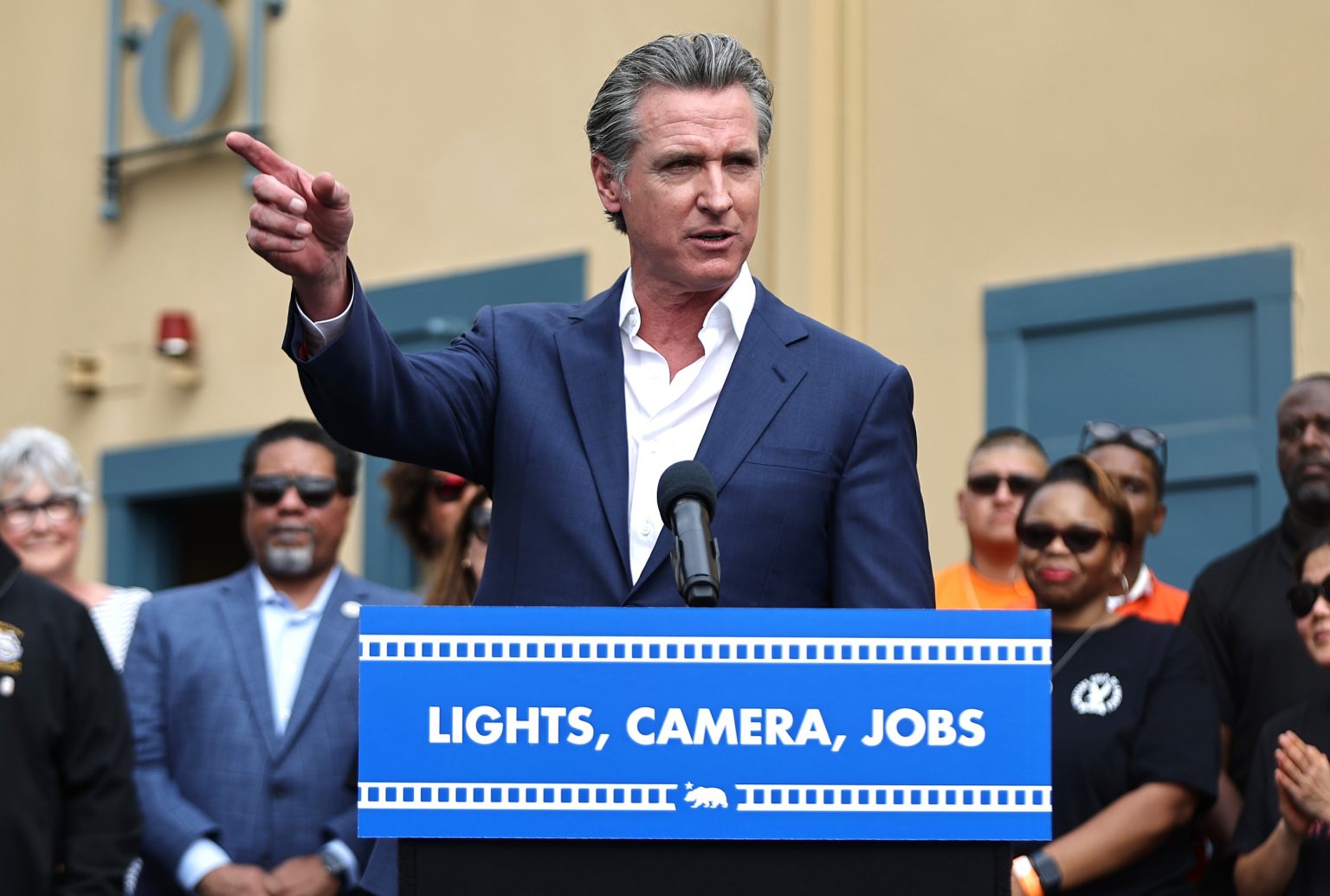

The state of California has historically been synonymous with Hollywood, known as the entertainment capital of the world. However, since the early 2000s, other U.S. states and international countries have been luring film and television productions away from California by offering financial incentives such as tax breaks. This exodus of filming has been a concern for the state, as it has resulted in significant economic losses and the loss of thousands of jobs. In response to this trend, California Governor Gavin Newsom has unveiled an expansion of the state’s Film and Television Tax Credit Program in an effort to attract productions back to Hollywood.

Newsom’s expansion of the tax credit program would increase the annual budget to $750 million, up from the previous $330 million. The governor emphasized the importance of keeping production at home in California, generating good-paying jobs, and strengthening the state’s iconic film and television industry. He also highlighted the economic impact of the tax credit program, which has generated $26 billion in economic activity and supported over 197,000 cast and crew jobs in the state since its inception 15 years ago. The program has been instrumental in propping up the industry and supporting the economy.

The tax credit expansion must be approved by the California legislature before it can come into effect on July 1, 2025. Los Angeles Mayor Karen Bass, who played a role in drafting the original tax credit system in 2009, expressed strong support for the expansion, emphasizing that Hollywood is a cornerstone of the city, the economy, and the state. The message to the industry is clear – California has their back and is committed to supporting the film and television sector. The tax credit program is seen as a crucial tool in keeping productions in the state and strengthening the industry.

Joe Chianese, SVP of Incentives at Entertainment Partners, discussed the importance of filming location decisions in the podcast The Town, emphasizing that financial incentives play a significant role in determining where productions are filmed. Other areas offering tax incentives have developed filmmaking infrastructure to support Hollywood-level productions, creating competition for U.S. projects at the box office. Chianese warned that as countries learn to make their own movies with their own stars and storylines, there is a risk of impacting the revenue generated by U.S. films. The expansion of California’s tax credit program aims to address this competitive landscape and keep productions within the state.

Newsom’s announcement of the tax credit program expansion was met with support from industry leaders and union representatives. The initiative is designed to address the challenges faced by the California film and television industry, particularly the loss of projects to other states and countries offering financial incentives. The expansion of the tax credit program reflects a commitment to supporting the creative industries in California, preserving the state’s status as the entertainment capital of the world, and ensuring the continued growth and success of the film and television sector. By increasing the annual budget for the tax credit program, California aims to attract more productions, generate economic activity, and create jobs within the state.