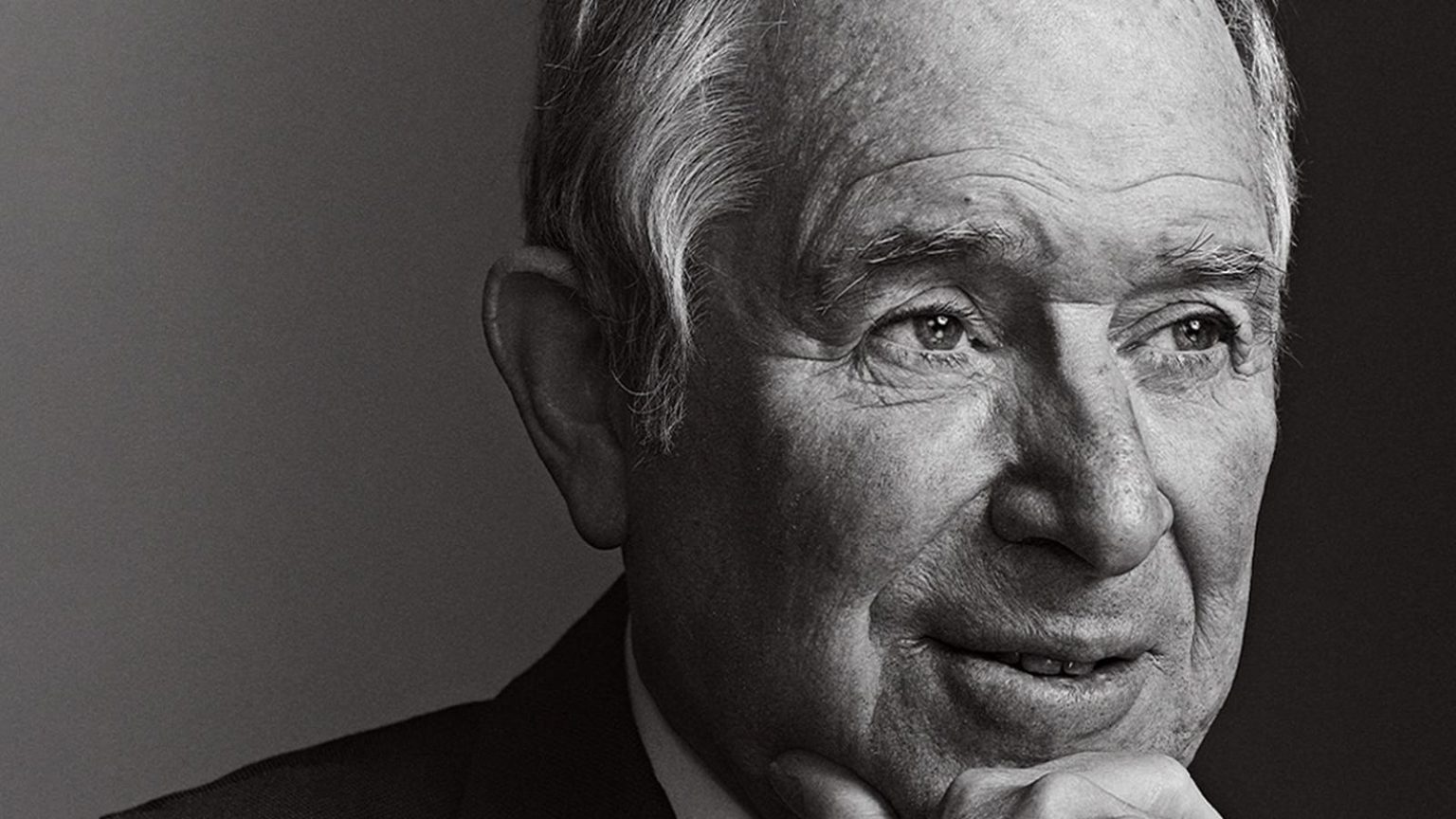

Steve Schwarzman, the 77-year-old founder and chief executive of Blackstone, has always had a “go big” philosophy. Despite Blackstone surpassing $1 trillion in assets, Schwarzman still feels expansive. Growing up in a suburb of Philadelphia, Schwarzman started working at his father’s curtains and linens store at a young age. His drive to succeed started early, with him running his own lawn mowing business at age 14. In his book “What It Takes,” Schwarzman recalls pleading with his father to expand their successful fabric store nationally, but his father refused, content with their current situation.

Since founding Blackstone in 1985, Schwarzman has made up for his father’s lack of ambition. Blackstone is now the world’s largest alternative asset manager with over $1 trillion in assets. Schwarzman’s net worth is estimated to be $39 billion, and his firm has minted several billionaires, including current president Jonathan Gray. Blackstone has evolved from a traditional leveraged buyout operation into a buy and build firm, with innovative financing techniques. Real estate is a massive business for Blackstone, with over 12,000 properties in its $300 billion commercial real estate portfolio.

Schwarzman got his start in private equity investing, representing firms that were just starting in the business. He eventually became managing director of the M&A group at Lehman Brothers. Schwarzman’s strategy with investments has changed over the years as the world has evolved. Blackstone now has 72 different strategies for investing, including real estate, hedge funds, and credit. Schwarzman believes in understanding the macro environment and investing in companies with growth potential.

One of Blackstone’s greatest triumphs was its investment in Hilton in 2007, which yielded a total return profit of $14 billion. On the flip side, Schwarzman recalls Edgcomb Steel, the third investment Blackstone ever made in 1989, as a disaster. They lost 100% of their original investment but learned valuable lessons from the experience. Schwarzman believes depersonalized decision making and thorough risk assessment are crucial for successful investing.

Schwarzman recommends surrounding oneself with smart people and generating proprietary data for investing. He advises patience and confidence in investment decisions, emphasizing the importance of having thorough information for decision-making. Schwarzman sees credit, real estate, and private equity as promising areas for investors today. He also highlights geopolitical risks, regulatory concerns, and political uncertainty as major risks facing investors.

Schwarzman recommends his book “What It Takes” for investors to read, as it has made a big impact on many people. He also enjoyed reading Phil Knight’s memoir “Shoe Dog,” which details the struggles of starting Nike. Schwarzman continues to read a number of books and stays active in the investing world, always seeking new opportunities and challenges.