The state and local authorities have been engaged in a financial war for years, accusing each other of wasteful spending. The tensions heightened in September when two resigning ministers, Bruno Le Maire (economics) and Thomas Cazenave (public accounts), warned parliamentarians that the “extremely rapid increase in local government spending” could burden the country’s finances by 16 billion euros by 2024. This led to immediate backlash and accusations of manipulation and lies from various political figures. However, the reality of the situation and the actual amounts involved need to be examined.

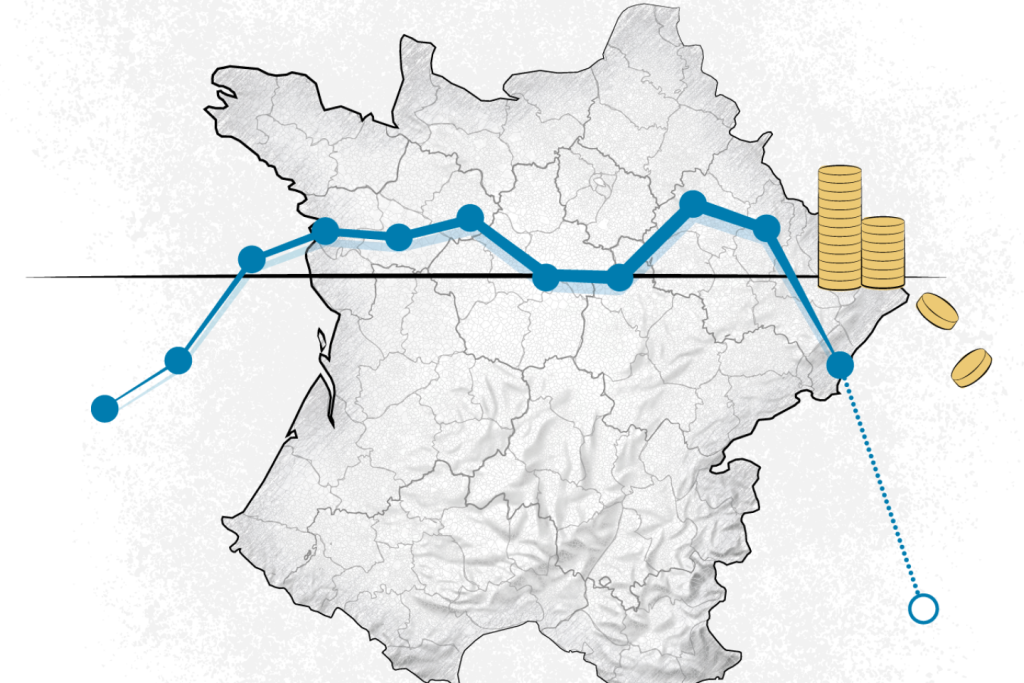

Local authorities represent only 18% of the 1,608 billion euros spent by public administrations in 2023 according to the National Institute of Statistics and Economic Studies (INSEE). The majority of spending goes towards social security (43%) and state expenses (39%). Local authorities account for 316 billion euros, with 250 billion euros for operations and 66 billion euros for investments. The revenue (306 billion euros) comes from local taxes, user fees, and transfers from the state, such as the general operating grant (27 billion euros) and tax transfers (52 billion euros).

Local authorities are not allowed to have deficits in operational expenses, as they cannot borrow to cover daily expenses. They must carefully monitor their budgets and often end up spending less than what they receive in revenue, creating a surplus. This financial responsibility is overseen by the prefect and regional audit chambers. Despite the accusations and tensions surrounding local government spending, it is essential to consider the facts and figures to understand the financial situation accurately.

The accusations and counter-accusations between the state and local authorities have created a tense atmosphere regarding financial management. However, understanding the breakdown of spending and revenue for local government is crucial in assessing the actual impact on the country’s finances. With local authorities responsible for a significant portion of public spending, it is essential to have transparency and accountability to ensure efficient use of resources and prevent financial strains on the country.

The debate about the financial practices of local authorities highlights the complexity of public spending and the need for effective management. Accusations of wasteful spending and manipulation must be examined in light of the fiscal responsibilities and limitations faced by local authorities. By analyzing the facts and figures, it is possible to gain a clearer understanding of the challenges and opportunities for improving financial management at the local level. Ultimately, transparency, accountability, and cooperation between state and local authorities are essential for ensuring the sustainable management of public finances.