On April 23, 2024, three companies, Lennar, Lowe’s Companies, and West Pharmaceutical Services, will all trade ex-dividend for their upcoming dividends. Lennar will be paying a quarterly dividend of $0.50 on May 8, 2024, Lowe’s Companies will pay a quarterly dividend of $1.10 on the same date, and West Pharmaceutical Services will pay a quarterly dividend of $0.20 on May 1, 2024. As a percentage of Lennar’s recent stock price of $152.49, this dividend equates to approximately 0.33%, signaling that shares of Lennar Corp may trade 0.33% lower when the market opens on April 23, 2024. Similarly, Lowe’s Companies and West Pharmaceutical Services shares are expected to open 0.48% and 0.05% lower, respectively.

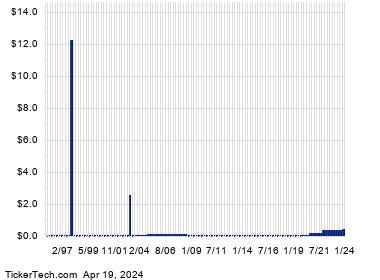

Looking at the dividend history charts for LEN, LOW, and WST, we can see the historical dividends paid by these companies prior to the most recent ones declared. Dividends are not always predictable and can fluctuate based on company profits over time. Therefore, it is essential to look at the historical dividend payouts to assess the stability of dividends over time, which can help investors form expectations about future annual yields for these companies. Based on the historical data, the current estimated yields on an annualized basis would be 1.31% for Lennar, 1.92% for Lowe’s Companies, and 0.21% for West Pharmaceutical Services.

In Friday trading, Lennar shares were up by approximately 0.4%, while Lowe’s Companies and West Pharmaceutical Services shares were trading flat on the day. These movements in share prices can be influenced by various factors, including dividend declarations, market sentiment, and company performance. Investors are advised to conduct thorough due diligence before making investment decisions, taking into consideration factors such as historical dividend payouts, company stability, and overall market conditions.

Receiving dividend payouts from companies can be a significant source of income for investors, providing regular returns on their investments. By investing in dividend-paying stocks such as Lennar, Lowe’s Companies, and West Pharmaceutical Services, investors can benefit from both capital appreciation and consistent dividend payments. It is crucial for investors to evaluate the dividend history and financial health of these companies before making investment decisions, to ensure a stable and reliable source of income over time.

In conclusion, the upcoming dividend payouts by Lennar, Lowe’s Companies, and West Pharmaceutical Services present an opportunity for investors to earn additional income from their investments. By understanding the dividend history, current yields, and market conditions, investors can make informed decisions about their investment portfolios. Dividend-paying stocks can provide a stable source of income and long-term growth potential for investors, making them a valuable asset in any investment strategy.