The IRS has announced a five-year extension of the Free File program, allowing taxpayers to continue accessing free private-sector tax software through October 2029. Established in 2003, Free File is a public-private partnership between the IRS and tax preparation software providers to offer free e-filing services to eligible taxpayers. The program was developed to help the IRS meet the e-file target set by the Restructuring and Reform Act of 1998. Initially controversial, Free File faced allegations of some providers directing taxpayers to paid services, leading to changes in regulations and increased transparency.

Despite being eligible for free filing, some taxpayers encountered challenges in accessing the service without incurring charges. Allegations of software companies hiding free filing options and directing users to paid services prompted investigations and legal action. Today, tax preparation software companies are required to provide clear information on free filing options and cannot hide them from search engine results. The 2019 Free File agreement also removed the IRS’ promise not to compete against existing tax prep software.

In the 2024 tax filing season, several traditional Free File participants, such as Intuit and H&R Block, opted out of the program. Eight private-sector Free File partners, including Drake, TaxAct, and TaxSlayer, provide online guided tax software products. Eligible taxpayers with income of $79,000 or less can access Free File options through the IRS website and select the best software for their tax needs. The program saw an increase in tax returns filed in 2024, reaching 2.9 million as of May 11, up by 7.3% compared to the previous year.

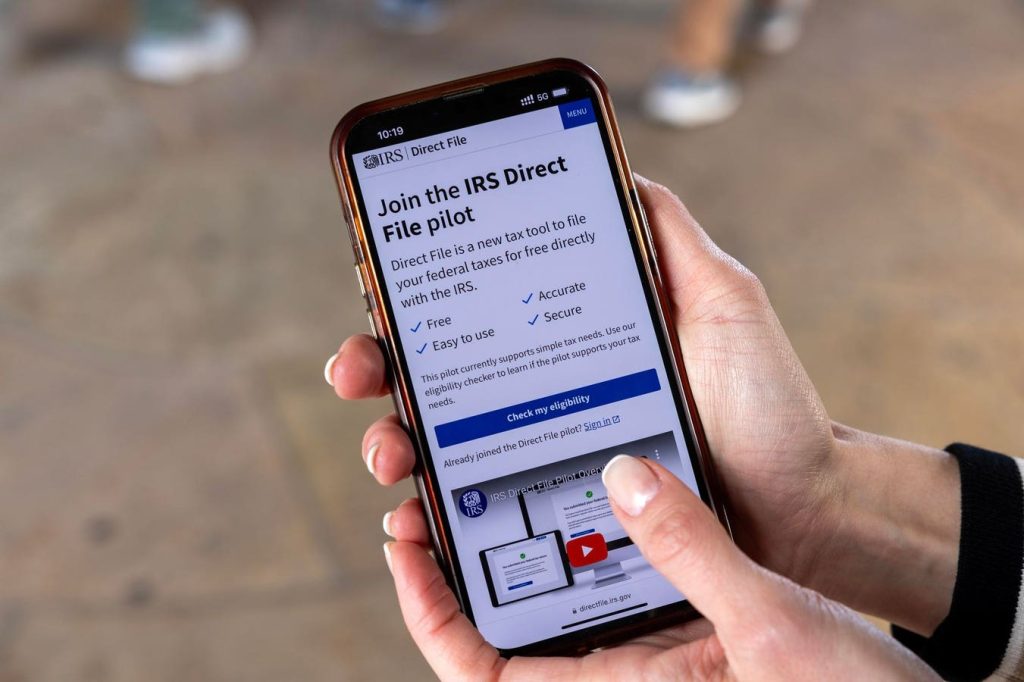

In addition to Free File, the IRS introduced a pilot program called Direct File in 2024, allowing eligible taxpayers to file their federal tax returns directly with the IRS for free. The pilot was deemed successful, with several hundred thousand taxpayers across 12 states signing up for Direct File accounts and 140,803 taxpayers using the service. Participants shared positive experiences with the user-friendly interface and privacy safeguards provided by the IRS. Some taxpayers expressed hope for expanding Direct File to accommodate more financial situations.

Efforts to expand Direct File nationwide have gained support from the Coalition for Free and Fair Filing, with 256 organizations advocating for the program to be permanent. The coalition claims that millions of Americans continue to pay billions of dollars in filing fees despite being eligible for free filing, citing potential savings of $11 billion in fees and time. While the IRS has shown willingness to continue with the program, support from Congress remains uncertain. The program initially cost taxpayers $25 million, with criticism from some lawmakers for being wasteful and duplicative during a Senate Finance Committee hearing.