Evolv, a security technology company, has warned its shareholders to no longer rely on recent financial statements due to employee misconduct related to certain sales. A group of independent board directors is currently conducting an internal investigation into the company’s sales practices, which has revealed that some sales were subject to extra-contractual terms and conditions not shared with accounting personnel. The investigation aims to determine if this misconduct impacted revenue reports and other financial metrics, as well as when senior personnel became aware of the situation.

As a result of the ongoing investigation, Evolv has stated that financial statements between the second quarter of 2022 and that of 2024 are no longer reliable. The company’s next earnings report will be delayed as the investigating committee estimates that the sales transactions in question resulted in premature or incorrect revenue recognition of about $4 million to $6 million through the end of June. Evolv has reported these issues to the U.S. Securities Exchange Commission and is working to conclude its thorough investigation in a timely manner.

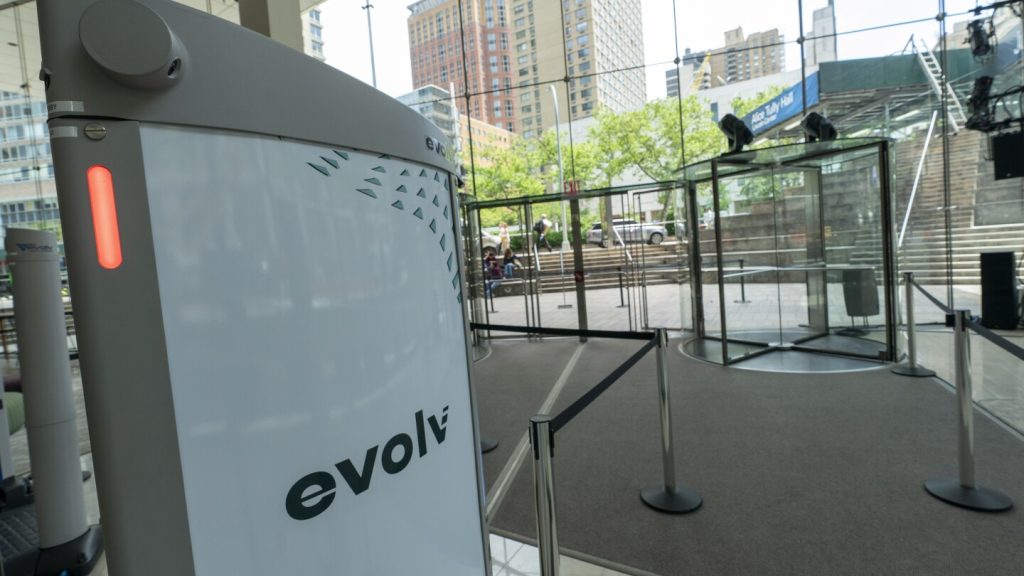

Evolv, based in Waltham, Massachusetts, previously reported second-quarter revenue of $25.5 million in August, reflecting a 29% increase compared to the second quarter of 2023. The company is committed to taking necessary remedial actions in light of the ongoing investigation and is dedicated to accurate and timely financial disclosures. Evolv provides security screening technology powered by artificial intelligence, manufacturing portal weapons scanners that were recently part of a pilot testing program in New York City subway stations. However, the program faced criticism and concerns over efficacy, as police data showed no detection of firearms and over 100 false alerts during the one-month test.

In addition to the sales practices investigation, Evolv is facing other legal issues, including federal probes into its marketing practices by the Federal Trade Commission and the SEC. Earlier in the year, investors filed a class-action lawsuit against company executives, accusing them of overstating the devices’ capabilities and raising doubts about the reliability of Evolv’s technology in detecting knives or guns. These challenges have resulted in a 38% decline in the company’s shares to $2.52 in afternoon trading. Evolv is working to address these issues and ensure compliance with regulatory requirements while maintaining transparency with shareholders and stakeholders.