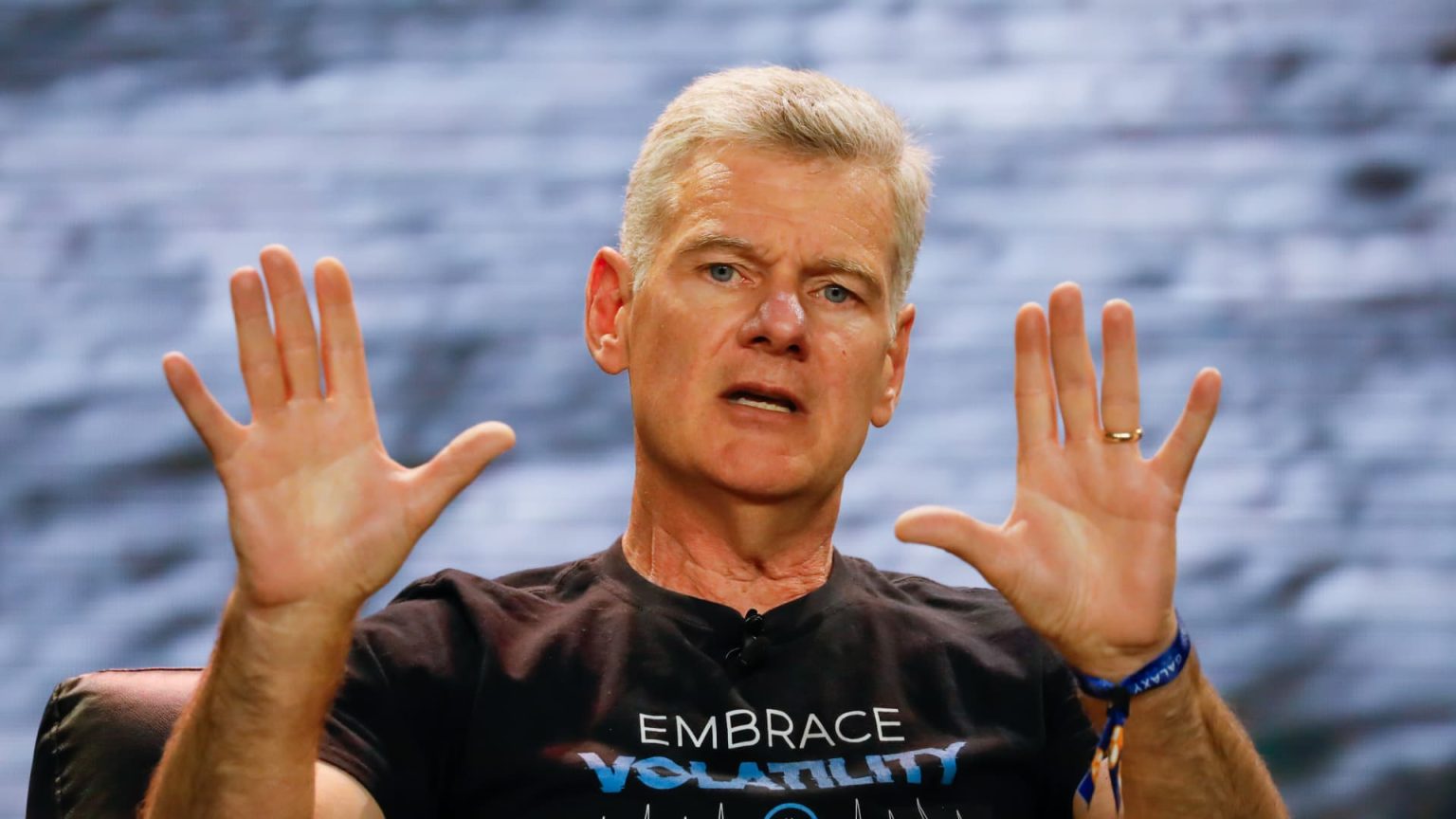

Hedge fund manager Mark Yusko predicts that bitcoin will surpass $150,000 this year, more than doubling its current value. He advises investors to allocate at least 1% to 3% of their portfolios to bitcoin, emphasizing its superiority to gold as an investment. As of March, bitcoin is up 159% over the past year, reaching a high of $73,000 before settling around $70,700. Yusko believes that bitcoin has the potential to increase tenfold over the next decade and points to the launch of bitcoin exchange-traded funds as a bullish driver for the cryptocurrency. He anticipates that the upcoming halving event in April will create a supply shock, leading to significant price growth.

Yusko expects the post-halving period to be particularly lucrative for bitcoin, with prices becoming more parabolic towards the end of the year. He suggests that historically, peak prices occur about nine months after the halving, typically around Thanksgiving or Christmas, before entering a bear market. Additionally, Yusko’s firm has invested in Coinbase, an online trading platform, in anticipation of substantial growth. Shares of Coinbase have increased by 321% over the past year, reflecting the positive sentiment towards the cryptocurrency industry.

Yusko’s investment firms own bitcoin, ethereum, gold, Coinbase, and Nvidia, underscoring his confidence in these assets. He sees a bright future for these investments and believes they will continue to perform well in the coming years. Yusko’s firm has positioned itself to capitalize on the anticipated growth in the cryptocurrency market, leveraging its exposure to various assets within the sector. By diversifying its portfolio across different digital and traditional assets, the firm aims to maximize returns and mitigate risks associated with market fluctuations.

By advocating for increased exposure to bitcoin and other cryptocurrencies, Yusko encourages investors to embrace emerging technologies and alternative asset classes. He argues that these investments offer unique opportunities for growth and diversification, enhancing traditional portfolio strategies. With the ongoing development of the cryptocurrency market and the increasing adoption of digital assets, Yusko’s bullish stance on bitcoin reflects a broader trend towards mainstream acceptance and recognition of blockchain technology. As bitcoin continues to gain traction as a store of value and investment vehicle, investors may increasingly look to incorporate it into their portfolios.

Yusko’s positive outlook on bitcoin and the broader cryptocurrency market signals a shift in investor sentiment towards digital assets. As the industry matures and regulatory clarity improves, more investors are likely to consider allocating a portion of their portfolios to cryptocurrencies. By emphasizing the potential for significant returns and the unique qualities of digital assets, Yusko aims to educate and inform investors about the opportunities available in this evolving market. His firm’s diverse holdings in bitcoin, ethereum, gold, and other assets reflect a strategic approach to capturing growth across different asset classes, positioning them for success in a dynamic and rapidly changing investment landscape.