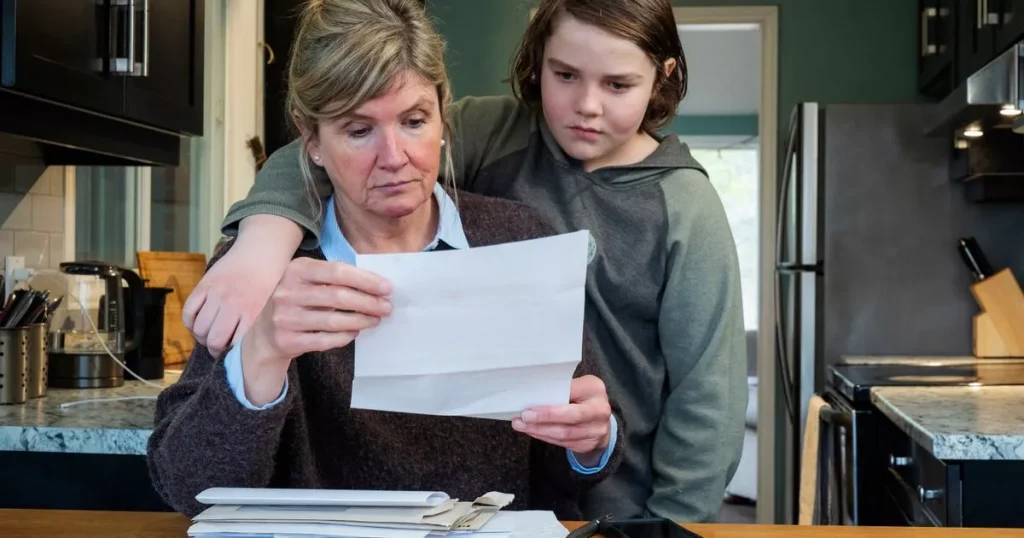

Most councils in England are increasing council tax bills by around 5%, the maximum allowed without a referendum. This increase will come into effect from April 1st, affecting millions of households. Some councils, including Birmingham, Slough, Thurrock, and Woking, have been granted permission to increase council tax by up to 10%. Residents in Wales will see a rise of 5-10%, while in Scotland, council tax bills have been frozen until 2025. Those in Northern Ireland are under a rates system instead of council tax.

There are ways to potentially reduce your council tax bill, including checking for discounts. Discounts can range from 25% to 100%, depending on various circumstances. For example, living alone or living with someone considered disregarded (such as a full-time student, child under 18, or someone severely mentally impaired) can lead to a 25% reduction. A 50% discount is possible if everyone in the household is disregarded, and a 100% discount is available to single occupants with severe mental impairment or all-student households.

Council Tax Support schemes are available for those on benefits or low incomes, potentially providing up to 100% off the bill. Each council sets its own criteria and discounts, so eligibility varies by location. Backdating support may also be possible, depending on individual circumstances. Qualifications for such assistance may depend on income level, benefit status, presence of children, and other adult household members. Contacting the local council is the best way to understand available support options.

Challenging your council tax band is another way to potentially save money. Many homes are believed to be in the wrong band, affecting their bills. Comparing your band to neighbors’ bands can offer insights, and determining the property’s value in 1991 when council tax was introduced is crucial. Online tools and calculators are available to assist in this process. If you suspect your band is incorrect, contacting the Valuation Office Agency in England and Wales or the Scottish Assessors Association in Scotland is the first step. An independent valuation tribunal can be appealed to if needed.

It is advised to make four key checks before the April tax deadline, according to financial expert Martin Lewis. These include confirming council tax discounts, reviewing eligibility for Council Tax Support or Council Tax Reduction schemes, challenging council tax bands if needed, and taking advantage of potential savings on your bills. Checking if a special permission has been granted to certain councils for higher increases, preparing for the timing of the first payment, and exploring possible reductions based on personal circumstances are essential steps. Stay informed about available options to minimize council tax bills.

In another topic, Greggs has announced changes to its spring menu with new items, appealing to those interested in food and cuisine. For those interested in beauty products, Charlotte Tilbury is offering a significant sale, attracting consumers looking for discounted makeup and beauty items. These updates in both food and beauty industries provide options for those seeking new products or looking for savings on their purchases. The announcements from Greggs and Charlotte Tilbury offer opportunities for consumers to explore new products and make the most of available discounts.