Nvidia reported impressive fiscal 2025 first-quarter results, with revenue surging 262% year-over-year to $26.04 billion, exceeding analysts’ forecasts. Adjusted earnings per share also increased significantly, and gross margin beat expectations. The company announced a 10-for-1 stock split, which is intended to make stock ownership more accessible to employees and investors. Nvidia’s high-performance GPUs are driving the accelerated data centers being built worldwide, with a potential software business through Nvidia AI Enterprise. The company’s strong results and forward guidance suggest continued demand for its products, with a focus on AI infrastructure and partnerships with major companies like Tesla and Meta.

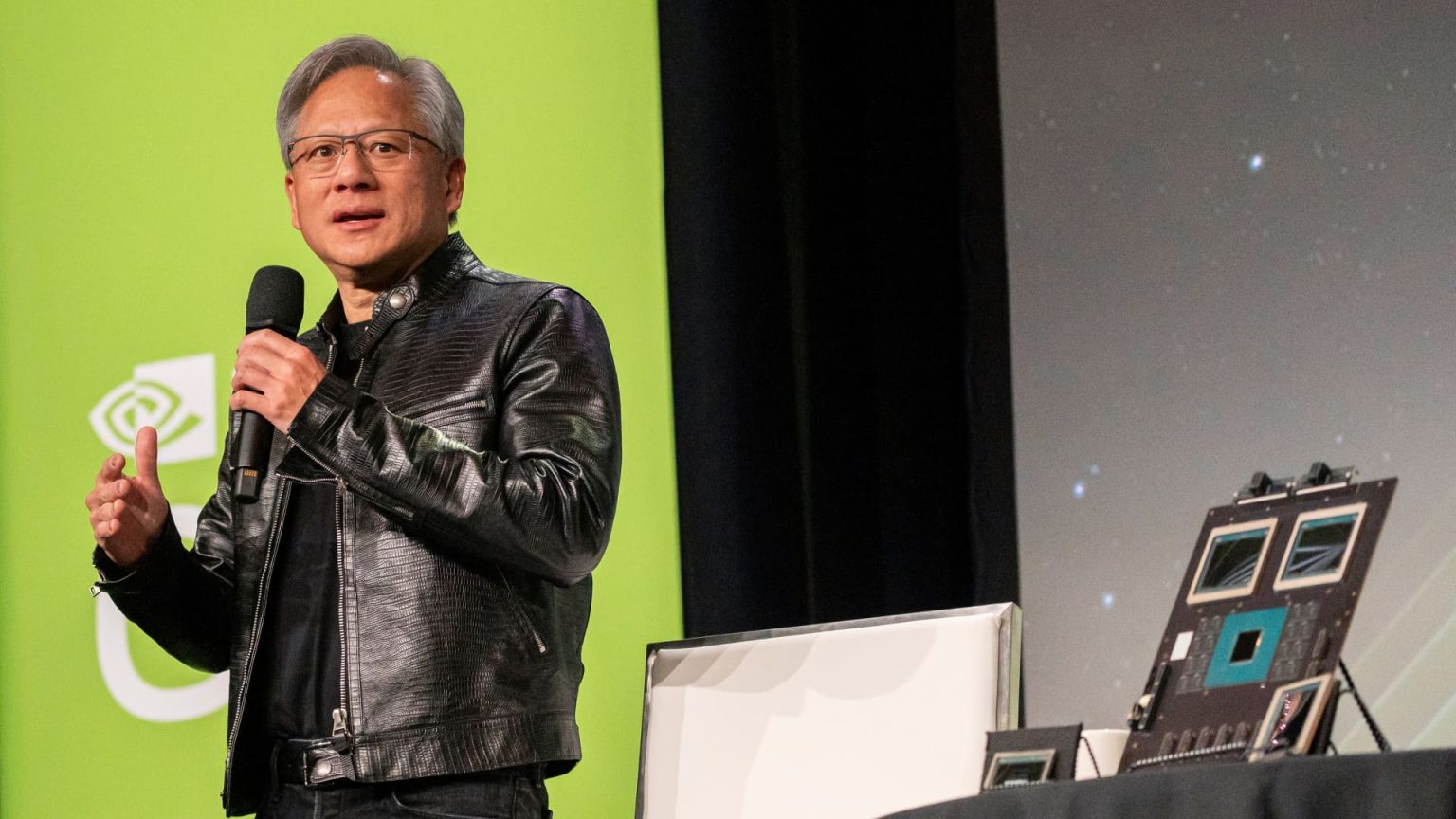

Nvidia’s CEO Jensen Huang emphasized the transformation of traditional data centers to accelerated computing, highlighting the company’s key role in the AI revolution. The shift in computing technology towards intention understanding and reasoning is seen as a fundamental platform shift. Nvidia’s market leadership, performance, and value proposition position it favorably in the competitive landscape. Despite concerns about custom chips from big cloud companies, Nvidia remains confident in its technology and value proposition. The company’s focus on accelerated computing and AI infrastructure reinforces its long-term growth potential and market position.

Nvidia’s strong quarterly results were driven by growth across customer types, particularly enterprise and consumer internet companies. Large cloud companies accounted for a significant portion of data center revenue, indicating strong demand for Nvidia’s products. The company highlighted partnerships with key customers like Tesla and Meta, showcasing the potential for growth in automotive and consumer internet AI applications. Nvidia sees significant opportunities in AI factories and sovereign AI, with revenue expected to grow substantially in these areas. Supply constraints on certain products are expected to persist but are offset by demand for new products like Blackwell.

The company’s fiscal Q2 guidance reflects continued strong demand for its products, dispelling concerns about an AI spending “air pocket.” Nvidia expects revenue to exceed consensus estimates, with gross margins also projected to be higher than expected. Capital returns include a significant increase in the quarterly dividend and stock repurchases in fiscal Q1. The company’s approach to capital returns and investment in new products demonstrate its commitment to long-term growth and shareholder value. Nvidia’s outlook remains positive, with a focus on expanding partnerships and market opportunities.

Overall, Nvidia’s strong financial performance, strategic vision, and innovative products position it well for continued growth in the AI and accelerated computing markets. The company’s leadership in high-performance GPUs, AI infrastructure, and partnerships with major customers indicate a resilient and competitive position in the industry. Nvidia’s focus on long-term value creation, capital returns, and strategic investments support its growth trajectory and market leadership. With a positive outlook for future revenue growth and profitability, Nvidia’s stock split and increased price target signal confidence in the company’s long-term prospects.