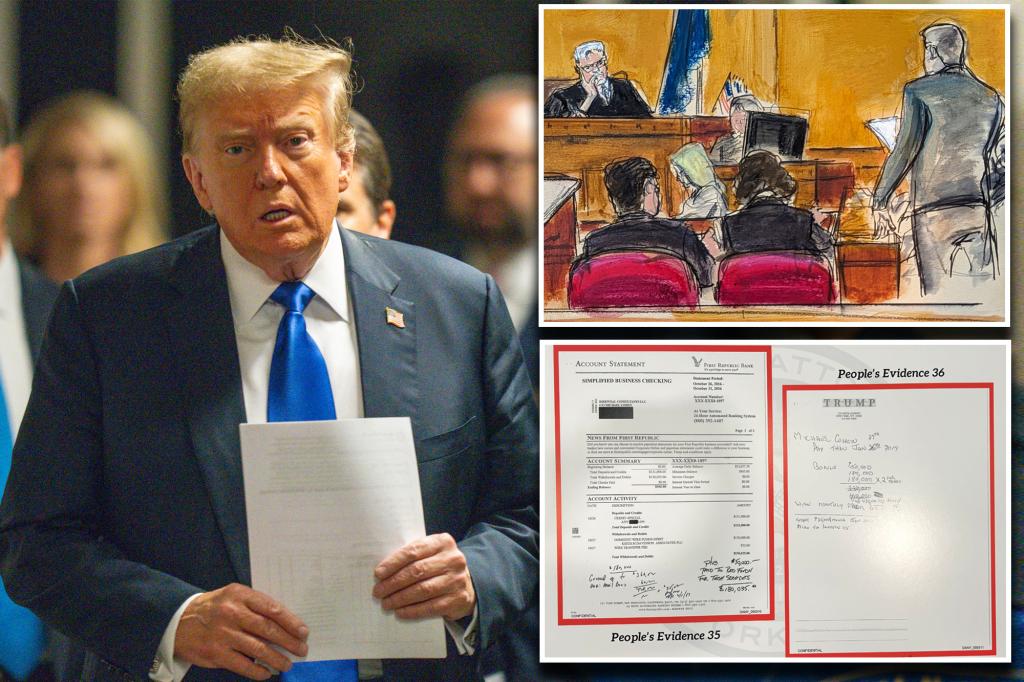

The Manhattan jury that found Donald Trump guilty of fudging business records with the “intent” to cover up running afoul of New York state law involving illegal activity in an attempt to get someone elected to public office by “unlawful means.” Prosecutors claimed that this unlawful means involved making hush-money payments to women who alleged affairs with Trump to prevent a sex scandal from impacting his chances in the 2016 election. The jury did not need to unanimously agree on the specifics of the unlawful means, but they were given three options by the judge. They could have breached federal campaign-finance laws, violated tax law, or falsified more business records during the alleged conspiracy.

The verdict sheet filled out by jurors showed a checkmark next to each of the 34 counts of falsifying business records against Trump, but did not provide details on the specific unlawful means they believed were involved in the conspiracy. The jury needed to unanimously agree that Trump intended to cover up another crime by fudging business records, but not necessarily on the specific means that were used. The judge gave them three options for what these unlawful means could have been, including breaching campaign-finance laws, violating tax law, or falsifying business records. The lack of clarity on the specifics of the unlawful means did not prevent the jury from reaching a verdict of guilty.

The prosecution argued that the conspiracy involved hush-money payments to women to prevent a sex scandal from affecting Trump’s chances in the 2016 election. The jury did not need to unanimously agree on the details of the conspiracy, but only that Trump had intended to cover up another crime. The verdict showed that the jury found Trump guilty on all 34 counts of falsifying business records, but did not specify the unlawful means they believed were involved in the conspiracy. The lack of specific details did not prevent the jury from reaching a unanimous verdict of guilty against Trump.

Manhattan Supreme Court Justice Juan Merchan gave the jury three options for the unlawful means involved in the conspiracy, including breaching campaign-finance laws, violating tax law, or falsifying business records. The jury was not required to unanimously agree on the specifics of these unlawful means, only that they believed Trump had the intent to cover up another crime through his actions. The verdict sheet filled out by the jurors showed that they found Trump guilty on all 34 counts of falsifying business records, but did not provide any additional information on the unlawful means they believed to be involved in the conspiracy.

The guilty verdict against Trump was based on the jury’s belief that he had intended to cover up another crime by fudging business records. The specifics of the unlawful means involved in the conspiracy were not detailed on the verdict sheet, but the jury did not need to unanimously agree on these specifics to reach a guilty verdict. Manhattan Supreme Court Justice Juan Merchan gave the jury three options for what these unlawful means could have been, including breaching campaign-finance laws, violating tax law, or falsifying business records. The lack of specific details did not prevent the jury from unanimously finding Trump guilty on all 34 counts of falsifying business records.