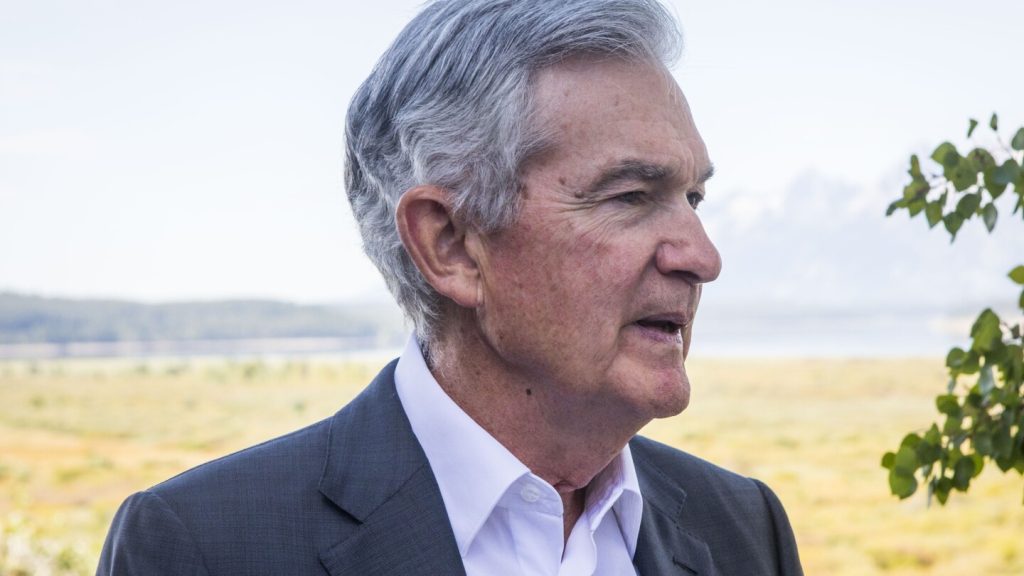

Federal Reserve officials are shifting their focus from taming inflation to monitoring the health of the job market. With inflation nearing its target of 2%, the Fed is set to cut its benchmark interest rate from its 23-year high, with future rate cuts depending on the pace of hiring. Fed Chair Jerome Powell is expected to provide insight into the economy and potential next steps in a speech at the annual conference in Jackson Hole, Wyoming.

Despite signs that the Fed is close to controlling high inflation, economists are hesitant to declare “mission accomplished.” The focus now is on the labor market, with the Fed closely monitoring economic data to determine the speed at which rates will be cut in the coming months. Stock prices fell on fears of a potential recession after a disappointing July jobs report, but improved economic reports, including declining inflation and strong retail sales, have eased concerns.

Mortgage rates have started to decline in anticipation of a rate reduction, with Wall Street traders expecting three quarter-point Fed cuts in September, November, and December. A half-point rate cut in September could become more likely if there are signs of a further slowdown in hiring. The next jobs report will be issued after the Jackson Hole conference but before the Fed’s next meeting in mid-September, providing crucial data for future rate decisions.

Fed officials like Raphael Bostic and Austan Goolsbee acknowledge the progress made on inflation and the need for rate cuts this year, even if hiring remains solid. With inflation falling and inflation-adjusted interest rates rising, concern arises over the potential for economic slowdown due to high rates. Bostic still expects a “soft landing” for the economy, with inflation returning to the Fed’s 2% target without a recession.

While the job market and economy appear healthy for now, the focus remains on future data and the potential need for policy adjustments. Despite uncertainties regarding the economy’s outlook, Powell may not be able to commit to a specific trajectory at the upcoming conference given the Fed’s reliance on incoming economic data. The Fed’s approach will be heavily influenced by how the economic data unfolds in the coming months.