In midday trading, several companies were making headlines. Nio, a Chinese electric vehicle maker, saw its U.S. shares rise by 2% following a JPMorgan upgrade to overweight from neutral. Analysts believe Nio could be in for a recovery rally after facing challenges throughout the year. On the other hand, Super Micro Computer saw its shares drop by 6% after JPMorgan downgraded the artificial intelligence server producer to neutral from overweight. The uncertainty surrounding regulatory compliance led the bank to slash its price target for the stock.

DocuSign, a software company, experienced a 3% increase in its shares after reporting fiscal second-quarter results that exceeded expectations. The company earned 97 cents in adjusted earnings per share on $736 million of revenue, surpassing analyst estimates. Similarly, Guidewire Software saw its stock jump by 11% following a strong fiscal fourth-quarter performance. The company’s earnings per share and revenue both exceeded expectations, leading to a positive full-year revenue forecast.

On the other hand, UiPath, a software stock, slid more than 5% amidst a tech-led market sell-off. Despite reporting better-than-expected fiscal second-quarter earnings and revenue, the company was unable to boost its stock price. Additionally, Bowlero, a bowling center stock, advanced nearly 7% after posting a revenue beat in the fiscal fourth quarter. The company reported $283.9 million in revenue, exceeding analyst expectations.

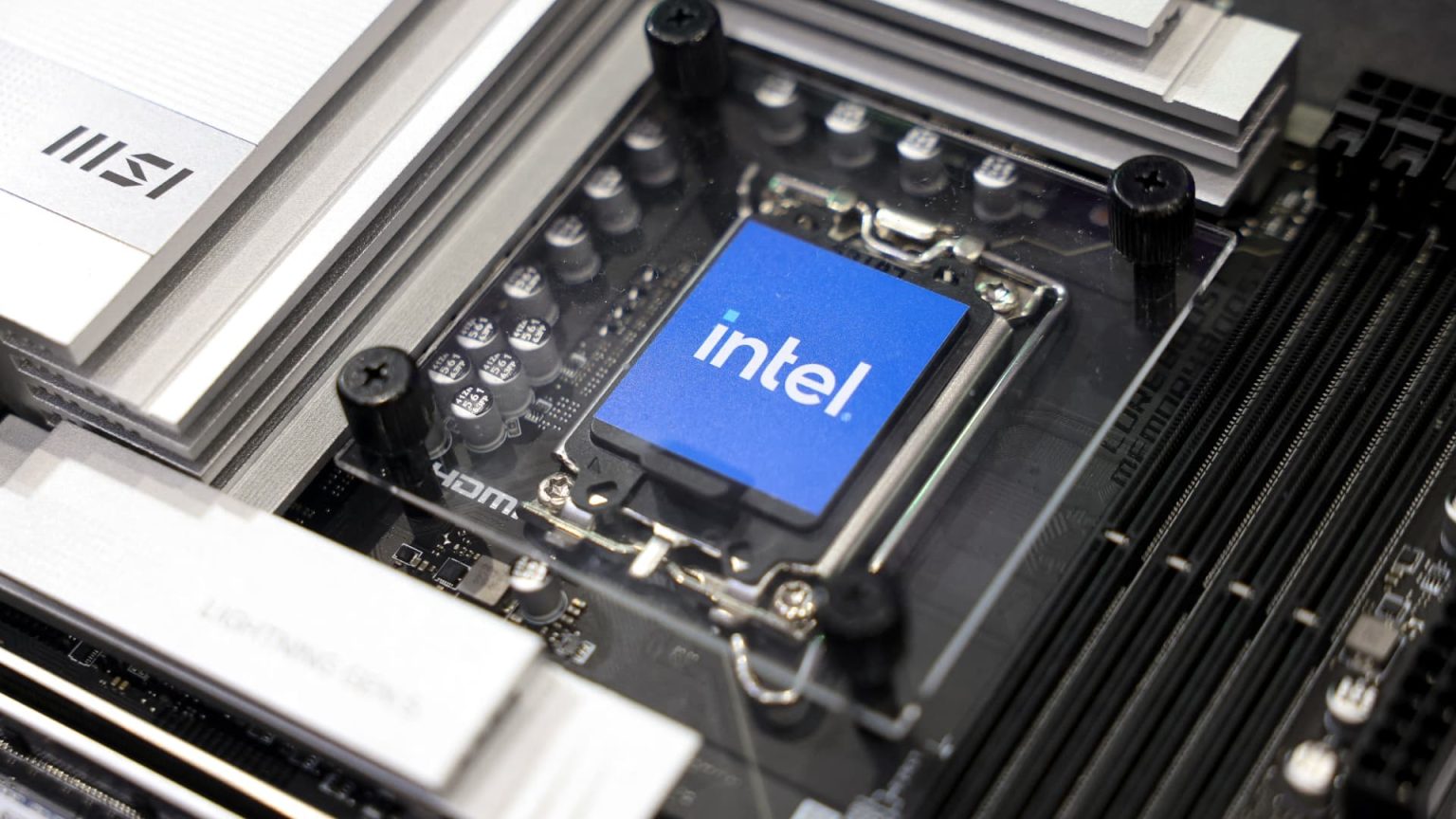

Shares of autonomous driving tech company Mobileye, owned by chipmaker Intel, slumped 8% after Bloomberg reported that Intel is considering options for its stake in Mobileye. This news contributed to a 3% decline in Intel’s shares. The broader semiconductor sector also experienced a sell-off, with the VanEck Semiconductor ETF down over 4%. Several chip stocks, including Nvidia, KLA Corporation, Marvell Technology, and ASML Holding, lost about 5% each.

In conclusion, the midday trading session saw a mix of gains and losses among various companies. Despite some positive performances from companies like Nio, DocuSign, and Guidewire Software, other companies like Super Micro Computer and UiPath faced declines. The uncertainty surrounding regulatory compliance for Super Micro and potential changes in ownership for Mobileye impacted investor sentiment. The broader semiconductor sector also faced downward pressure, contributing to a tech-led market sell-off. Investors will continue to monitor these companies for further developments as the trading day progresses.