In a recent SEC filing, Intel disclosed that its semiconductor manufacturing business, also known as its foundry business, reported an operating loss of $7 billion in 2023 on sales of $18.9 billion. This marks a wider loss compared to the $5.2 billion loss reported in 2022 on $25.7 billion in sales. This is the first time Intel has revealed the revenue generated by its foundry business, historically focusing on designing and manufacturing its own chips rather than reporting foundry business details. Other American semiconductor companies such as Nvidia and AMD typically outsource manufacturing to Asian foundries like TSMC.

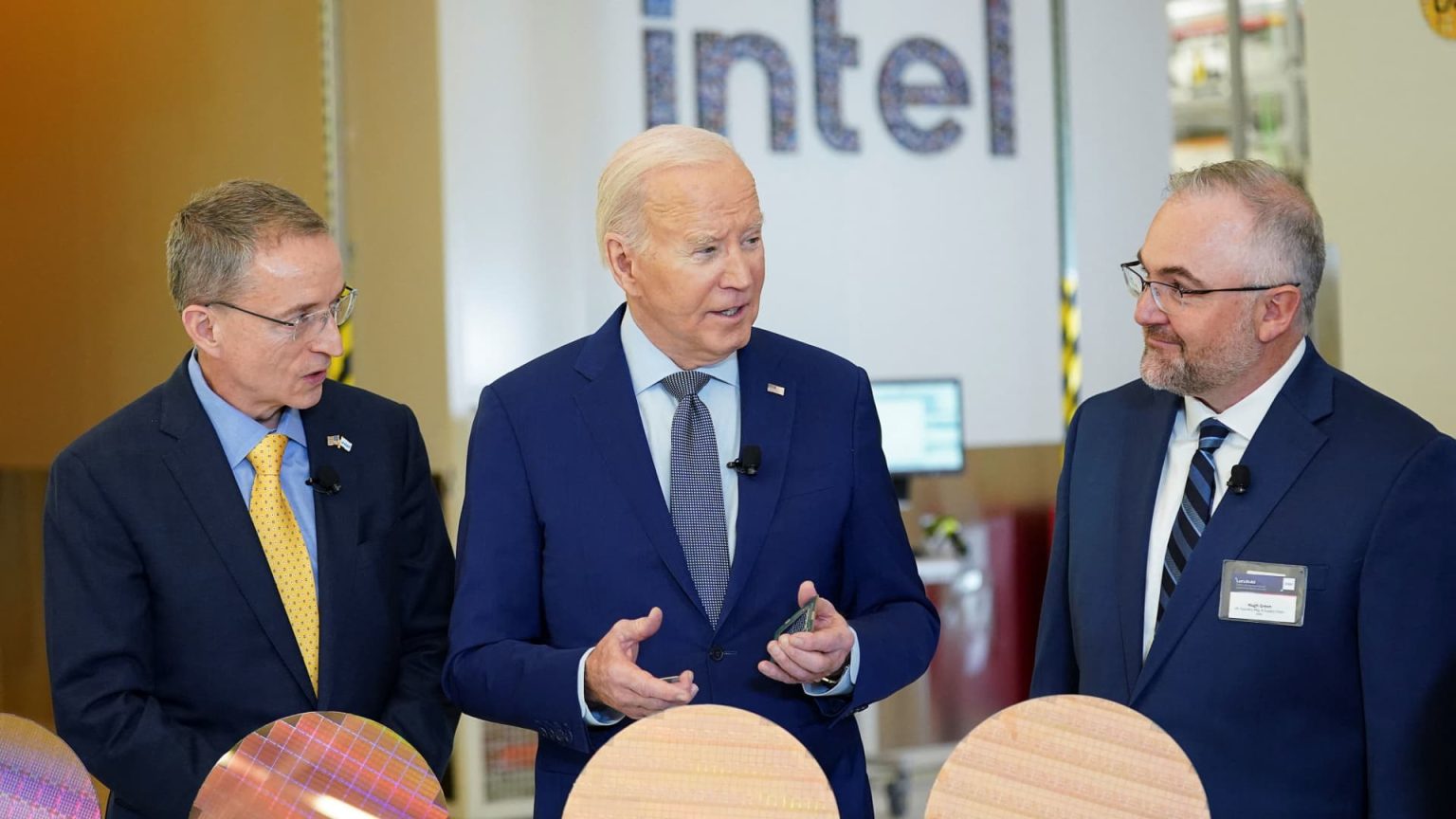

Under the leadership of CEO Patrick Gelsinger, Intel has been developing a plan to continue manufacturing its own processors while also expanding into the external foundry business by producing chips for other companies. This initiative, coupled with Intel’s role as a leading American semiconductor manufacturer, contributed to the company receiving nearly $20 billion in CHIPS act funding. Despite currently generating most of its foundry revenue internally, Intel has restructured its Products division to account for foundry operations as a cost to reflect a more comprehensive financial picture.

Intel’s Products division, primarily focused on processors for PCs and servers, reported $11.3 billion in operating income on $47.7 billion in sales in 2023. The company anticipates that the foundry’s losses will peak in 2024 and reach break-even status sometime between the current quarter and the end of 2030. Intel has already secured $15 billion in foundry revenue by striking a deal with Microsoft, highlighting the potential growth and earnings trajectory for its foundry business. Gelsinger emphasized that 2024 would mark the lowest point for foundry operating losses, signaling future profitability.

In a promotional video, Intel attributed a significant portion of its foundry business’s lack of profitability to past decisions and a delay in adopting advanced chip-making technology called EUV. Gelsinger acknowledged Intel’s historical sluggishness in embracing EUV technology, resulting in challenges for the foundry business. Despite these obstacles, Intel remains optimistic about the growth potential for its foundry business, projecting considerable earnings growth over time. By strategically navigating the transition to external foundry operations and enhancing profitability, Intel aims to leverage its position as a leading American semiconductor manufacturer to drive future success in the industry.