Nebraska’s unicameral Legislature is currently debating a proposal to increase the state’s sales tax by one percent. This would raise the tax to 6.5% on every taxable dollar spent, making it among the highest in the country. The bill also includes new taxes on candy and soda, as well as a 100% tax on hemp and CBD products. Lawmakers were set to vote on whether to advance the bill to a second round of debate, where it faces opposition from both the left and far-right due to concerns about its impact on lower-income populations.

Supporters of the bill argue that the proposed tax increase is aimed at higher-income residents with more disposable income, rather than those struggling to make ends meet. The bill also includes a provision to eliminate sales tax on utility bills in an effort to address concerns about the impact on lower-income individuals. However, critics argue that a sales tax inherently puts more burden on lower-income populations, and that the tax increase will outweigh any property tax cuts for the majority of Nebraskans.

The bill is a key component of Governor Jim Pillen’s plan to reduce skyrocketing property taxes in Nebraska, which reached $5.3 billion in 2023. The increase in property taxes has been driven by rapidly rising housing prices, causing some individuals, particularly elderly people on fixed incomes, to be priced out of their homes. Pillen has indicated that he may call lawmakers back for a special session if property tax relief efforts fail to pass during the current legislative session, which is set to end by April 18.

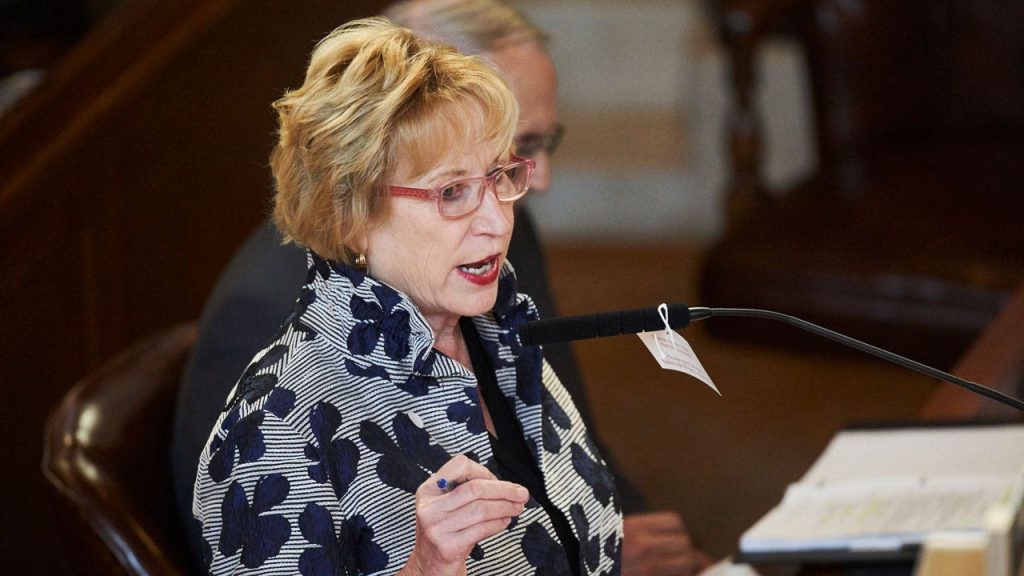

The bill has faced challenges in garnering enough support to advance, with Senator Lou Ann Linehan struggling to secure the necessary votes. Linehan argues that the bill is targeted at those with higher incomes who have more discretionary spending, rather than those living in poverty. The bill seeks to provide relief for property owners while increasing revenue from wealthier individuals who can afford to spend more on non-essential items. However, the bill has faced opposition from both sides of the political spectrum, with concerns raised about its potential impact on lower-income populations.

Overall, the debate over the proposed sales tax increase in Nebraska reflects broader concerns about tax policy and its impact on different income groups. While supporters argue that the tax increase is necessary to generate revenue and provide relief for property owners, critics question the fairness of burdening lower-income individuals with an increased tax burden. As the bill moves through the legislative process, it remains to be seen how lawmakers will address these competing priorities and concerns in their decision-making.