The Department of Education will begin reaching out to eligible borrowers this week to inform them about a new student loan forgiveness plan, the agency announced on Wednesday. This plan, originally announced in April, aims to forgive loans for four groups of borrowers: those who owe more than they did when they started repaying, those who have been paying off undergraduate loans for over 20 years, those eligible for existing forgiveness plans but never applied, and those who were in low financial-value programs at institutions that didn’t meet the agency’s standards. The plan is expected to take effect in the fall, although final regulations have not yet been established and changes may still be made.

Under the new plan, borrowers with loan balances higher than their original amount could see $20,000 of the difference forgiven, or their student loans could be completely forgiven if they are in an income-driven repayment plan and make $120,000 or less annually. Those who took out undergraduate loans before July 1, 2005, and graduate loans before July 1, 2000, would also be eligible for debt forgiveness. Additionally, borrowers eligible for relief under income-driven repayment plans who did not apply for them would automatically receive relief, along with borrowers eligible for other programs like loan discharge if their institution closes.

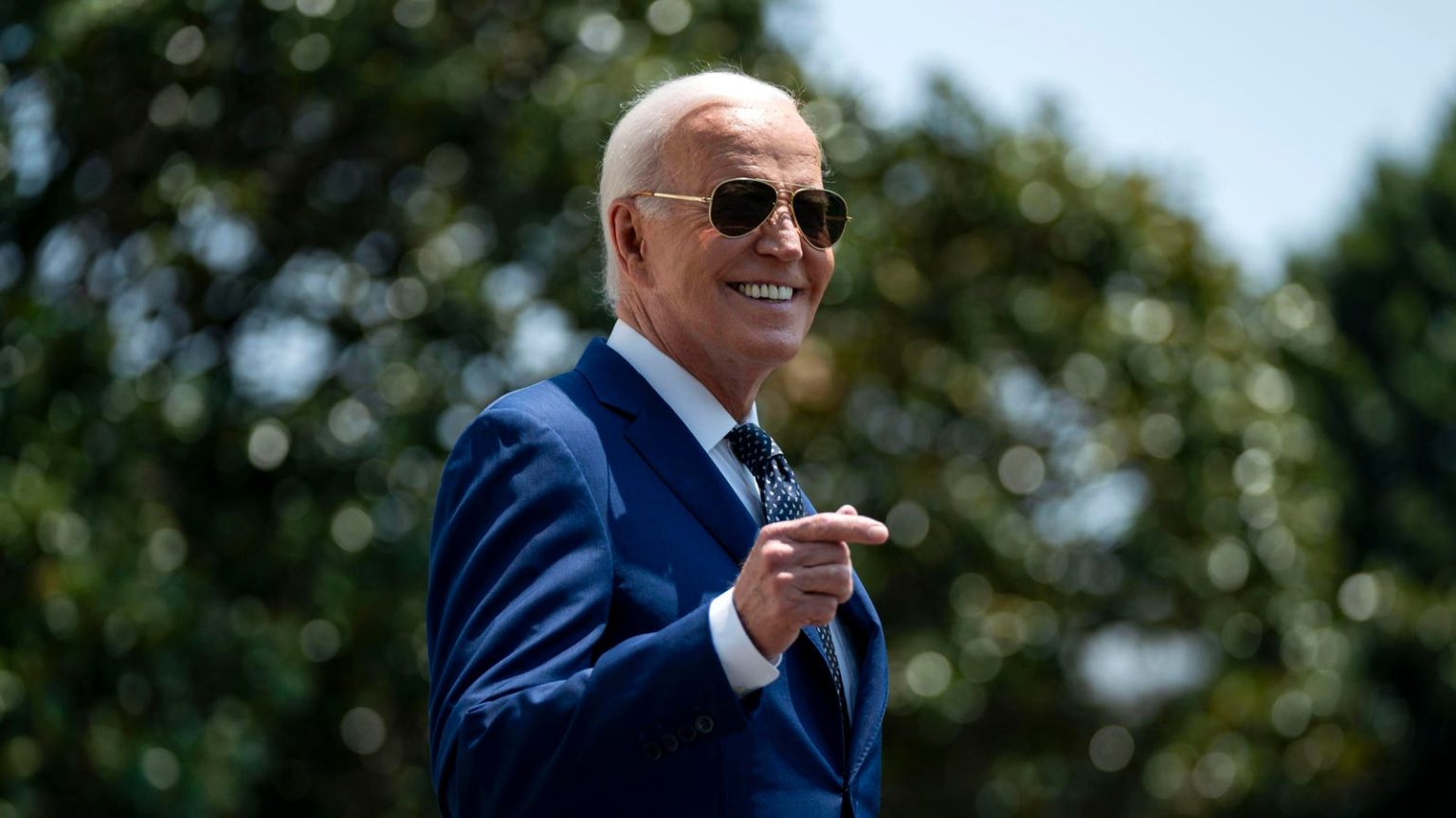

The Education Department intends to email all borrowers with federal student loans about the new debt relief program and will provide further updates once the plan is finalized. Borrowers who wish to opt out of receiving relief under the plan must do so by August 30. It remains to be seen if any lawsuits challenging the program will be filed once the rules are finalized and how they may impact borrowers. The Biden administration estimates that more than 30 million borrowers could receive debt relief under the new plan, a significant increase from the 4.8 million who have already received relief through the administration’s previous efforts.

The Biden administration’s new approach to student loan forgiveness comes as a separate student debt relief effort, the Saving on a Valuable Education (SAVE) repayment plan, faces legal challenges from GOP-led states. The Supreme Court is expected to rule on select provisions of the plan, which a lower federal court recently blocked. The administration has faced obstacles in its efforts to provide widespread student loan forgiveness, with an initial plan to forgive up to $20,000 for all federal borrowers making up to $125,000 a year being struck down by the Supreme Court in June 2023. As a result, the administration has shifted its focus to targeted forgiveness for specific groups of borrowers, providing over $168 million in relief so far.

As student loan forgiveness becomes an increasingly pressing issue, the Biden administration’s efforts to provide relief have faced legal challenges and setbacks. With the new student loan forgiveness plan set to impact millions of borrowers, the Department of Education is working to finalize the regulations and notify eligible individuals about the relief they may receive. While the program represents a significant step towards addressing the student debt crisis, it remains to be seen how it will be implemented and how it will impact borrowers across the country.