Nvidia, a leading chip-making company based in Santa Clara, California, reported a massive increase in profit in its first quarter, ending April 28. The company’s net income rose more than sevenfold compared to the previous year, jumping to $14.88 billion from $2.04 billion. Revenue also more than tripled, reaching $26.04 billion from $7.19 billion. The company’s earnings per share adjusted to exclude one-time items were $6.12, exceeding Wall Street analysts’ expectations of $5.60. Additionally, Nvidia announced a 10-for-1 stock split and increased its dividend to 10 cents a share from 4 cents.

Nvidia’s success can be attributed to its early lead in developing hardware and software for AI applications. CEO Jensen Huang’s foresight in steering the company towards AI technology over a decade ago has paid off, making Nvidia a dominant player in the AI industry. In addition to AI, the company also manufactures chips for gaming and automotive applications. With the third highest market value on Wall Street, Nvidia is behind only Microsoft and Apple in terms of market capitalization. Despite efforts by other tech companies to reduce their dependence on Nvidia, the company’s hardware dominance in AI remains unmatched, resembling the early days of Intel Corp.

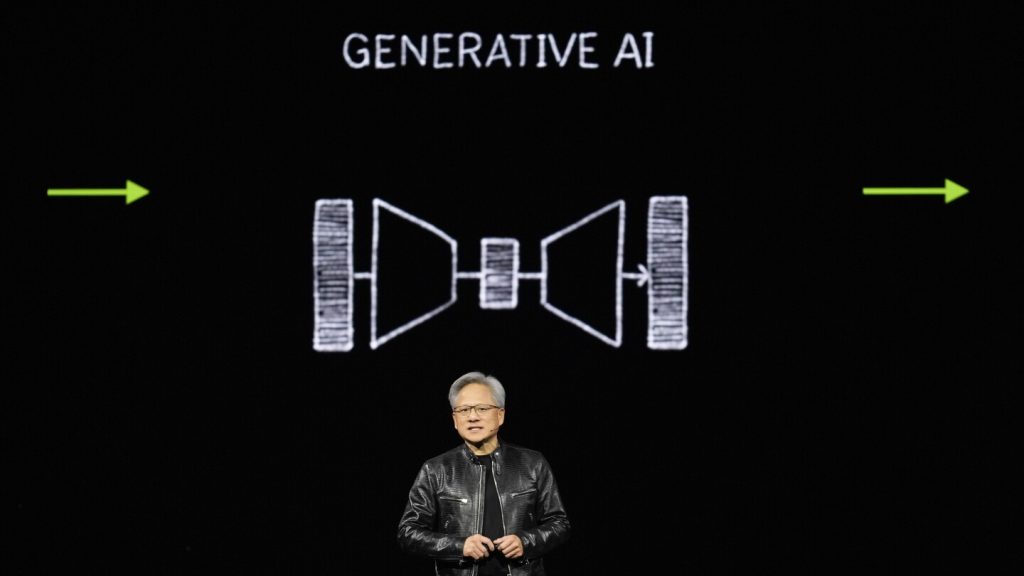

The rising demand for generative AI systems, capable of tasks like composing documents, creating images, and serving as personal assistants, has been a driving force behind Nvidia’s skyrocketing sales of specialized AI chips. Major tech players such as Amazon, Google, Meta, and Microsoft have signaled their intention to increase spending on Nvidia’s chips and data centers to support their AI systems. This growth in AI applications has contributed to Nvidia’s impressive financial performance in the past year, with its stock price rising over 200%. Analysts see Nvidia’s strong quarterly report as a testament to the company’s resilience and position in the booming AI market.

Emarketer analyst Jacob Bourne described Nvidia’s latest financial results as defying gravity, highlighting the company’s continued success in the face of challenges. While some tech companies are eager to reduce their reliance on Nvidia, given its dominant position in AI hardware, they have yet to fully achieve this goal. Nvidia’s specialized AI chips have enabled it to carve out a niche in the market, driving substantial revenue growth. The announcement of a stock split and dividend increase reflects Nvidia’s confidence in its future prospects and commitment to making its shares more accessible to employees and investors.

Investors responded positively to Nvidia’s earnings report, with the company’s stock rising more than 4% in after-hours trading to $991.85. This upward trend in Nvidia’s stock price reinforces its position as a strong performer in the tech industry. As the demand for AI technology continues to grow, Nvidia is well-positioned to capitalize on this trend and maintain its leadership in the market. With ongoing advancements in AI applications and partnerships with major tech companies, Nvidia’s future looks promising, signaling continued growth and success in the years to come.