In addition, the security’s Schaeffer’s Volatility Scorecard (SVS) sits at 70 out of 100, indicating that DKNG has tended to exceed these expectations during the past year. In other words, the stock has made bigger moves on the charts than the options market has priced in, which could create opportunities for traders looking to speculate on DraftKings’ short-term trajectory.

Looking back, the equity’s peak 7-day put/call volume ratio of 1.11 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 76th percentile of its 12-month range. This suggests a healthier-than-usual appetite for long puts over calls of late.

Amid all the potential headwinds, an exodus of short sellers could create tailwinds for DraftKings. Short interest fell 7.3% in the most recent reporting period, and now accounts for a slim 3.3% of the stock’s available float. In simpler terms, it would take just over two days to buy back these bearish bets, at the security’s average pace of trading.

Nonetheless, not everyone is convinced of the stock’s potential rebound. In fact, the equity is now at risk of additional bear notes from analysts. Of the 24 in coverage, 11 still rate DKNG a “buy” or better, compared to 13 “hold” ratings.

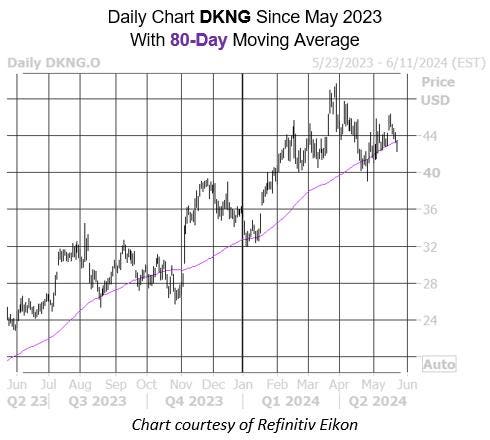

The leading digital sports entertainment and gaming company, DraftKings, is currently experiencing a period of volatility in its stock price. Despite a recent post-earnings bear gap and a decline in share price over the past few days, the stock is nearing a bullish trendline that has historically signaled positive returns in the past. Additionally, options on DKNG are currently priced affordably, providing an opportunity for traders to capitalize on potential short-term movements in the stock. Furthermore, a decrease in short interest may create momentum for DraftKings in the near future.

Potential short-term bearish sentiment surrounding DraftKings, as indicated by the put/call volume ratio and analyst ratings, contrasts with the historical trend of the stock rebounding after reaching the 80-day moving average. With low volatility expectations reflected in options pricing, traders may find opportunities to speculate on DraftKings’ future performance. Furthermore, a decrease in short interest adds to the bullish case for the stock, suggesting that there may be room for further upside.

Despite the recent challenges facing DraftKings, including a post-earnings bear gap and a decline in share price, the company’s long-term prospects remain strong. With the potential for a rebound in the stock price based on historical trends and current market conditions, DraftKings could be positioned for a positive trajectory in the coming months. Traders and investors alike will be closely monitoring the stock’s movements and any developments that may impact its performance in the sports entertainment and gaming industry.