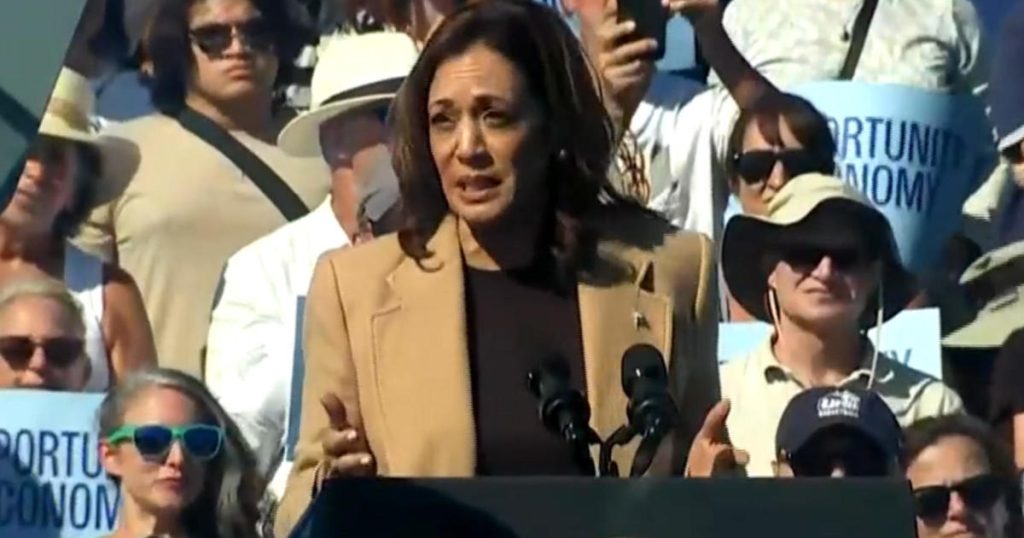

Vice President Kamala Harris proposed a tax incentive for small businesses during a campaign event in New Hampshire. She suggested allowing new small businesses to write off up to $50,000 in startup costs, a significant increase from the current maximum of $5,000. This proposal aims to provide financial relief and support to small businesses as they navigate the challenges of starting and growing their ventures. The increased write-off limit would help alleviate some of the financial burden that small business owners often face during the startup phase.

Small businesses play a crucial role in the economy, creating jobs and driving innovation. However, many small businesses struggle with limited financial resources and high operating costs. By offering tax incentives such as the one proposed by Harris, the government can help small businesses access the capital they need to sustain and expand their operations. These incentives can also encourage entrepreneurship and stimulate economic growth by supporting the development of new businesses and industries.

Harris’s proposal to increase the tax write-off limit for small businesses reflects a broader strategy to promote economic recovery and prosperity. The COVID-19 pandemic has had a devastating impact on businesses of all sizes, but small businesses have been particularly hard hit. Many have faced closures, layoffs, and financial hardships, making it essential for policymakers to implement measures to support their recovery. By providing tax incentives for small businesses, the government can help them recover from the economic damage caused by the pandemic and rebuild their operations.

The proposed tax incentive would benefit not only individual small business owners but also the communities they serve. Small businesses are often integral to local economies, providing goods, services, and employment opportunities that contribute to the overall well-being of communities. By supporting small businesses through tax incentives, policymakers can help ensure the vitality and resilience of local economies. This, in turn, can lead to job creation, economic growth, and increased prosperity for communities across the country.

It is essential for policymakers to prioritize small businesses in their economic recovery efforts, as these enterprises are the backbone of the economy and drivers of innovation and job creation. By offering tax incentives to small businesses, the government can help level the playing field and create a more favorable environment for entrepreneurship and business growth. These incentives can provide small businesses with the financial support they need to weather economic challenges and thrive in the post-pandemic landscape.

Overall, Harris’s proposed tax incentive for small businesses represents a step in the right direction towards supporting economic recovery and fostering entrepreneurship. By increasing the write-off limit for startup costs, the government can empower small business owners to pursue their ventures with greater financial security and confidence. This measure can help strengthen the small business sector, stimulate economic growth, and create a more resilient and prosperous economy for all.