As graduation season approaches, over 2 million high school students are faced with the daunting task of choosing which college to attend in the fall. However, for many, the costs associated with attending college are staggering, with some private institutions surpassing the $90,000 mark for tuition, board, meals, and other expenses. This means that families may need to shell out over $1 million for three children to complete a four-year degree. Despite the high sticker prices, many colleges with large endowments have implemented generous financial aid programs to make attending college more affordable for lower-income students.

One such institution is Wellesley College, which will see costs for wealthy students exceeding $90,000 this fall. However, the average financial aid package for students at Wellesley is over $62,000, significantly reducing their costs. Unfortunately, many prospective students are facing delays and anxiety in receiving aid offers due to issues with a new U.S. Department of Education online form. This has caused chaos and confusion in the financial aid process, leaving many students unsure of how much assistance they will receive from colleges.

Financial aid expert Mark Kantrowitz has expressed concerns about the rollout of the new aid application system, citing major delays, glitches, and stringent requirements for proof of identity from parents. This has deterred eligible but undocumented parents from applying for aid, potentially leading to lower enrollments and financial strain on institutions. Despite efforts to make elite colleges more affordable for lower-income students, there is still a perception of high costs that may deter some from applying. It is crucial for students to consider the actual cost they will pay rather than relying on the sticker price when making educational decisions.

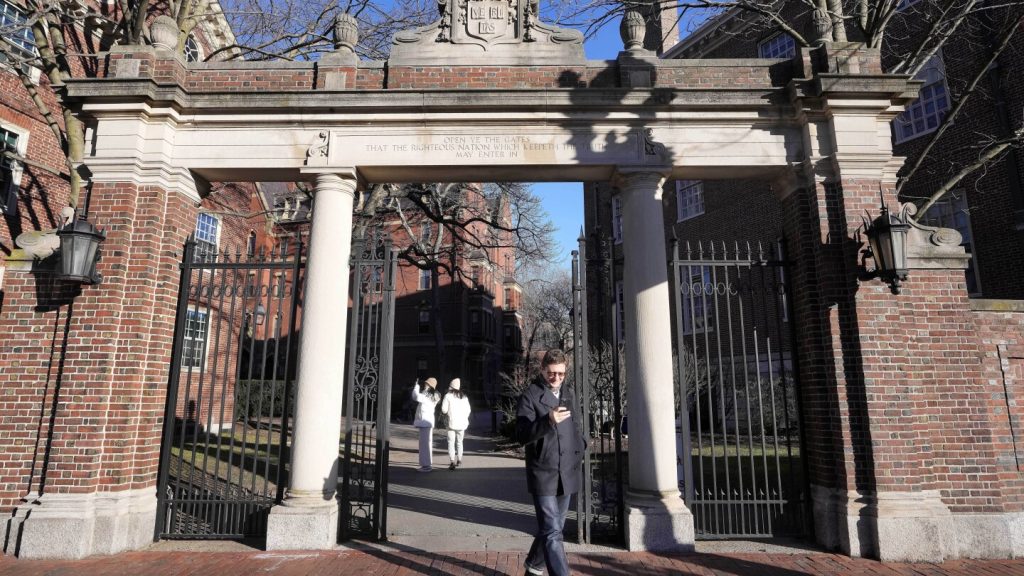

Several colleges, including the University of Southern California, Harvey Mudd College, and the University of Pennsylvania, have set their costs above $90,000 this year. Harvard University, with an endowment of over $50 billion, boasts a generous aid program, where a quarter of families pay nothing at all. The College Board estimates that the average advertised cost for private nonprofit colleges last year was $60,000, with unmet needs for students averaging around $10,000 per year. Kantrowitz believes that college can be a good investment as long as students borrow responsibly and complete their studies to ensure that they can repay their debts.

In conclusion, the rising costs of attending college, especially at elite institutions, are a major concern for families and students. While the sticker prices may seem daunting, many colleges offer substantial financial aid packages to make attending more affordable for lower-income families. It is essential for students to carefully consider their options and not be deterred by the high costs, as scholarships, grants, and aid programs can significantly reduce the financial burden. Despite challenges with the aid application process, experts believe that college can still be a worthwhile investment as long as students borrow responsibly and complete their education to secure better job prospects in the future.