Nvidia’s stock has soared 248% since a strong quarterly earnings report last year, leading to predictions that the stock price could surpass $1,000. The company recently reported earnings that beat expectations and raised guidance, leading to a 10-for-1 stock split, increased dividends, and stock buybacks. With the split expected to push the stock price down to around $100 per share, there are expectations of sustained high growth for the company in the future.

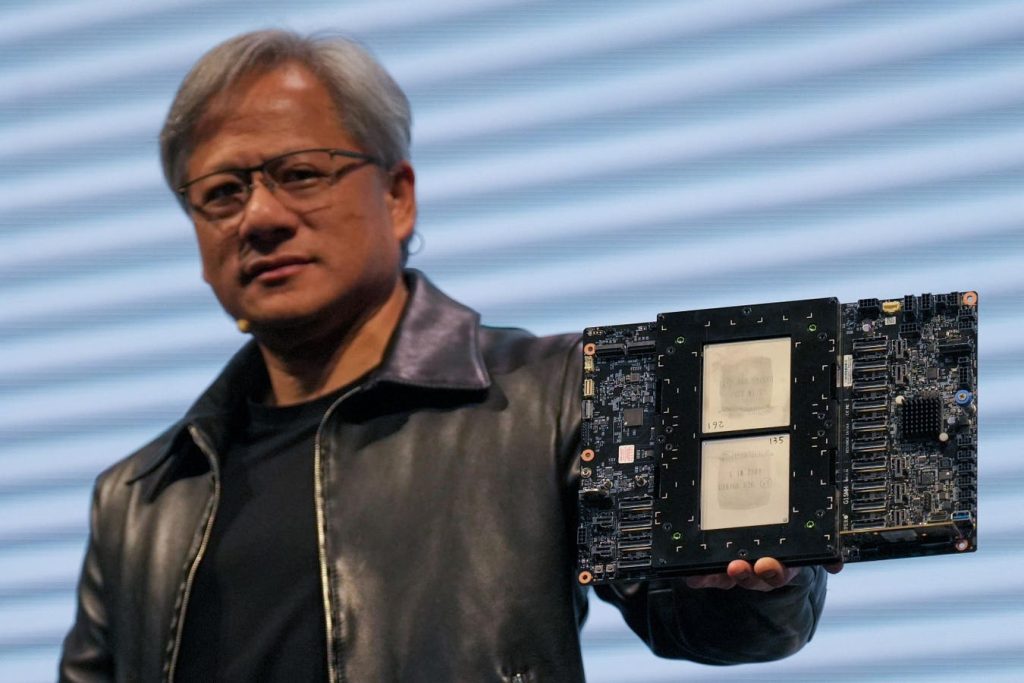

The factors that could potentially drive Nvidia’s shares back above $1,000 post-split include the company’s strong performance and prospects, successful growth investments, and CEO Jensen Huang’s leadership. Investors are optimistic about Nvidia’s growth trajectory and the potential for continued success under Huang’s leadership. However, there are concerns about the company’s reliance on Huang and the need to identify a capable successor to ensure continued growth and success.

Nvidia’s recent performance in the first quarter of 2025 exceeded investor expectations, with higher net sales, gross margins, and adjusted earnings per share. The company’s focus on data centers and innovative products like the H100 GPU and Blackwell successor has driven significant revenue growth. Under Huang’s leadership, Nvidia has gained a dominant market share in the AI chip industry, with customers willing to pay a premium for the company’s products.

Despite Nvidia’s strong performance and growth prospects, there are risks to the company’s continued success, including its dependence on CEO Jensen Huang. The need to identify and develop a capable successor is crucial to ensure the company’s long-term success. Nvidia’s post-split stock is expected to rise significantly, with optimistic projections suggesting a potential increase from $100 to $1,000 by 2026 if the company continues to beat growth expectations and raise forecasts.

Analysts have differing opinions on the future prospects of Nvidia’s stock, with some highlighting the company’s innovation and potential for sustained growth through generative AI technology. However, there are concerns about the need for Nvidia to continue outperforming expectations and navigate competition from rivals in the industry. Overall, Nvidia’s stock is expected to remain strong in the coming years, driven by its innovative products and leadership in the AI chip market.