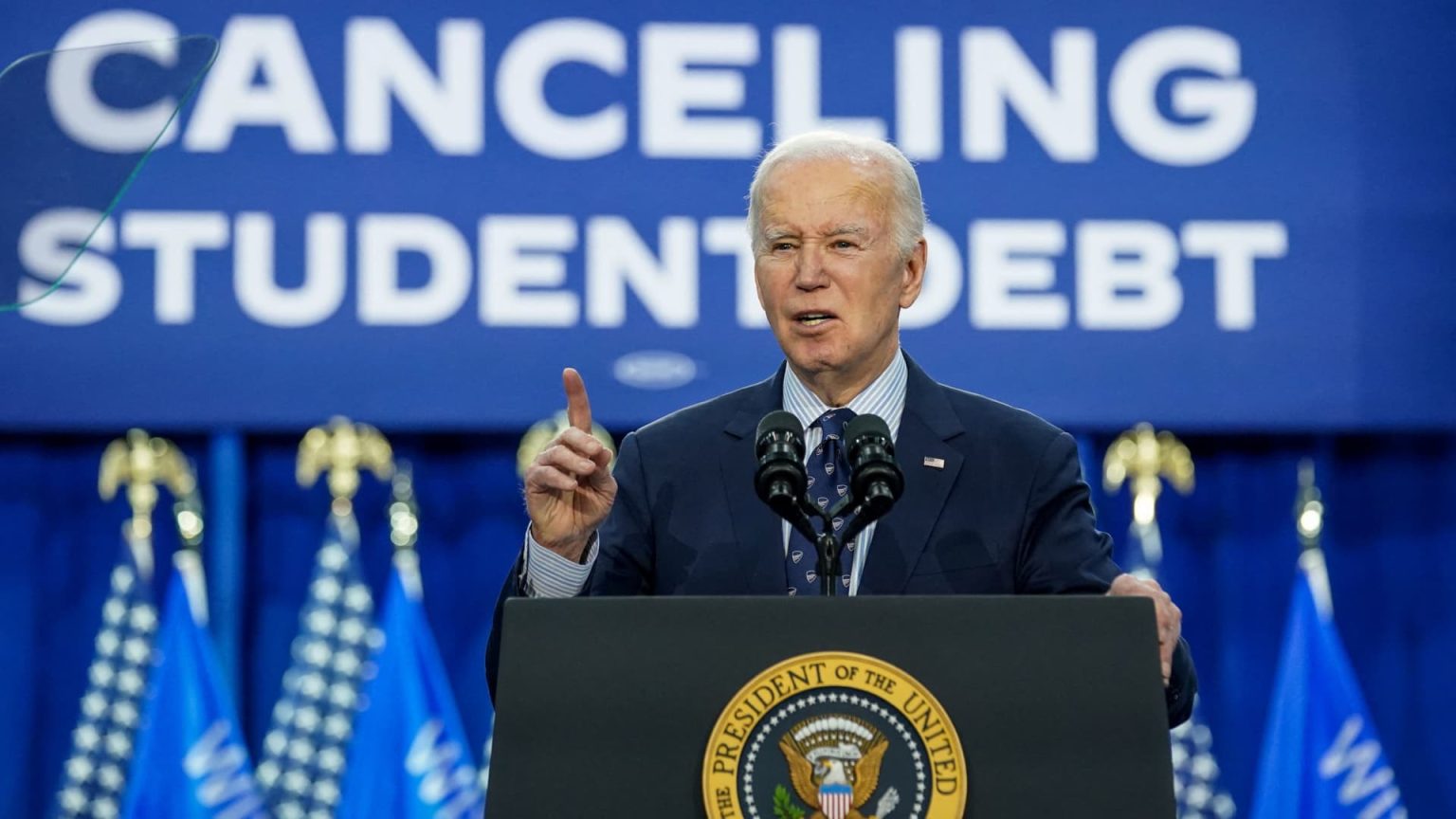

The Biden administration has proposed a new plan that could potentially erase up to $20,000 per borrower in unpaid interest on federal student loans. This plan aims to provide relief to the more than 25 million federal student borrowers who owe more than they originally borrowed. Under the plan, certain low- and middle-income borrowers could have the entire amount of interest that has accrued on their debt since they entered repayment canceled. Borrowers enrolled in income-driven repayment plans would automatically qualify for this relief without the need to apply.

The new forgiveness plan will also benefit certain groups of borrowers, including those who are already eligible for debt cancellation under an existing government program but have not yet applied, borrowers who have been in repayment for 20 years or longer on their undergraduate loans, or over 25 years on their graduate loans, those who attended schools of questionable value, and individuals experiencing financial hardship. The definition of financial hardship may include those burdened by medical debt or high child care expenses. President Biden originally attempted to cancel student debt through executive action but has now turned to the rulemaking process, with plans to begin forgiving student debt before the November election.

Interest rates on federal student loans have long been criticized for exceeding 8%, making it difficult for borrowers who fall behind or are on certain payment plans to reduce their balances. Student debt interest capitalization has been identified as a major obstacle keeping families from achieving their version of the American Dream. By erasing this debt, the burden of student loan debt on millions of borrowers could be lessened, allowing them to pay off their loans in a timely manner. The proposed plan estimates that borrowers will receive up to $20,000 of unpaid interest forgiven, regardless of their income, providing much-needed relief to those struggling with student loan debt.

While the full details of the new forgiveness plan are still forthcoming, it is expected to provide significant relief to a wide range of borrowers facing financial challenges. The Biden administration is working on issuing a proposed rule on its plan, which will be followed by a public comment period before implementation. By targeting groups of borrowers who are in need of assistance, such as those experiencing financial hardship or those who attended questionable schools, the plan aims to address the systemic issues within the student loan system that have left millions of Americans struggling with debt. Ultimately, the goal is to provide relief to borrowers and allow them to achieve financial stability and freedom from the burden of student loan debt.