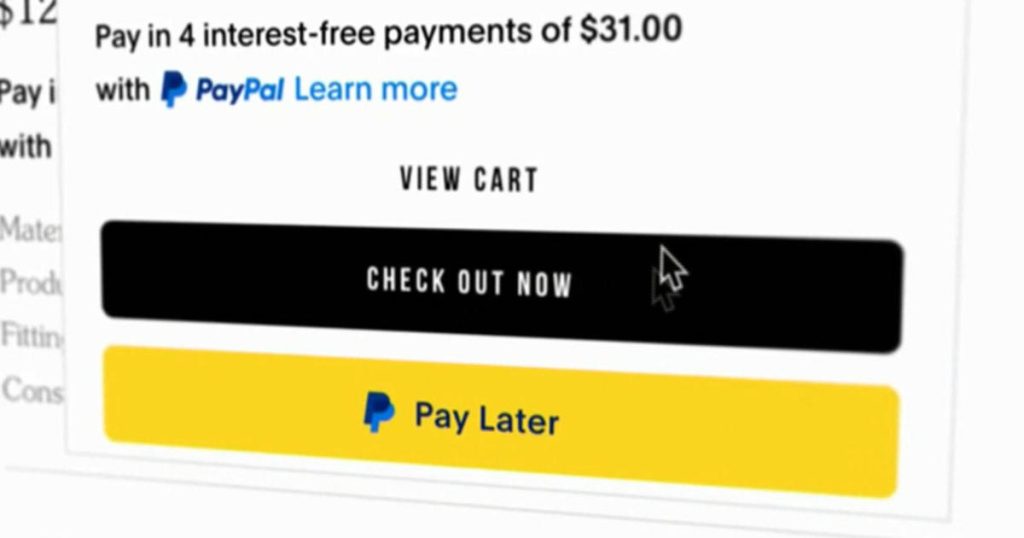

The Federal Trade Commission (FTC) is warning consumers to be cautious when using “buy now, pay later” plans, as they have received a high number of complaints about these services. These plans allow consumers to make a purchase and pay for it in installments, often interest-free, over a period of time. However, many consumers have reported issues with disputed transactions and unclear refund policies, leading to concerns about the fairness of these plans.

The popularity of “buy now, pay later” plans has grown significantly in recent years, with many consumers opting to use these services for their convenience and flexibility. However, the FTC warns that consumers should be aware of the risks associated with these plans, and make sure they understand the terms and conditions before making a purchase. In some cases, consumers have been hit with unexpected fees or charges, leading to frustration and complaints about the lack of transparency.

Starting today, the FTC is cracking down on companies that offer “buy now, pay later” plans, in an effort to protect consumers and ensure fair practices in the industry. The regulator will be closely monitoring these companies to ensure compliance with consumer protection laws, and will take action against any companies found to be engaging in unfair or deceptive practices. This crackdown is aimed at holding companies accountable and ensuring that consumers are treated fairly when using these services.

Consumers are advised to do their research before using “buy now, pay later” plans, and to be cautious when making purchases through these services. It is important to read and understand the terms and conditions, including any potential fees or charges that may apply. If a dispute arises or a refund is needed, consumers should be prepared to follow the company’s process for resolving these issues, and seek assistance from the FTC if necessary.

Overall, the FTC’s crackdown on “buy now, pay later” plans is a step towards protecting consumers from unfair practices in the industry. By holding companies accountable and ensuring compliance with consumer protection laws, the regulator aims to create a more transparent and fair marketplace for these services. Consumers are encouraged to be vigilant and informed when using these plans, and to report any issues or concerns to the FTC for further investigation and action.

In conclusion, while “buy now, pay later” plans offer convenience and flexibility for consumers, there are risks and potential pitfalls that should be carefully considered. By staying informed and aware of the terms and conditions, consumers can protect themselves from unexpected fees or charges, and ensure a positive experience when using these services. The FTC’s crackdown serves as a reminder to companies offering these plans to prioritize consumer protection and transparency, and to uphold fair practices in the industry.