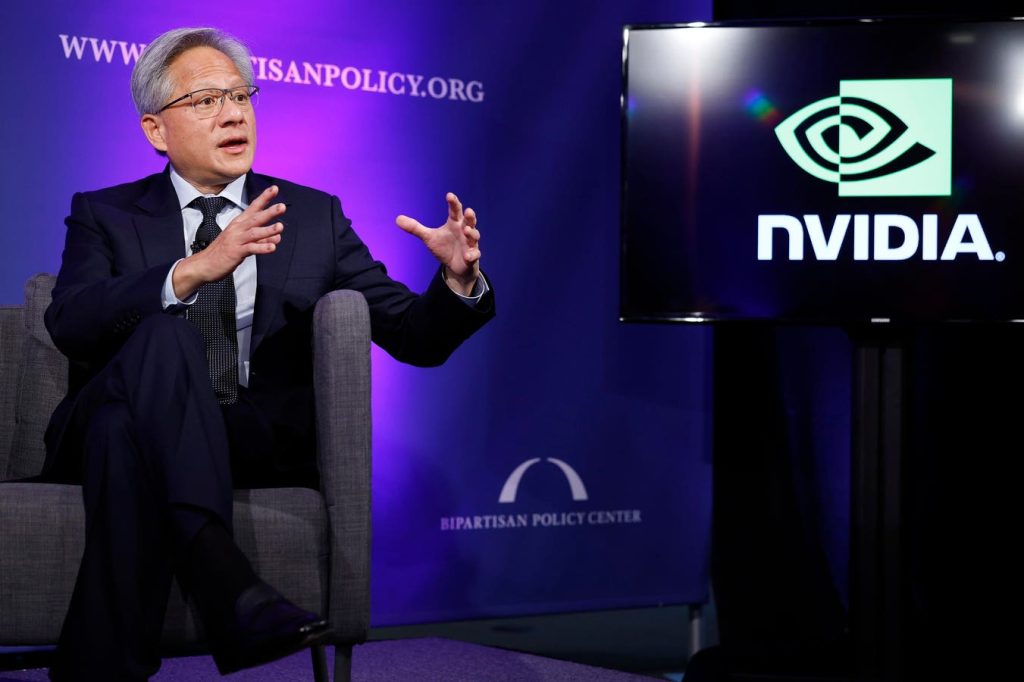

Nvidia CEO Jensen Huang recently revealed in an interview that demand for the tech giant’s upcoming Blackwell “Superchip” is incredibly high, leading to a surge in Nvidia’s shares by more than 3%. The stock reached as high as $124.26 before closing at $122.80, marking a 3.3% increase. Huang mentioned that companies like Microsoft, OpenAI, Meta, and other AI-related firms are eager to get their hands on the Blackwell chip, with everyone wanting to be first to utilize it.

This positive trading day follows a series of gains for Nvidia since early September, when the company’s shares dipped to $102.83 despite reporting record revenues. The Blackwell-based products are set to be shipped to cloud service divisions at major tech companies like Oracle, Amazon, Microsoft, and Google later this year. This heightened demand for the Blackwell chip is a testament to Nvidia’s strong position in the artificial intelligence market.

Despite the rise in Nvidia’s shares, the broader stock market was down on the day, with the S&P 500 dropping and the Nasdaq closing in the red. However, the increase in Nvidia’s stock price has contributed to CEO Jensen Huang’s net worth, which is now estimated to be $107 billion, making him the twelfth-richest person in the world. The Blackwell chip is expected to be priced between $30,000 and $40,000 per unit and is designed to train AI models at high speeds while minimizing energy consumption.

Nvidia’s Blackwell chip further solidifies the company’s position as a leader in the AI market, with major tech players relying on its products and services. Despite some fluctuations in its stock price between July and September, Nvidia’s stock has risen significantly since the beginning of the year. The company reported record revenues in the second quarter, reaching $30 billion in sales and $16.5 billion in net income. The datacenter division, which includes its AI offerings, generated $26.3 billion in revenue, reflecting a 154% year-over-year increase.

Overall, Nvidia’s Blackwell chip and the high demand for it reinforce the company’s reputation in the AI market and its strong financial performance. With major tech firms eager to utilize the innovative technology, Nvidia continues to be a key player in shaping the future of artificial intelligence.