The hypothetical question of what would happen if the State of California defaulted on its debt and how it would impact leading businesses like Apple, Google, and Nvidia is explored. Despite California’s occasional fiscal lapses and its large economy, the financial impact on these trillion-dollar companies is deemed minimal. These companies are backed by financial institutions around the world willing to lend to them, buy equity in them, and support their financial needs regardless of California’s financial situation.

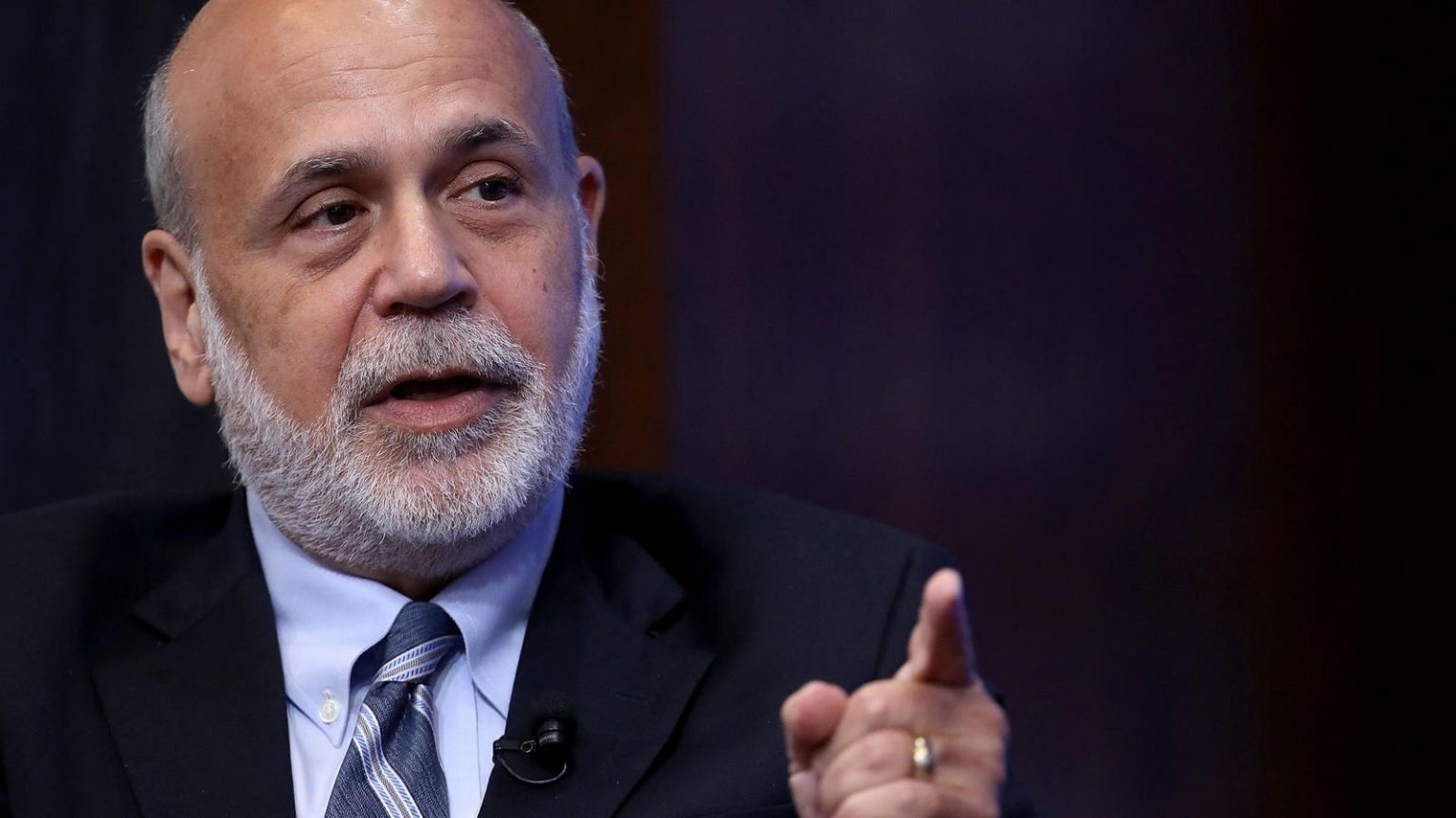

The discussion moves on to Ben Bernanke’s book “21st Century Monetary Policy” and his role in the Fed’s intervention in the U.S. economy in 2008. Bernanke’s ideas about influencing private sector decisions raise questions about the effectiveness of central planning and intervention, especially during times of economic turmoil. The underlying assumption that lower yields in the Treasury market would stimulate business investment and consumer spending is criticized as being misguided and overly simplistic.

The article reflects on George W. Bush’s nomination of Bernanke as Fed Chairman and the reaction from free market pundits. Steve Forbes stands out as one of the few who were skeptical of the excitement surrounding Bernanke’s nomination. The conceit of PhD economists like Bernanke, who believed that their interventions could influence interest rates and financial asset prices, is criticized as misguided. The impact of the Fed’s actions on housing consumption and corporate interest rates is called into question.

Bernanke’s belief that intervention in interest rates would increase the prices of financial assets like stocks is challenged as being based on flawed economic reasoning. The idea that central bankers can manipulate economic activity by controlling interest rates is dismissed as simplistic and unrealistic. The potential consequences of weakening the dollar through market interventions are examined, raising concerns about the broader impact on global financial conditions.

The article concludes by cautioning against the dangers of empowering economists to make decisions about the economy, citing the limitations of their models and theories. The value of Adam Smith’s insights into economic principles and the limitations of economists with PhD credentials are highlighted. The need to look beyond traditional economic thinking and consider alternative perspectives on economic policy and decision-making is emphasized. Overall, the article raises important questions about the role of central banks and economists in shaping economic policy and outcomes.