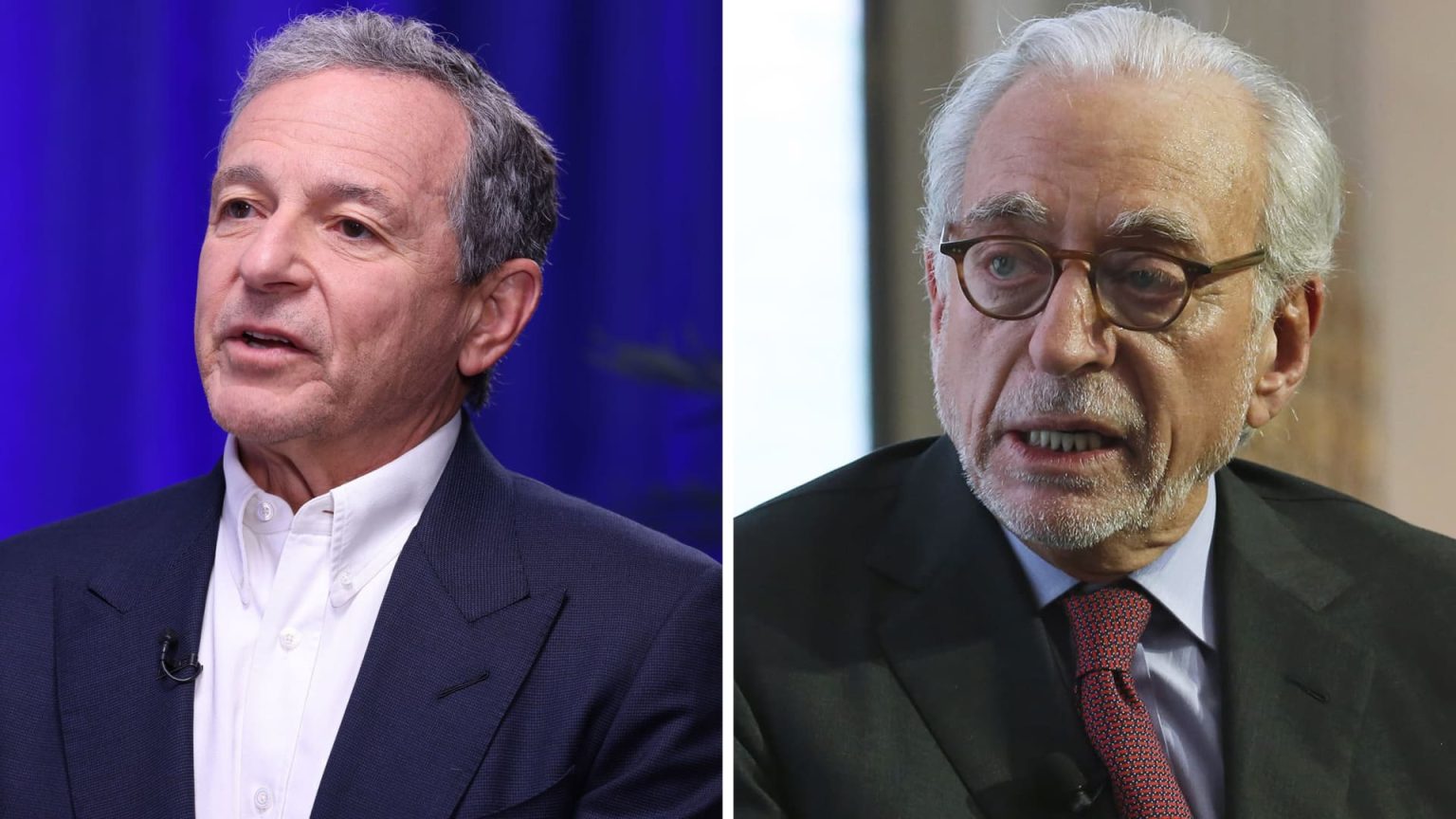

Activist investor Nelson Peltz has recently sold his entire stake in Disney, making approximately $1 billion on the position. This decision came after Peltz’s Trian Partners lost a proxy battle at Disney in early April, where shareholders reelected the company’s full slate of board nominees. Peltz had been attempting to elect himself and former Disney Chief Financial Officer Jay Rasulo to the board, but ultimately did not succeed. Peltz had previously been critical of Disney’s governance, focusing on issues such as the company’s streaming strategy and their CEO succession plan.

In October, CNBC reported that Peltz had increased his stake in Disney to around 30 million shares and had reignited his proxy campaign. Although his efforts did not result in the changes he desired, Trian Partners expressed pride in the impact they had on refocusing the company on value creation and good governance following the April shareholder vote. Despite the setback, shares of Disney have seen an 11% increase so far this year, slightly outperforming the S&P 500. Peltz’s decision to sell his entire stake in Disney at around $120 per share adds to his successful investment in the company.

The sale of Peltz’s Disney stock marks a significant development in his relationship with the company and reflects his dissatisfaction with the direction of their governance and strategic decisions. Disney’s streaming strategy and CEO succession plan were among the key areas of concern for Peltz, prompting his proxy campaigns and increased stake in the company. While Trian Partners did not achieve their desired outcome, their impact on Disney’s focus on value creation and good governance is acknowledged in their statement following the shareholder vote.

Peltz’s exit from Disney with a substantial profit of $1 billion on his stake indicates a successful investment decision despite the proxy battle loss. The sale at approximately $120 per share, compared to the current trading price of around $100 per share, demonstrates Peltz’s ability to capitalize on his position in the company. This move also highlights the volatile nature of activist investing and the potential for significant gains or losses depending on the outcomes of proxy battles and strategic conflicts with company management.

Disney’s response to Peltz’s exit from the company is not immediately clear, as they did not provide a comment on the matter. The impact of Peltz’s departure on Disney’s future strategy and governance remains to be seen, as his advocacy for changes in governance and strategic direction may have influenced the company’s decisions. Despite the challenges faced by Trian Partners in their proxy battle with Disney, the company’s stock performance and focus on value creation indicate a positive trajectory for the company following the shareholder vote. Peltz’s decision to sell his stake in Disney marks the end of a chapter in his relationship with the company, but the impact of his activism on Disney’s governance and strategic direction may continue to be felt in the future.