Nvidia’s shares surged over 10% after the company reported strong earnings that surpassed Wall Street estimates and showcased continued high demand for its artificial intelligence chips. The company’s data center revenue experienced an impressive 427% growth during the quarter, contributing to a total first-quarter revenue of $26.04 billion, exceeding expectations. Nvidia also issued a bullish guidance for the current quarter, projecting $28 billion in revenue, well above analyst estimates.

The company’s stock reached a record high of $1,051.96 during intraday trading, crossing the $1,000 mark for the first time. Overall, Nvidia’s shares have risen about 111% since the beginning of the year, reflecting positive investor sentiment. Despite some concerns about a potential “air pocket,” analysts have become increasingly optimistic about Nvidia’s growth prospects following the strong earnings report. Bernstein raised its price target to $1,300, emphasizing that the company’s growth story is far from over.

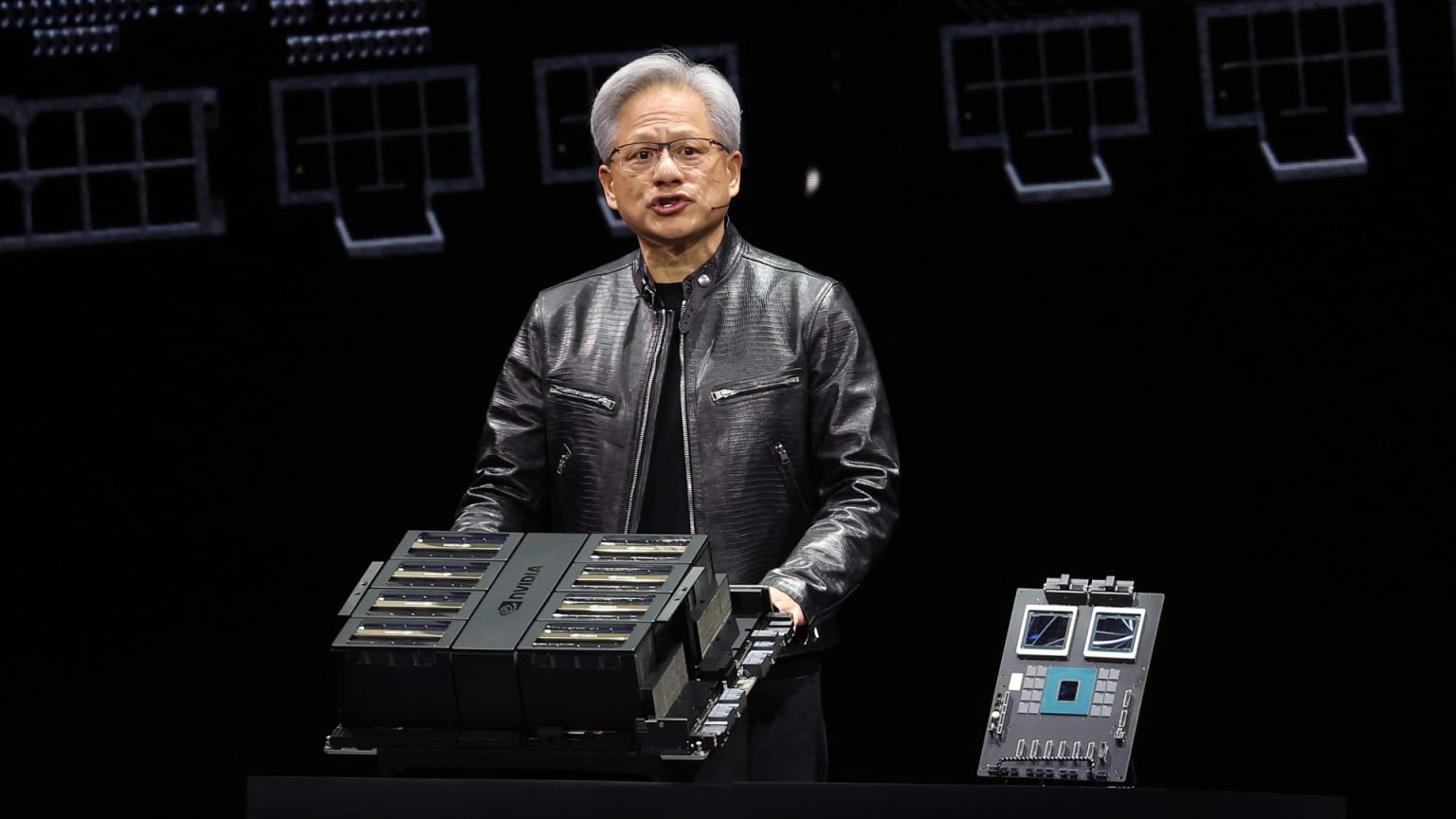

Jefferies also increased its price target to $1,350, citing expectations of a successful launch for Nvidia’s new AI graphics processors, called Blackwell, and anticipating further outperformance later in the year. Nvidia’s net income for the quarter was $14.88 billion, or $5.98 per share, a significant increase from the $2.04 billion, or 82 cents per share, reported in the same period last year. The company’s strong financial performance has positioned it as a key player in the AI and data center markets.

In addition to its financial success, Nvidia announced a 10-for-1 stock split, with shares set to begin trading on a split-adjusted basis on June 10. This move aims to make Nvidia’s stock more accessible to a wider range of investors and increase market liquidity. The stock split reinforces Nvidia’s confidence in its future growth prospects and its commitment to creating long-term value for shareholders.

Overall, Nvidia’s robust earnings report, strong revenue guidance, record stock price, and upcoming stock split reflect the company’s continued success in the AI and data center markets. Analysts remain optimistic about Nvidia’s growth potential and are raising their price targets to reflect the company’s strong performance. With ongoing demand for its AI chips and new product launches on the horizon, Nvidia is well-positioned for further growth and expansion in the coming months.