Last week, despite no significant changes in the economic outlook for the first quarter of the US GDP growth or the probability of recession in the next year, the equity market experienced a downturn. Market participants seemed eager to find reasons to dampen stock prices, with Minneapolis Fed President Neel Kashkari suggesting that there might not be a need for rate cuts if inflation does not improve. Federal Reserve Chair Jerome H. Powell, however, maintained a positive outlook, emphasizing solid growth, a strong labor market, and inflation moving towards 2%.

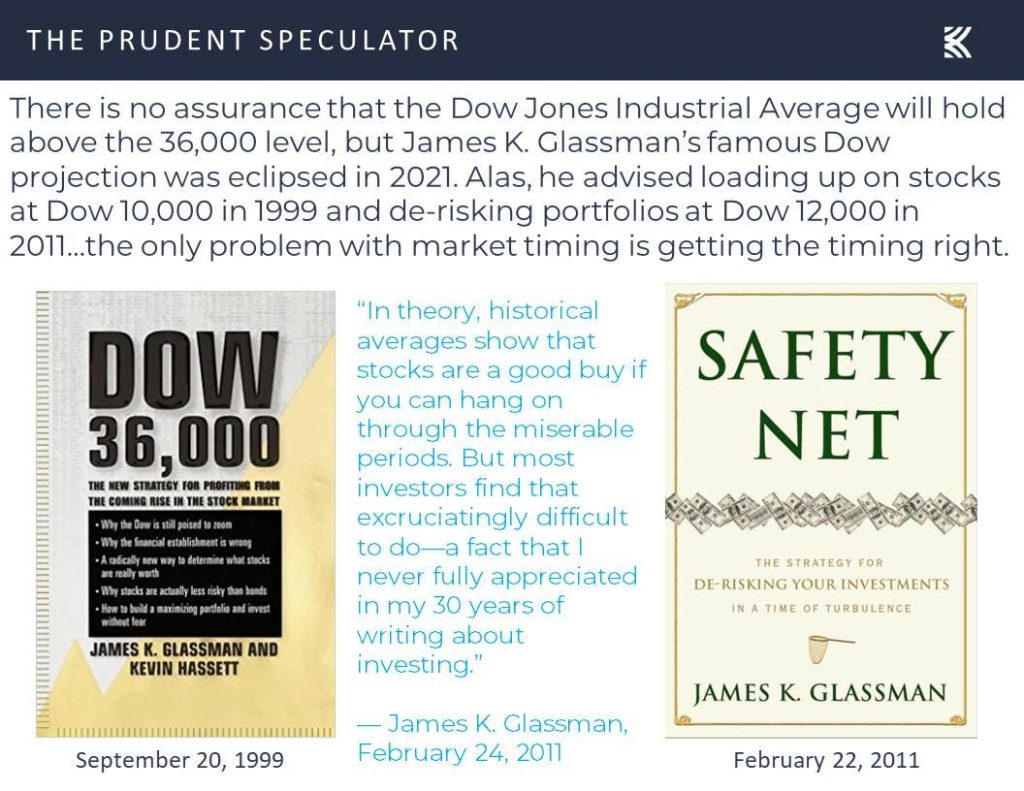

While the Dow Jones Industrial Average failed to reach 40,000, dropping below 39,000, it is still significantly higher than the recent Bear Market low of September 2022. The market has seen substantial growth over the years, proving rewarding for those who stay invested in equities. Despite the potential for more volatility, it is essential to remember that success in stocks comes from not letting fear drive investment decisions.

Health insurance stocks took a hit following a CMS ruling that left Medicare Advantage plan payment proposals unchanged. Elevance Health saw a decline in its stock price, as analysts and management teams revised their earnings forecasts lower due to the impact on Medicare Advantage plans. However, the company remains less reliant on Part C plans for growth compared to some of its peers. With a pharmacy benefit management platform and strong market penetration, Elevance’s earnings forecast remains positive, with a P/E ratio of 13.7 times the NTM EPS forecast and 12% growth predicted for the next three years.

This condensed version of an article from The Prudent Speculator highlights the recent market trends and offers investment insights for those following a Value-oriented philosophy. The weekly commentary from The Prudent Speculator provides valuable resources on stock market news, investing tips, and economic trends. To stay updated on such information and receive free stock picks, readers can sign up for regular reports from The Prudent Speculator for informed decision-making in the investment world.