Nvidia reported earnings that exceeded expectations, with over $30 billion in sales in the fiscal second quarter, up 122% from the previous year. Profits also more than doubled to $16.6 billion. The company’s sales guidance for the current quarter was better than expected, but Nvidia’s stock dipped by 5% in after-hours trading after the report. The company’s impressive growth in the AI sector has contributed to a rise in its stock price, which is up 154% this year and over 3,000% in the past five years. Nvidia’s market value is now over $3 trillion, making it one of only three US companies to reach that milestone.

Questions have begun to arise about the sustainability of the AI hype cycle, particularly related to uncertainty about the technology’s contributions to tech giants’ bottom lines and the overall growth potential of the sector. Nvidia’s stock volatility after the earnings report reflected concerns about potential delays in their latest AI chips, known as Blackwell. Despite these worries, Nvidia expects to begin generating revenue from Blackwell in the fiscal year. The smaller-than-expected beat in their earnings added to concerns across the tech space, according to Investing.com senior analyst Thomas Monteiro.

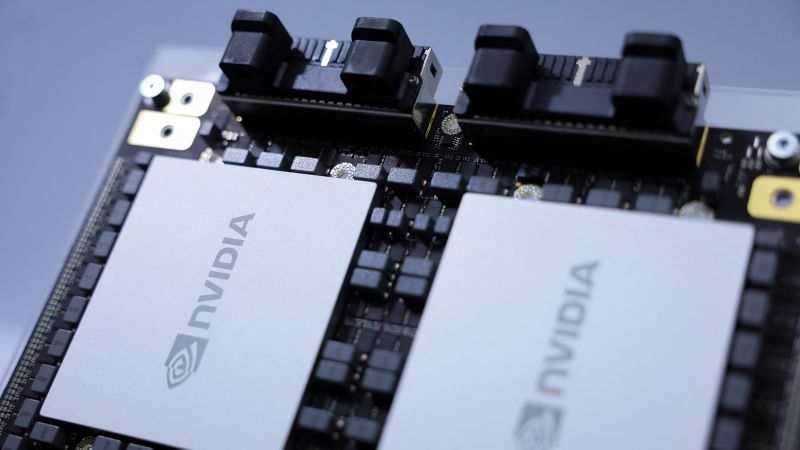

Nvidia’s data center business remains a strong driver of its success, accounting for 87% of the company’s total revenue. The demand for AI infrastructure in the tech sector continues to increase, with Silicon Valley giants like Google, Microsoft, and Meta Platforms signaling increased AI investment. Despite concerns about Blackwell delays, Third Bridge estimates that a significant portion of AI model training at hyperscalers will be done using Nvidia chips by the end of next year. Even with these challenges, Nvidia CEO Jensen Huang emphasized that the company’s chips are used in various applications beyond AI chatbots, including ad targeting systems, search engines, and social media algorithms.

The trajectory of Nvidia’s stock has significant effects on the broader market due to the company’s substantial weighting in the S&P 500. The company’s earnings reports have become a crucial financial event. While investors may have been disappointed by the smaller-than-expected beat in earnings, business does not appear to be slowing down for Nvidia. Market paradoxes, such as tech companies investing in AI infrastructure while also developing their own silicon, continue to drive demand for Nvidia’s chips. Huang reiterated that Nvidia’s chips provide immediate returns for investors through more efficient data processing, ensuring strong fundamentals for the company in the future.

In conclusion, despite concerns about potential setbacks with Blackwell and the sustainability of the AI hype cycle, Nvidia’s fundamental business remains robust. The company continues to benefit from increased AI investments from tech giants and a growing demand for its chips. Huang’s emphasis on the diverse applications of Nvidia’s chips beyond AI highlights their potential for future growth. While the hype surrounding Nvidia’s stock may fluctuate, the company’s strong performance and leadership in the AI sector position it well for continued success in the future.