Nvidia’s shares experienced a significant 10% drop on Friday, marking the worst day for the chipmaker since March 2020 when the company’s value was significantly lower at one-twelfth of its current $1.9 trillion market cap. This sudden decline was not directly linked to any specific news related to Nvidia. However, another vendor, Super Micro Computer, which builds Nvidia-based servers, also saw a sharp drop of 23% in its shares on the same day after deviating from its usual pattern of providing preliminary results. Super Micro announced that it would report its earnings later this month, leading to uncertainty in the market.

In January, Super Micro had raised its sales and earnings guidance just 11 days before announcing its second-quarter financial results. The company is set to report its fiscal third-quarter results on April 30. Despite its recent success and rise in sales due to the high demand for Nvidia-based computers used in artificial intelligence applications like ChatGPT, Super Micro, and Nvidia emerged as the worst performers in the S&P 500 on Friday. Investors also began reducing their holdings of various semiconductor stocks ahead of earnings reports expected later in the month, contributing to the general downturn in the industry.

The VanEck Semiconductor Index, a chip-focused index, dropped by 4.5% on the same day, and Arm’s shares fell by 17%. Arm, a provider of intellectual property for chips that complements Nvidia’s graphics processor-based AI servers, experienced a significant decline in its stock value. Additionally, AMD, Nvidia’s primary competitor in the GPU market, also saw its shares fall by 5%. Despite these setbacks, Super Micro’s shares remain up by approximately 151% this year, following a 246% increase in 2023. Similarly, Nvidia’s shares have seen a strong performance so far in 2024, rising by over 58%.

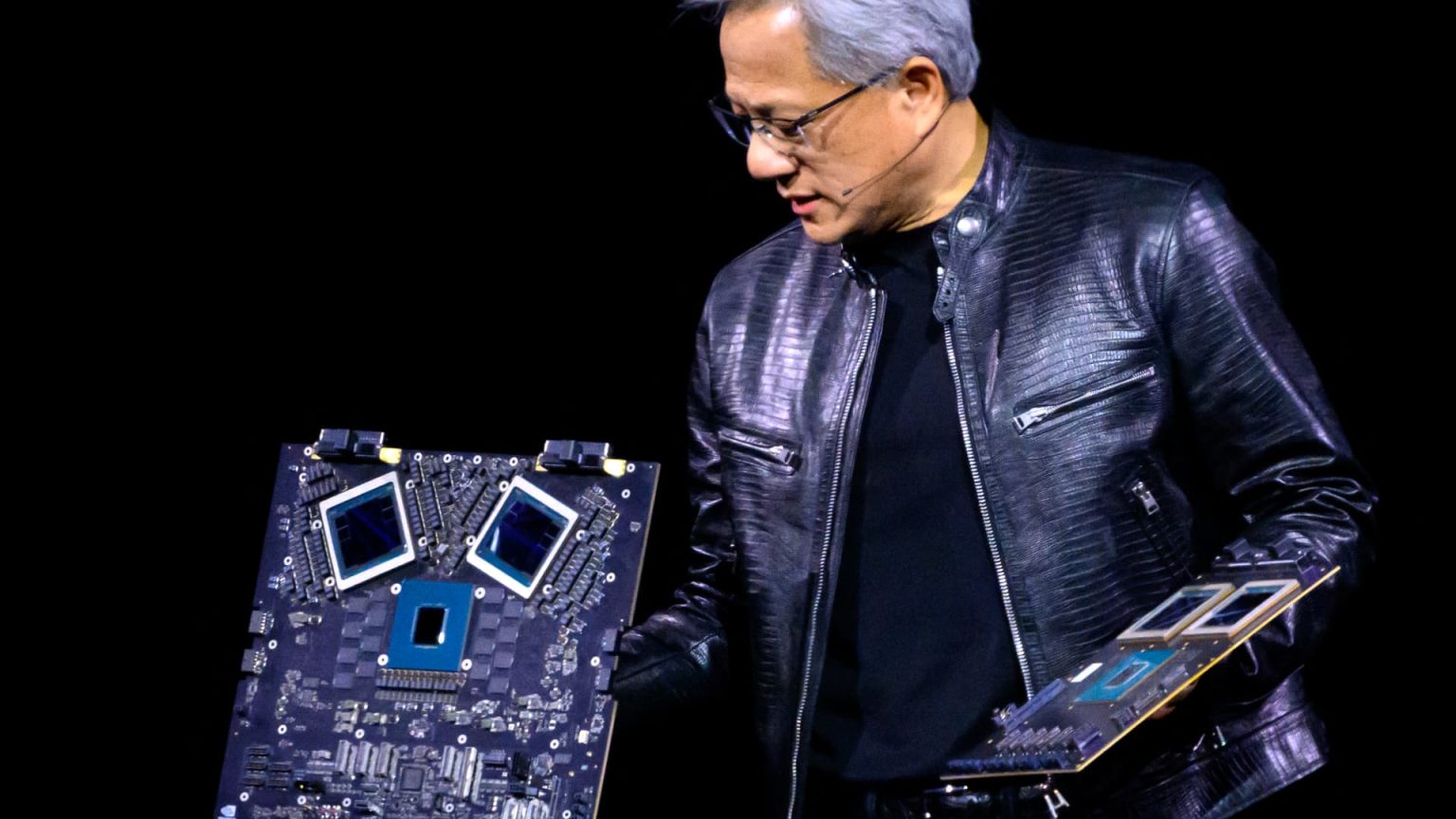

However, in the face of rising competition and market volatility, the situation remains highly contested. Competitors like Dell and Hewlett Packard Enterprise are gearing up to build systems using Nvidia’s latest generation of Blackwell graphics processing units, posing a challenge to both Nvidia and Super Micro. As the market continues to evolve and new technologies emerge, it is crucial for companies in the semiconductor industry to adapt and innovate in order to maintain their competitive edge and respond effectively to market fluctuations.