Intel’s long-awaited turnaround seems to be further away than ever, as the company reported disappointing first-quarter earnings, causing investors to push shares down. Although Intel is no longer experiencing revenue declines and remains the leading producer of processors for PCs and laptops, its first-quarter sales fell short of estimates. Additionally, the company provided a weak forecast for the second quarter, suggesting weak demand. CEO Pat Gelsinger, early in his fourth year at the helm, faces challenges in turning the company around, which has been plagued by problems for decades.

Before Gelsinger returned to Intel in 2021, the company had lost its edge in semiconductor manufacturing to international competitors like Taiwan Semiconductor Manufacturing Co. As part of a high-risk strategy, Intel is investing billions per quarter in an effort to regain lost ground. Gelsinger aims to close this technology gap by 2026, but investors remain skeptical. Intel’s stock is down 37% this year, making it the worst-performing tech stock in the S&P 500. Competitors like Nvidia and Super Micro Computer have outperformed Intel, with Nvidia surpassing Intel in market cap and revenue rankings.

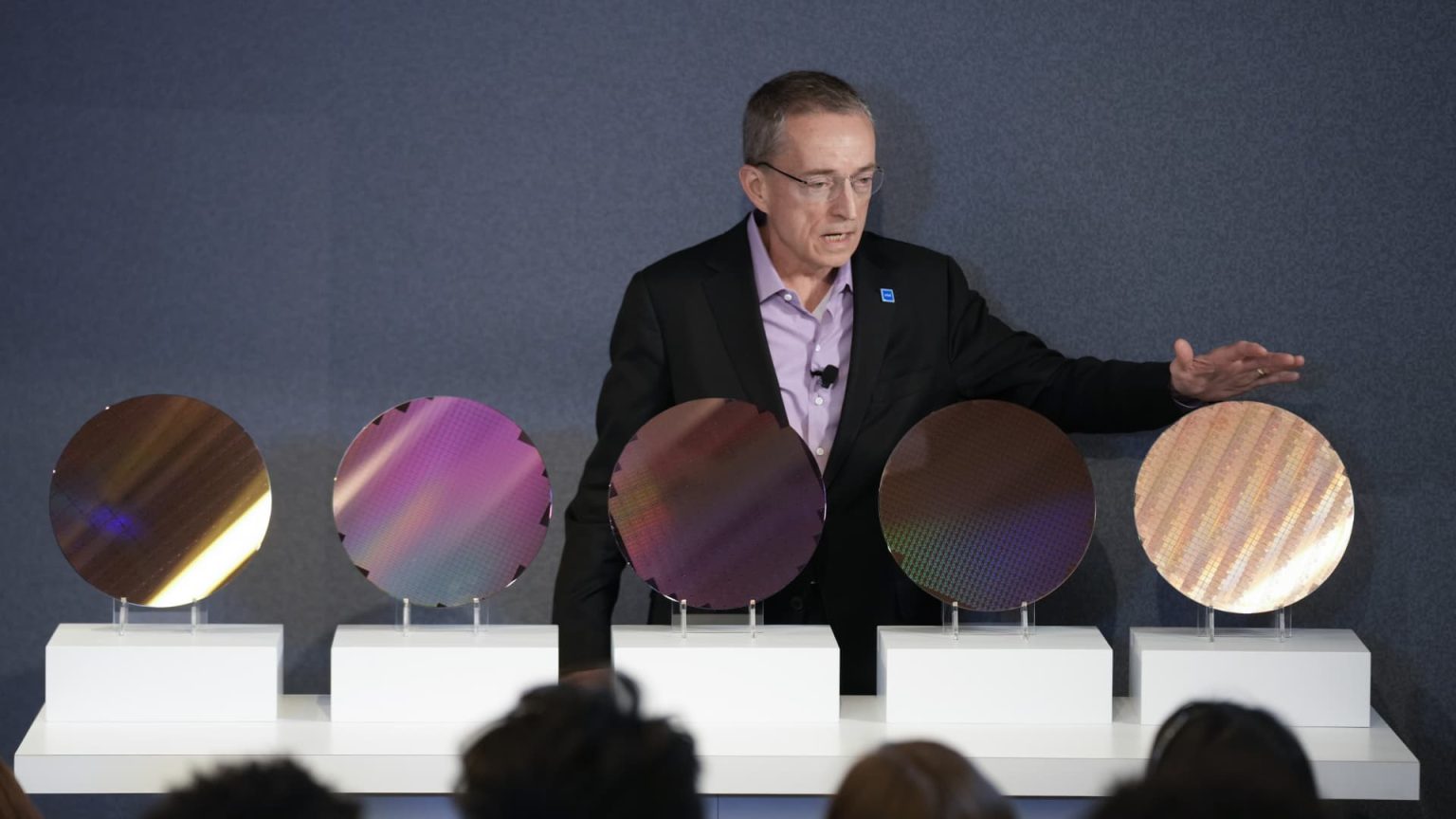

Intel is now pursuing a new business model that involves producing its own branded processors and acting as a factory for other chip companies that outsource their manufacturing. This move positions Intel as an alternative to TSMC, giving companies the option to diversify their supply chain. U.S. political leaders view Intel as a critical player in the American chip industry and support the company’s efforts to remain competitive in the semiconductor market. However, Intel’s track record of continuously promising improved performance in the next quarter without delivering has left analysts and investors wary of its future prospects.

Intel’s missed opportunities, such as not providing chips for the iPhone and failing to capitalize on the AI boom, have contributed to its current position. When Apple introduced the iPhone, it opted for Samsung chips over Intel’s due to concerns about pricing and intellectual property rights. Apple’s transition to Arm-based chips for its phones further eroded Intel’s market share in the mobile space. In terms of AI, Intel lagged behind companies like Nvidia that developed GPUs ideal for running AI algorithms, ultimately losing out on a rapidly expanding market.

The company’s struggles with its transistor technology, particularly delays in advancing its process nodes, have impacted its competitiveness. Intel’s failure to keep pace with the development of smaller transistors led to missed deadlines for new processes, allowing competitors like AMD to gain ground. Intel’s focus on AI with the Gaudi chip represents a potential area for growth, but the company faces stiff competition from Nvidia and AMD in this space. With new investments in advanced chip manufacturing and plans to catch up on process node technology, Intel aims to rebuild customer trust and regain a competitive edge.

Gelsinger has led Intel on a “death march” to catch up with TSMC through a rapid advancement in technology nodes. This strategy, despite being financially taxing, is essential for Intel to excel in producing the smallest transistors and remain a leader in the semiconductor industry. While Intel has secured some contracts with external companies to use its fabs, the success of its foundry division will heavily influence the company’s overall performance. Gelsinger remains optimistic about Intel’s future, expressing confidence in the forthcoming server chips and the potential to win back customers who had switched to competitors.