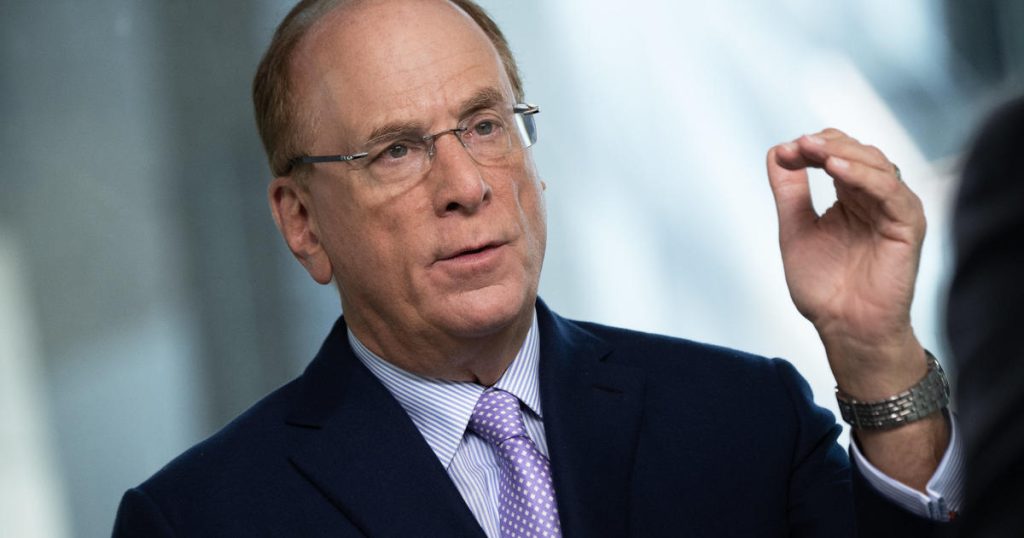

Larry Fink, the CEO of BlackRock, has suggested in his 2024 annual shareholder letter that Americans should work longer before retiring to address the retirement crisis facing the U.S. He argues that as people are living longer and spending more years in retirement, the nation’s retirement system is under immense strain. Fink questions the traditional retirement age of 65, which he believes originates from the time of the Ottoman Empire, and suggests that Americans should work longer to improve their retirement prospects.

The proposal to raise the retirement age for claiming Social Security benefits has been raised by some Republican lawmakers in response to the funding shortfall that the program is facing. However, this suggestion overlooks the reality of aging in the workplace, with the majority of workers over 50 reporting ageism in a survey. Many Americans stop working before they planned to due to ill health or unexpected job loss, with the median retirement age in the U.S. being 62, lower than the traditional retirement age of 65.

The retirement expert and professor Teresa Ghilarducci agrees that the retirement system is failing most households, but she disagrees with Fink’s assertion that people should work longer. She argues that after 40 years of a voluntary pension system, half of workers have no easy way to save for retirement, and most people don’t retire when they want to anyway. Fink’s comments are significant due to his position as the head of the world’s largest asset manager, and his vested interest in Americans boosting their retirement assets.

Fink acknowledges that his generation, the baby boomers, have focused on their financial well-being to the detriment of younger generations like millennials and Gen Z. He believes that his generation has an obligation to fix the nation’s retirement problems before passing the baton to the next generation. Failing to address the retirement crisis not only impacts individual retirees but damages the collective belief in the future of the U.S., risking a scenario where people keep their money under the mattress and their dreams bottled up in their bedroom.

Fink also mentions successful public policy examples, such as Australia’s retirement system, which began in the early 1990s and requires employers to contribute a portion of a worker’s income to a retirement fund. He encourages making retirement investing more automatic for workers to improve retirement savings. While Fink’s proposal to raise the retirement age and boost retirement assets align with his firm’s interests, some experts, like Boston University economist Laurence Kotlikoff, caution about potentially privatizing Social Security to make profits. Ultimately, the debate about the future of Social Security and retirement reform continues as the nation’s demographics shift with an aging population.