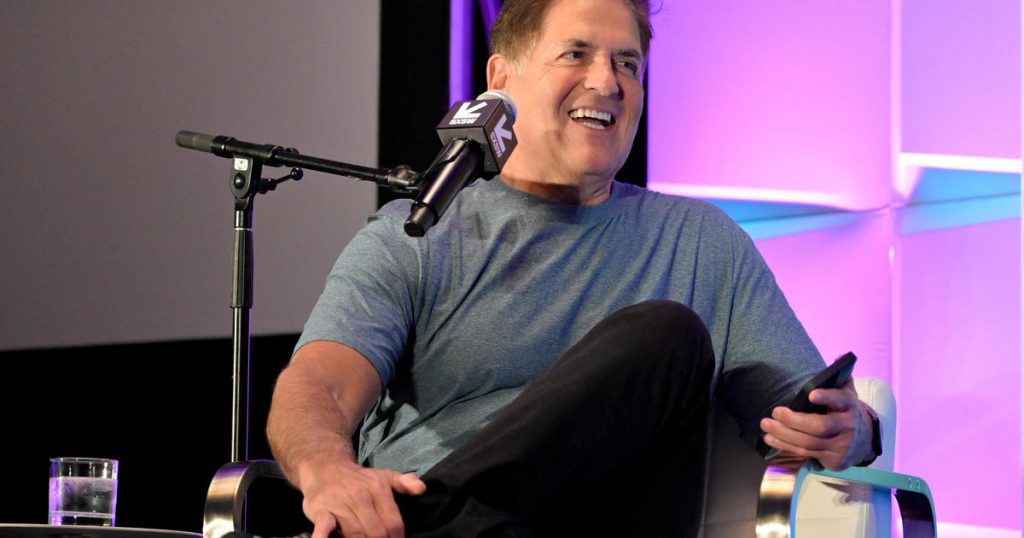

Billionaire entrepreneur Mark Cuban recently disclosed how much he owes in taxes to the IRS, revealing that he has to pay a total of $275,900,000. Cuban’s initial estimate was $288,000,000, in response to a question about whether he pays more than required in order to contribute his fair share. Cuban emphasized that he pays what he owes and takes pride in contributing to the country through taxes, despite acknowledging that not all tax money may be used wisely. He considers paying taxes to be one of the most patriotic things individuals can do, second only to military service.

With a reported net worth of $5.4 billion, Cuban shared his tax strategies in a social media post, including his transition from using tax refunds for savings to investing in his business. He also mentioned utilizing tax-free bonds to save on taxes and funding a business in an opportunity zone to further reduce his tax liabilities. Cuban emphasized the importance of being cautious with taxes, noting that he always gets audited and discouraging individuals from pursuing risky tax schemes. The tax filing deadline was approaching, with returns due by 11:59 p.m. in the taxpayer’s time zone, although extensions were available for those who required more time.

Cuban’s commitment to paying taxes and his belief in contributing to the country reflect his strong sense of patriotism and gratitude for the opportunities he has received. Despite recognizing areas where tax spending may not align with his preferences, Cuban remains dedicated to fulfilling his tax obligations and giving back to the country. His personal experiences with tax planning and investments serve as an example of prudent financial management, leveraging tax-saving strategies while also making substantial contributions to business development and opportunity creation. As a prominent figure in the business and investment world, Cuban’s approach to taxes and financial responsibility offers insights into effective wealth management and civic responsibility.