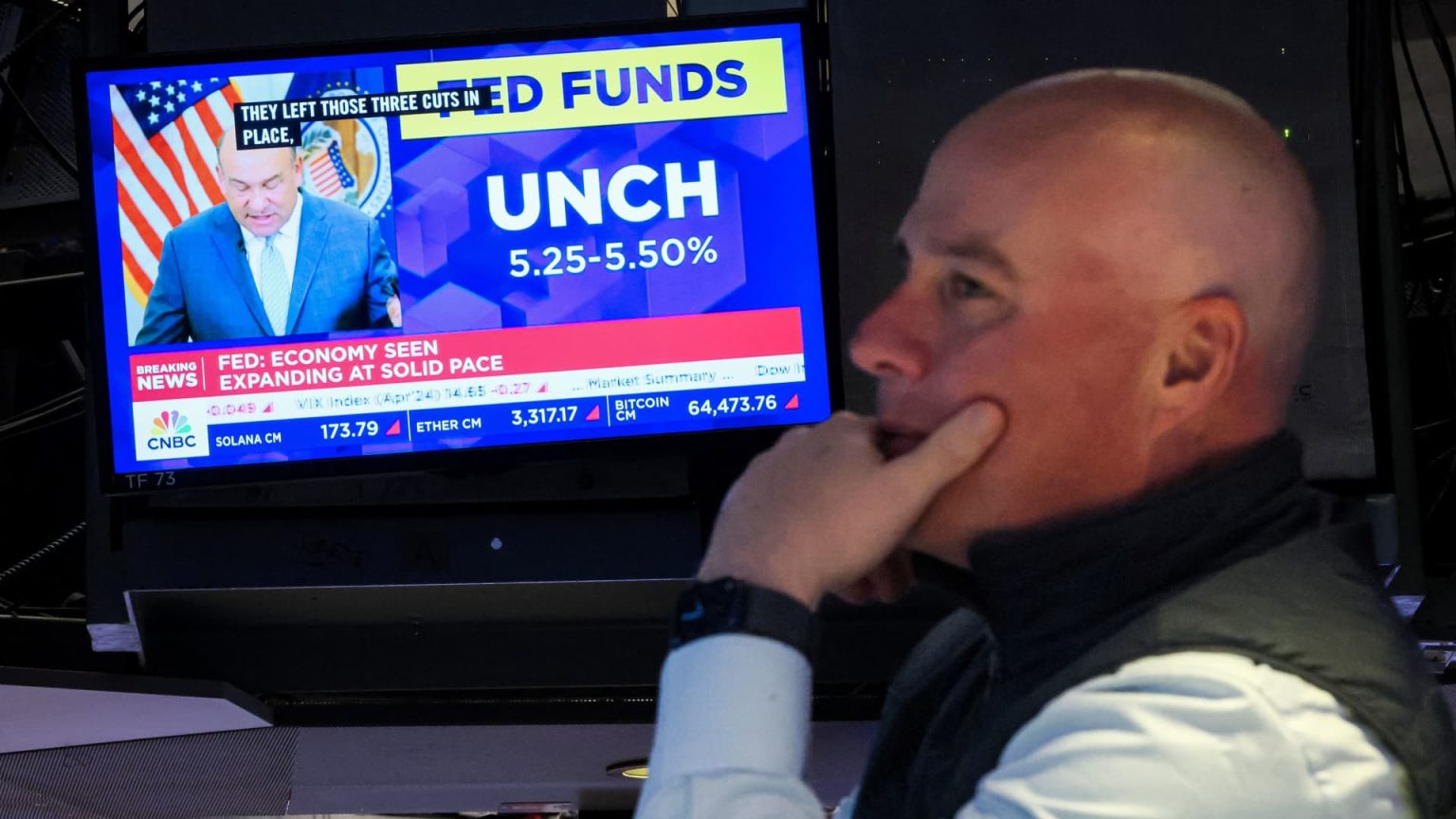

Citi recently named an under-the-radar company to buy on a “data and AI opportunity,” noting that the company’s total addressable market has increased three times thanks to its artificial intelligence potential. With the consumer price index showing inflation slightly easing in April, Mark Hamrick, senior economist at Bankrate, said the “lack of a nasty surprise” was welcome. Interest rates will still remain higher for longer, he noted, as inflation levels remain “irritatingly high.” Indian investor and market expert warned that India’s mid-cap stocks are in a “bubble” and highlighted the only stock he owns. European markets were expected to open higher on Thursday, with earnings due from companies such as Swiss Re, Zurich Insurance, Siemens, Deutsche Telekom, BT, and EasyJet.