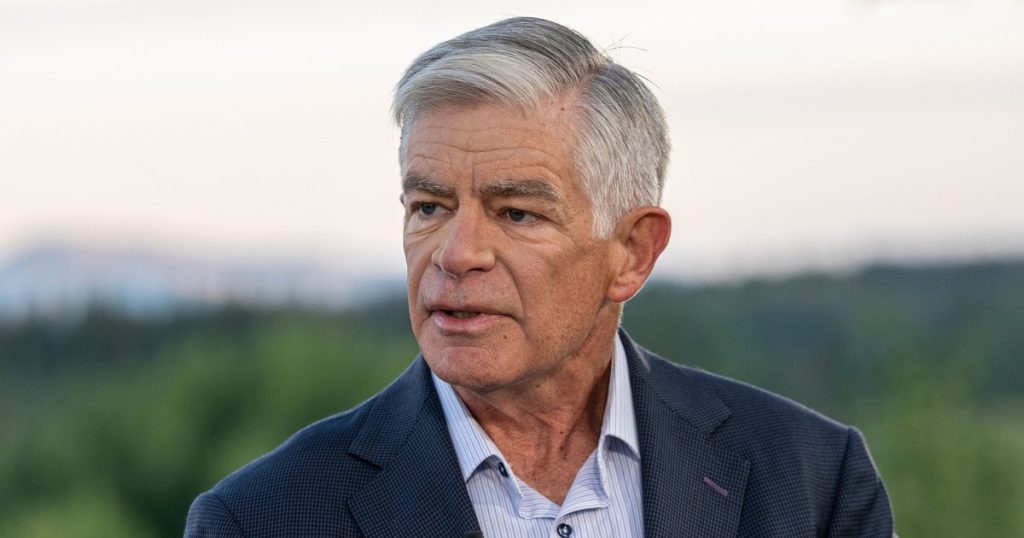

Philadelphia Federal Reserve President Patrick Harker has voiced strong support for an interest rate cut in September. He made this statement during an interview with CNBC from the Fed’s annual retreat in Jackson Hole, Wyoming, indicating that a rate cut is almost a certainty at the next meeting. Harker emphasized the importance of easing monetary policy methodically and providing advance signals of any moves. While markets are already pricing in a 25 basis point cut, with a possibility of a larger reduction, Harker stated that he still needs to see more data before making a decision on the exact amount of the cut.

The Federal Reserve has maintained its benchmark overnight borrowing rate in a range of 5.25%-5.5% since July 2023 due to concerns about inflation. However, recent meeting minutes and statements from policymakers suggest that they are leaning towards a rate cut to prevent further economic weakness. Harker emphasized that decisions on monetary policy are based on data and not influenced by political considerations, especially with the looming presidential election in the background. As a non-voting member of the Federal Open Market Committee, Harker still has input in decision-making processes and is aligned with the need to start bringing rates down.

Kansas City Fed President Jeffrey Schmid also shared his views on the future of monetary policy, leaning towards a rate cut as well. He highlighted the rising unemployment rate as a factor in driving future policy decisions. Schmid noted that a cooling labor market has helped alleviate inflation pressures, which were partly driven by a supply-demand mismatch. Despite the gradual increase in the unemployment rate, Schmid does not believe that monetary policy is overly restrictive. Both Harker and Schmid, as non-voting members of the committee, have an influence on the discussions regarding interest rate changes and other monetary policy decisions.

Harker and Schmid are aligned in their assessment that a rate cut is necessary in the current economic environment to address inflation and labor market concerns. While Harker expressed the need for more data before determining the exact size of the rate cut, Schmid emphasized the importance of monitoring unemployment trends. Both policymakers emphasized the need for a methodical approach to easing monetary policy and providing clear signals in advance to manage market expectations. Despite not having a vote on the committee this year, Harker and Schmid play crucial roles in shaping the discourse and decision-making process within the Federal Reserve.

As policymakers prepare for their upcoming meeting in less than a month, they are increasingly confident in the need for an interest rate cut. The Fed’s initial reluctance to introduce rate cuts has shifted due to evolving economic conditions and the need to address potential weaknesses in the labor market. Both Harker and Schmid’s assessment of the economic landscape underscores the importance of data-driven decision-making and the role of central banks as technocrats. The upcoming rate cut decision will likely have a significant impact on market expectations and economic outlook, as policymakers strive to support sustainable economic growth and maintain price stability.