Pandora, the world’s largest jewelry maker by production volume, saw strong first-quarter sales with an 18% annual increase and projected growth of 8% to 10% for the fiscal year. The surge was attributed to an 87% jump in lab-grown diamond sales, signaling a shift in consumer preferences. The company has been focusing on lab-grown diamonds since September, which has driven demand across all its products, particularly in the U.S. market, where sales were up 16% from the previous year. Shares have surged over 80% in the past year due to strong earnings.

Lab-grown diamonds account for 20% of global diamond jewelry sales, with rapid growth in recent years. Global sales have soared to nearly $12 billion in 2022, up from $1 billion in 2016. In contrast, companies specializing in natural diamonds are struggling with a price slump due to weakening demand and oversupply, with even industry giants like De Beers considering selling their business after writing down its value by $1.6 billion. Signet Jewelers, the world’s largest retailer of natural diamonds, posted a 9.6% drop in same-store sales revenues, citing challenges posed by independent jewelers’ discounting on lab-created products.

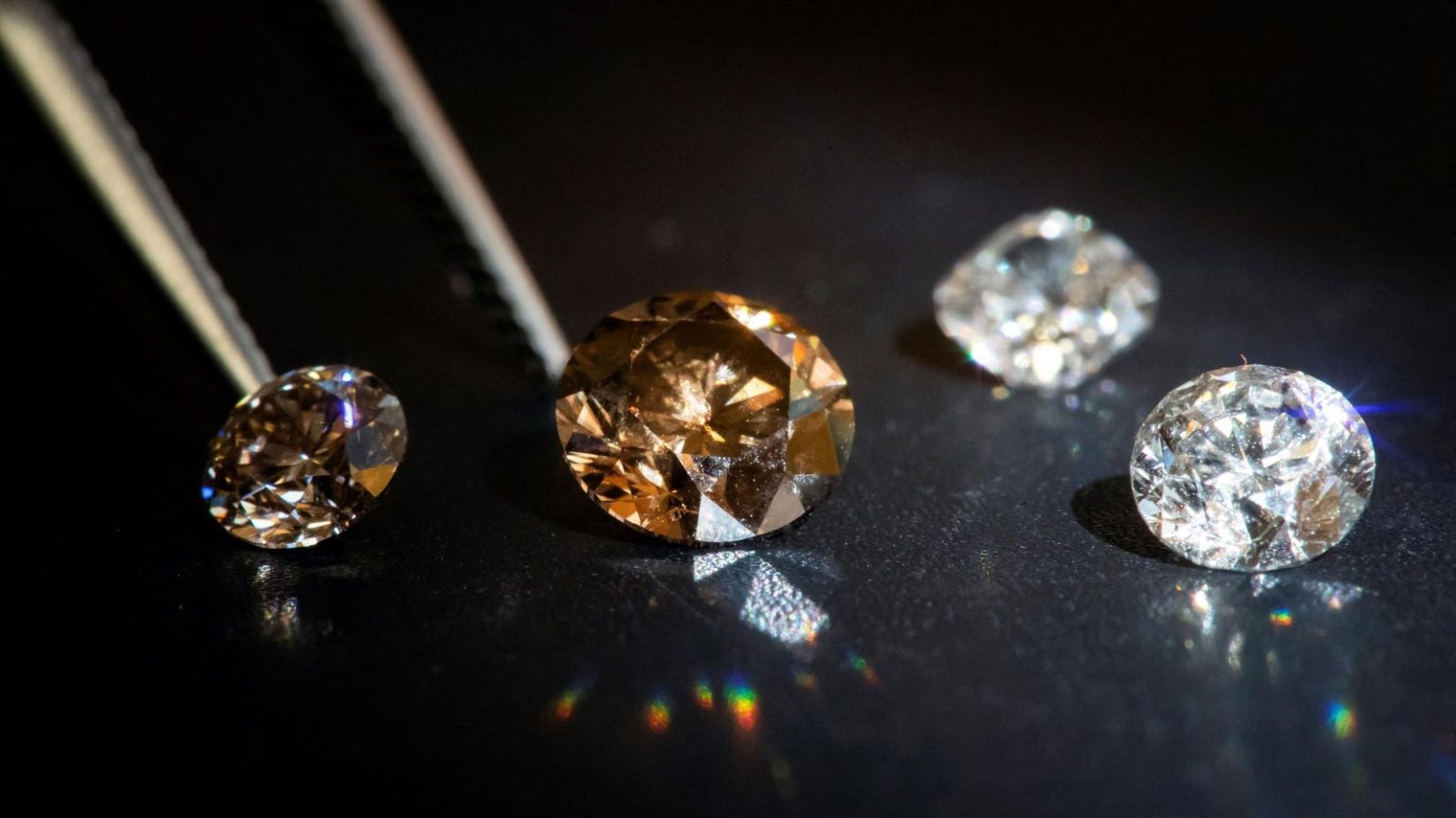

Lab-grown diamonds can be significantly cheaper than natural diamonds, ranging from 70% to 90% cheaper depending on the size. This has led to increased demand for lab-grown diamonds, with some industry experts predicting they will eventually dominate the fashion jewelry world. The Federal Trade Commission officially recognized lab-grown diamonds as real diamonds in 2018, leading to wider acceptance and supply. The price gap between lab-grown and natural diamonds has widened from 10% in 2016 to as much as 80% in 2022, making lab-grown diamonds an attractive and affordable alternative.

Despite the success of lab-grown diamonds, concerns linger about declining prices and potential impact on profitability. Revenues from lab-grown diamonds continue to shrink even as unit sales increase, with retail sales experiencing declines. Retailers may face eroding profitability and direct customers to other products if prices continue to drop. However, experts believe the future of natural diamonds is not entirely threatened by lab-grown diamonds, as the rarity and value of natural diamonds hold appeal for some consumers who prioritize retained value.

The natural diamond industry has faced challenges during the pandemic, with demand declining as everyday life resumed. Major miners like De Beers have had to make steep price cuts to revive sales due to oversupply and sluggish demand. However, experts still see potential for a turnaround in the natural diamond market. A recent discovery by scientists of a new method to create lab-grown diamonds in just a few hours using liquid metals and gases could revolutionize the industry. The scalability and cost-effectiveness of this new process remain to be seen.

The emergence of lab-grown diamonds as a viable alternative to natural diamonds has disrupted the traditional diamond industry, with companies like Pandora benefiting from the trend. While the natural diamond market faces challenges, experts remain optimistic about the future of natural diamonds, emphasizing their rarity and value. As the industry continues to evolve, it will be crucial to monitor how companies adjust to changing consumer preferences and technological advancements in the diamond market.