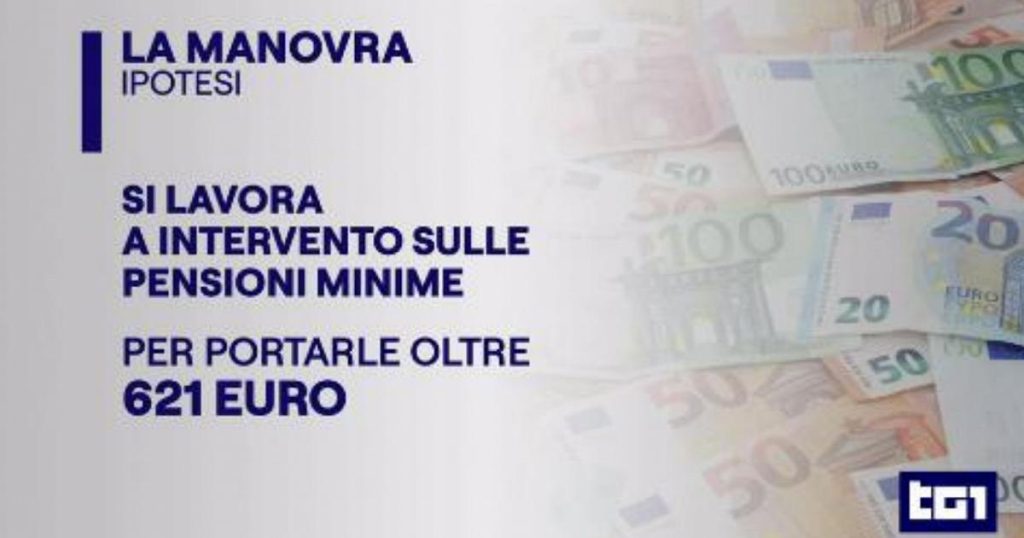

In order to find resources, the Italian government is considering asking larger businesses to make an effort. Confindustria, the main organization representing Italian manufacturing and service companies, has expressed its willingness to review tax breaks amounting to 120 billion euros. Aligning excise duties on gasoline and diesel would result in increased revenue for the state of about one billion euros. There is also consideration being given to increasing the minimum pension to over 620 euros.

These measures are being proposed in order to address Italy’s economic challenges, including the need to reduce public debt and stimulate growth. The government is looking for ways to generate additional revenue and reduce expenses, in light of the budget deficit and debt levels. By revising tax breaks and adjusting excise duties, the government hopes to increase revenue and meet its fiscal targets. Additionally, tackling the issue of minimum pensions aims to address the issue of poverty among retirees.

The potential changes to tax breaks and excise duties have raised concerns among businesses and consumers. Large companies may see an increase in their tax burden, which could impact their competitiveness and ability to create jobs. Consumers, on the other hand, may face higher costs for gasoline and diesel, as the alignment of excise duties would likely result in higher prices at the pump. These changes could also impact the economy as a whole, potentially affecting consumption and investment.

The government’s proposal to increase minimum pensions has been met with both support and opposition. Supporters argue that raising the minimum pension to over 620 euros would help lift retirees out of poverty and ensure a decent standard of living for all. Opponents, however, raise concerns about the cost of such a measure and its impact on public finances. There are also questions about the sustainability of the pension system in the long term, given Italy’s aging population and low birth rate.

Overall, the government’s efforts to find additional resources and address economic challenges are part of a broader strategy to strengthen Italy’s economy and ensure long-term sustainability. By revising tax breaks, adjusting excise duties, and addressing social welfare issues such as minimum pensions, the government aims to improve public finances and support economic growth. However, these measures are likely to face opposition and challenges, as they involve difficult choices and potential sacrifices for businesses and consumers. It remains to be seen how these proposals will be implemented and their impact on Italy’s economy in the coming years.