CVS Health currently ranks in the top 10% of dividend stocks based on the DividendRank formula, indicating that it is a stock worth researching further. Additionally, CVS recently entered oversold territory with its stock price dropping to $56.71 per share on Thursday. This suggests that the stock may be undervalued and present a buying opportunity for investors. The Relative Strength Index, or RSI, for CVS is 29.4, lower than the average RSI of 49.8 for dividend stocks, indicating a potential turnaround in the stock price.

For dividend investors, a falling stock price like CVS’s can provide a higher yield on their investment. With an annualized dividend of 2.66 per share, the current yield stands at 4.63% based on the recent share price of $57.44. This can be an attractive option for investors looking to generate income from their investments. The recent sell-off in CVS’s stock price could be seen as a signal that the downward trend may be coming to an end, presenting an opportunity for investors to consider buying the stock.

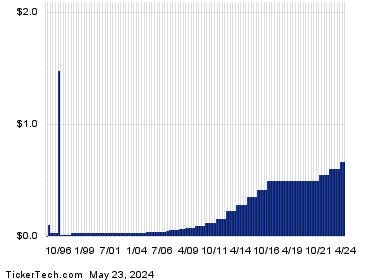

Investors interested in CVS should also consider the company’s dividend history when making their investment decision. While dividends are not always predictable, analyzing past performance can provide insight into the likelihood of future dividend payments. By examining the historical dividend chart for CVS, investors can assess the company’s track record and make an informed decision about the stability of its dividend payments. This can be a crucial factor for income-focused investors looking for reliable returns.

For investors looking to discuss income investing further, ValueForum.com offers a platform for joining the conversation with a special Seven Days for Seven Dollars invitation. This can provide investors with the opportunity to engage with like-minded individuals and gain insights into income investing strategies. By participating in these discussions, investors can expand their knowledge and make more informed decisions about their investments, particularly in dividend stocks like CVS Health.

In conclusion, CVS Health’s strong ranking in the DividendRank formula and its recent entry into oversold territory make it an appealing stock for investors seeking income opportunities. With a high annual yield of 4.63% and a potential turnaround in the stock price indicated by the RSI, CVS presents a compelling option for dividend investors. By considering the company’s dividend history and engaging in conversations about income investing on platforms like ValueForum.com, investors can make informed decisions and potentially benefit from the opportunities presented by stocks like CVS Health.