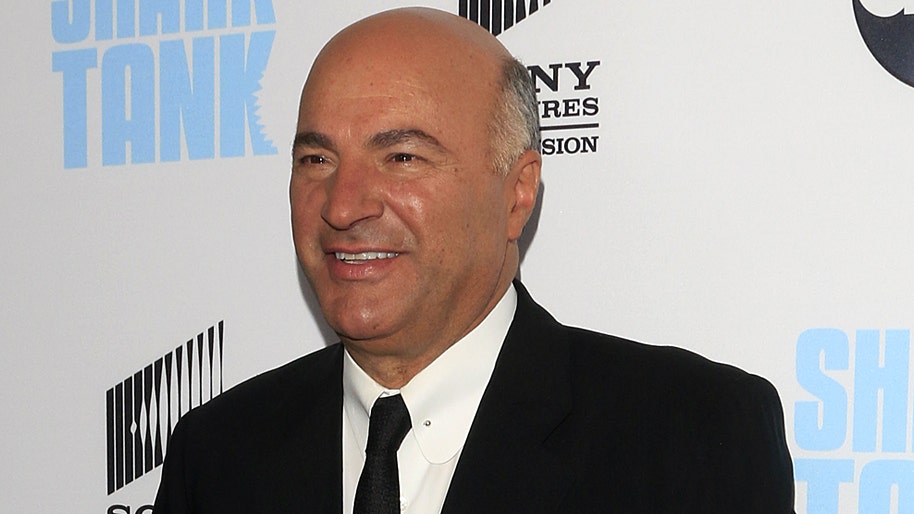

Kevin O’Leary, also known as “Mr. Wonderful” from Shark Tank, recently shared his investment strategy on LinkedIn, highlighting the importance of cash-flowing investments in a well-balanced portfolio. O’Leary revealed that the majority of his family’s wealth is invested in ETFs, particularly focusing on quality dividends and positive cash flow. His company, O’Shares, offers ETFs such as OUSA and OUSM, which cherry-pick companies with strong balance sheets and positive cash flow from the S&P 500 and Russell 2000.

O’Leary’s emphasis on cash flow serves as a reminder that the foundation of a solid investment portfolio lies in steady, reliable income. While high-risk investments like those seen on Shark Tank or volatile assets like Bitcoin can be exciting, O’Leary’s investments in OUSA and OUSM provide a balance of income and growth. These ETFs are designed to provide exposure to large-cap and small-cap dividend-paying companies that exhibit quality and low volatility.

For investors looking to add yield-producing assets to their portfolio, ETFs like OUSA and OUSM can be an attractive option. They offer the potential for steady income through dividends and capital appreciation. Investors can also consider adding alternative assets with low correlation to the stock market, such as real estate and private credit, to their portfolio for higher yields and diversification.

Real estate can be a source of passive income for investors, providing steady rental income and potential appreciation in value over time. Private credit, specifically real estate notes, offers investors the opportunity to earn interest income by providing financing to property owners or buyers. These notes can offer a fixed return and serve as a diversification tool within an income-focused portfolio, allowing investors to start with as little as $500.

In uncertain market conditions, having a portion of your portfolio dedicated to cash-flowing investments can provide stability and help mitigate risk. While speculative investments may offer quick gains, O’Leary’s investment strategy emphasizes the importance of a strong foundation of cash-flowing assets like dividend stocks, ETFs, real estate, or private credit. By incorporating yield-producing investments into your portfolio, you can generate a steady stream of income and secure long-term financial stability.

Overall, O’Leary’s strategy focuses on the importance of cash flow in building a well-balanced investment portfolio. While exciting and high-risk investments have their place, a foundation of reliable income is crucial for long-term financial success. By investing in quality dividend-paying companies and alternative assets like real estate and private credit, investors can create a diverse portfolio that generates steady income and helps weather market uncertainties.