New York State is taking action to remove three top Boeing executives and block pay raises using its pension fund in response to a series of disasters involving the company. State Comptroller Tom DiNapoli, who oversees the fund, has announced plans to vote against shareholders’ proposals, arguing that Boeing executives should not receive pay raises due to the safety issues surrounding the 737 Max 9 aircraft. DiNapoli believes that Boeing’s directors have failed to properly oversee the company’s strategy, safety, and corporate culture, prompting the pension fund to take action.

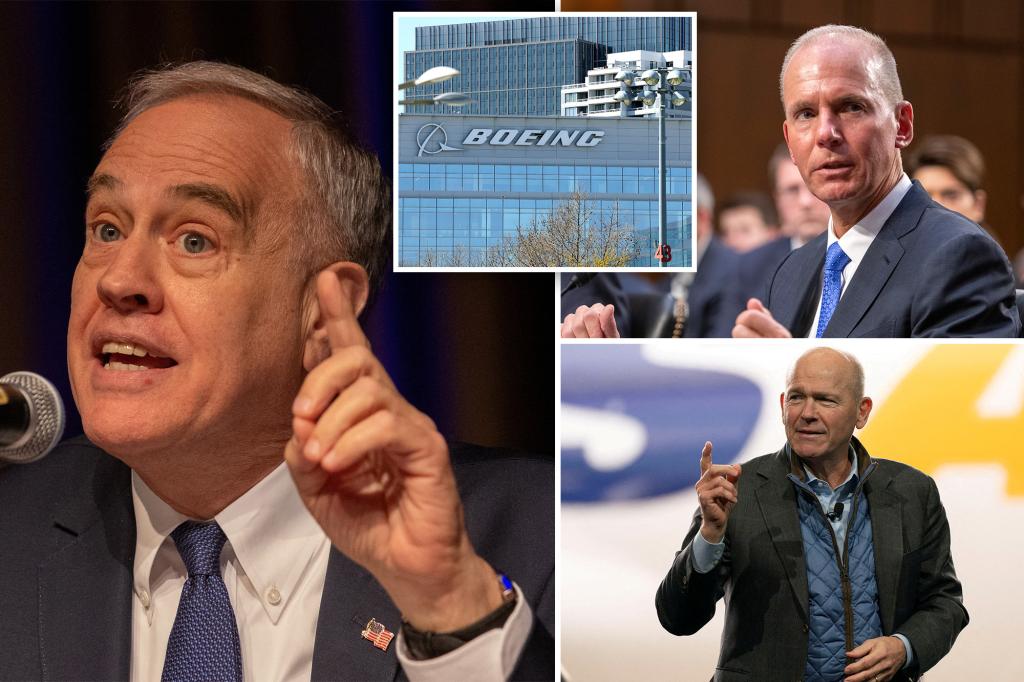

The decision to vote against the executives is based on the terrifying Alaska Airlines flight incident in January, where a door blew off a 737 Max jet, resulting in minor injuries to passengers. The pension fund will specifically vote against the reappointment of Dave Calhoun, the board’s chairman and CEO, as well as two other board members, Lynn Good and Robert Bradway. Calhoun has already announced plans to step down by the end of the year as part of efforts to improve the company’s safety and quality standards.

Boeing has responded to the pension fund’s actions, stating that the changes are intended to improve the company’s performance in achieving safety and quality goals outlined by the Compensation Committee for 2024. The company has provided a lengthy statement to shareholders in response to the upcoming shareholder meeting, where these votes will take place. The push to remove executives and block pay raises is part of an effort to hold Boeing accountable for its handling of safety issues and corporate oversight.

DiNapoli frequently uses New York’s $205 billion pension fund to align shareholder votes with environmental, social, and governance goals. In addition to taking action against Boeing, the comptroller plans to direct the fund to vote against proposals from other companies such as Amazon, Tesla, Meta, and Dollar General in the coming weeks. This approach is part of a broader strategy to leverage the fund’s power as a shareholder to advocate for responsible corporate behavior and governance practices.

The pension fund’s decision to vote against Boeing executives and proposals reflects growing concerns about corporate accountability and transparency in the wake of recent disasters. By using its shareholder influence, New York State aims to send a strong message to companies about the importance of prioritizing safety, quality, and responsible governance. The actions taken by the pension fund are intended to drive positive change within Boeing and other companies, emphasizing the need for ethical leadership and oversight in corporate decision-making.

Overall, New York State’s efforts to remove three top Boeing executives and block pay raises through its pension fund represent a significant step in holding companies accountable for their actions. By leveraging its shareholder power, the state aims to promote responsible corporate behavior and governance practices, particularly in industries with high stakes for public safety. The push to remove Boeing executives serves as a warning to other companies that neglecting safety and oversight can have serious consequences, both financially and reputational. Through these actions, the pension fund seeks to drive meaningful change in the corporate sector and foster a culture of accountability and transparency among companies.