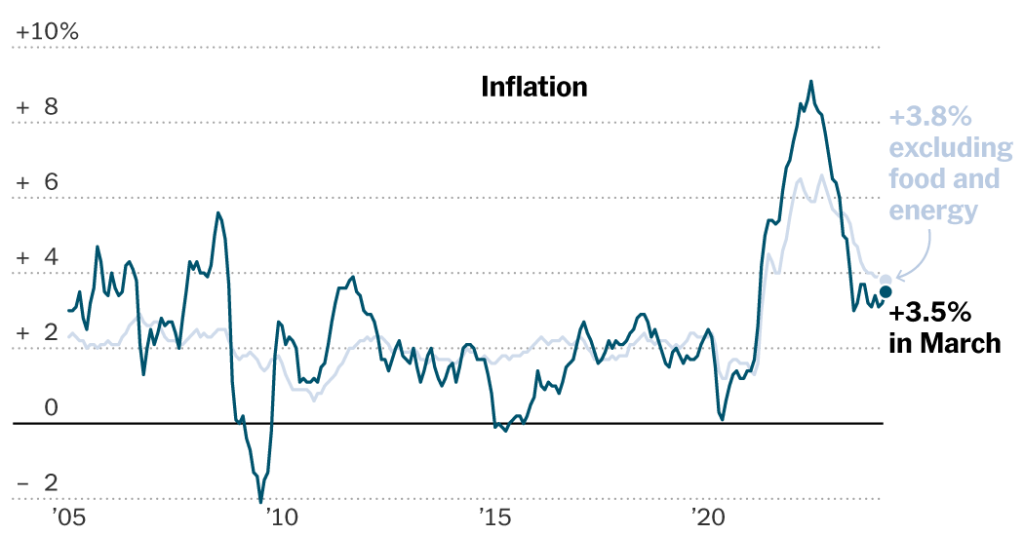

Inflation remained stronger than expected in March, with the Consumer Price Index climbing 3.8 percent on an annual basis after removing food and fuel prices. The core index that excludes food and fuel was also stronger than expected, which raised doubts about the Federal Reserve’s ability to start cutting interest rates this year. The monthly reading was higher than economists had forecast, with inflation climbing 3.5 percent including food and fuel. This news comes at a crucial time for the Fed as they hoped that warmer inflation figures earlier in the year were only temporary.

The Fed has been looking for proof that inflation is cooling before they cut interest rates, and they have raised borrowing costs in recent years. They forecasted three cuts this year but are cautious about lowering rates too early and allowing inflation to pick back up. Lingering inflation has become a significant concern for policymakers, especially since inflation flatlined in January and February, causing some alarm. Investors had expected rate cuts in 2024, but those expectations have been scaled back as inflation remains stubborn.

Stocks dropped following the inflation release as investors adjusted their expectations for lower rates. The S&P 500, Nasdaq composite, and Russell 2000 index all closed lower as investors hoped for lower interest rates. While lower rates tend to boost asset prices like stocks, the current economic conditions do not appear to warrant rate cuts as the economy is growing and employers are hiring at a robust pace.

The Consumer Price Index report showed that housing inflation remains firm, auto insurance costs increased, and apparel prices climbed. An important measure of services inflation contributed to the rise in annual inflation, putting pressure on Fed officials to justify cutting rates. With inflation showing no signs of slowing down, the Fed may need more convincing evidence before making a decision on rate cuts.

Some economists are predicting that rate cuts could be delayed until autumn, with September being more likely than July. The upcoming election could further complicate the Fed’s decision on rate cuts, as cuts made just before the election could make policymakers a target of partisan scrutiny. Consumers are concerned about rising prices and high interest rates impacting housing affordability, which could affect the political landscape leading up to the election.

President Biden has expressed concerns about high prices, pointing to corporations as playing a role in recent rapid inflation. While Mr. Biden expects to see rate cuts this year, his comments are unusual as the White House typically avoids discussing Fed policy to maintain the central bank’s independence. The current economic climate is complex, with inflation and interest rates affecting consumer sentiments and potentially influencing the upcoming election. Fed policymakers will need to carefully navigate these economic challenges to ensure stability and growth in the future.